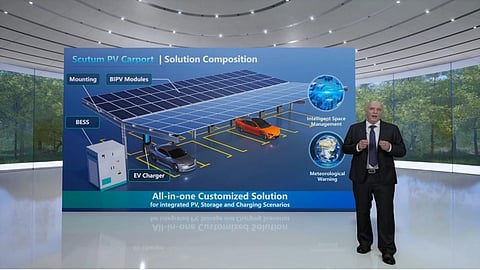

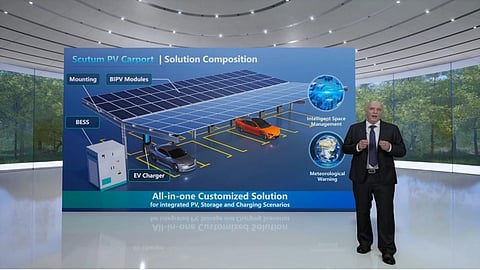

Solar module manufacturer PHONO Solar has launched its Scutum PV carport solution. The product integrates PV technology into carports, transforming parking spaces into distributed energy hubs, addressing urban energy challenges, and optimizing land use by integrating PV technology into carports. The system incorporates PHONO’s Draco series modules, which received abZ certification from DIBt in July (see China Solar PV News Snippets), signifying recognition in the European construction sector. The Scutum solution offers 4 versatile mounting structures for residential, commercial, industrial, and public applications, emphasizing a lightweight, high-strength design, structural waterproofing, modular construction, and ease of installation.

PV module manufacturer Haitai New Energy has announced that its 182-72, 182-78, 210R-66, and 210-66N TOPCon dual-glass modules have successfully passed high-speed wind tunnel testing and obtained TÜV Nord certification. The company states the certification confirms the modules’ wind load resistance, safety, reliability, and differentiated weatherability, demonstrating strong adaptability and competitiveness in high-altitude, coastal, and hurricane-prone projects.

Silicon wafer manufacturer and solar power plant developer JYT Corporation reported a 47.25% year-over-year (YoY) decline in revenues to RMB 1.525 billion ($213.94 million) in the first half of 2025. The company’s net loss, excluding non-recurring gains and losses, narrowed significantly to RMB 212 million ($29.73 million), compared to RMB 1.085 billion ($152.16 million) in the same period last year. The net loss number for the period is toward the higher end of, but well within, the company’s previously forecasted range of RMB 165 million ($22.92 million) to RMB 225 million ($31.25 million) (see China Solar PV News Snippets). As of June 2025, JYT had 40 GW of pulling and slicing capacity. The company is also developing renewable energy projects, with a total installed and grid-connected capacity of approximately 1.34 GW of solar and wind power by the end of June.

PV encapsulation material manufacturer HIUV recorded a sharp 57.47% YoY drop in revenues to RMB 633 million ($88.80 million) in H1 2025. The company reported a net loss, excluding non-recurring gains and losses, totaling RMB 134.88 million ($18.92 million), a slight improvement from the same period last year. HIUV attributed the decline in revenues to falling product prices and lower sales volumes. The company said that despite the challenging market environment, it continues to invest in innovation and launched new products in H1 2025, including zero-migration light-conversion films, new PVE films and colored films for BIPV applications.

Earlier, in July, HIUV cancelled Phase I of its 200 million m2 PV encapsulation film facility in Pinghu, Zhejiang Province, citing weakened downstream demand and an oversupplied encapsulant market (see China Solar PV News Snippets).

China’s New Energy Consumption Monitoring and Early Warning Center reported that in July 2025, the utilization rates of solar PV and wind power in China reached 96.4% and 97%, respectively, both setting new highs for the year. From January to July 2025, the average utilization rates were 94.7% for solar PV and 93.8% for wind power, up from 94.2% and 93.2% reported for the period until May 2025 (see China Solar PV News Snippets).