The EIA forecasts almost 69 GW of new US solar capacity across 2026 and 2027 in its STEO January 2026

Solar will drive the biggest increase in power generation among all sources, according to the report

While electricity demand is expected to grow, natural gas generation remains largely flat and coal continues to decline during the forecast period, reinforcing solar’s role in meeting new demand

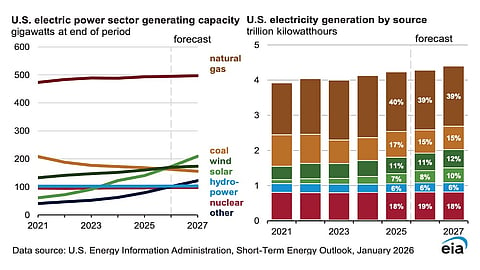

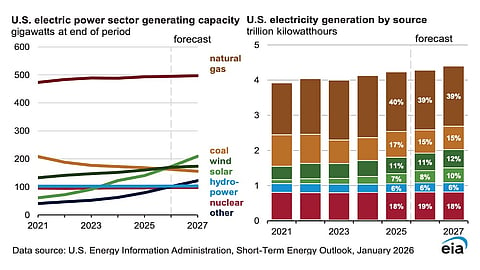

The Energy Information Administration (EIA) forecasts the US solar market to grow by close to 69 GW over 2026 and 2027, supplying the largest increase in power generation in its Short-Term Energy Outlook (STEO) January 2026.

This will include 32.1 GW in 2026 and 36.5 GW in 2027, according to EIA, which forecasts solar generation to increase 21% during both these years, after increasing by 33% in 2025. SEIA and Wood Mackenzie had previously pegged US solar installations peaking at a record 50 GW in 2024 (see US Market Grew By Record 50 GW New Solar Capacity In 2024).

While EIA expects new solar PV installations over the 2 years to be subdued, it will still be doing better than its conventional competitors.

During the forecast period, EIA expects natural gas generation to remain flat in 2026 and rise by 1% in 2027, whereas coal-fired power generation will drop by 9% this year and decrease by less than 1% in 2027.

Yet, this will be the period when the government agency expects electricity consumption to grow by 1% in 2026 and 3% in 2027, the strongest 4-year period of growth since the turn of the century, thanks mainly to growing power demand in the commercial & industrial (C&I) sectors.

Solar, with its faster deployment feature and self-consumption benefits, will then continue to make its presence felt under an administration that considers green energy a ‘scam’. Challenges for renewables, particularly solar and wind, have only mounted since last year with tariffs, tax credit changes, and Foreign Entity of Concern (FEOC) rulings.

The government has also heightened scrutiny for solar and wind projects, practically halting them (see US Solar Industry Urges Congress To Fast-Track Permitting).

Wood Mackenzie and CohnReznick still see strong structural factors supporting solar and energy storage deployment across the US, including the speed of installation, increased investor interest, and bankability (see Policy Shifts Reshape US Solar, Storage Economics).