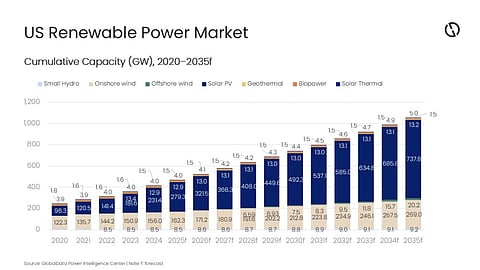

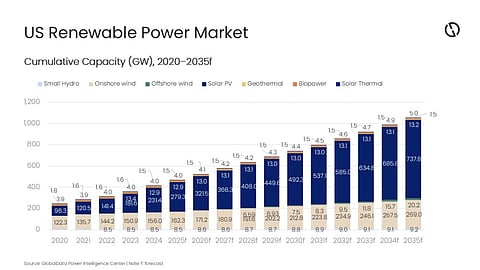

GlobalData projects US solar capacity to reach 737.8 GW by 2035, driven mainly by state-level mandates, distributed generation policies, and utility procurement programs

Texas, California, and Midwest states will continue to anchor demand through net metering, net billing, and large-scale utility contracting

Trade measures and tariffs introduced in 2025 are increasing input costs, slowing project timelines, and leading to delays and cancellations

Yet, demand for new power generation capacity remains strong, according to the analysts

Despite the federal government’s preference for fossil fuels, US states are likely to continue the expansion of solar energy in the country, albeit slowly, reaching a combined capacity of 737.8 GW by the end of 2035, says GlobalData.

Analysts expect annual growth to slow down between 2025 and 2035. It will be driven by state procurement targets, distributed generation policies, and net billing and net metering frameworks. Large-scale utility contracting across the key markets of Texas, California, and the Midwest will also contribute.

In 2025, GlobalData sees the US solar market growing by 47.9 GW, down from 49.8 GW in the previous year (see US Market Grew By Record 50 GW New Solar Capacity In 2024).

It will further go down to 42.2 GW in 2026, growing to 44.8 GW in 2027, down again to 41.7 GW in 2028, holding the pace at 41.6 GW in 2029, reaching an annual capacity of 42.7 GW in 2030, and a cumulative of 492.3 GW.

Post-2030, 44.8 GW will be installed in 2031, 47.9 GW in 2032, and 49.8 GW in 2033. The market will once again reach the 50 GW milestone only in 2034, expanding to 52 GW in 2035.

“The US power sector continues to attract large-scale investment in renewables, supported primarily by state-level clean energy mandates, long-term utility procurement programs, and sustained corporate power purchase agreement activity,” says GlobalData Power Analyst Mohammed Ziauddin. “Between 2025-2030, renewable investment is expected to reach around $442.2 billion, reflecting the scale of ongoing solar and wind development across key regional markets.”

Owing to trade and tariffs introduced in 2025, renewable energy technologies for which the market is reliant on foreign supplies, including solar, are nonetheless facing additional cost pressure and uncertainty across the power sector. Higher input costs have slowed project timelines, increased capital requirements, and are leading to delays and cancellations across parts of the development pipeline, even though demand for new power generation capacity remains high, says the global consultancy.

“Despite policy shifts and tariff-related cost pressures, renewable energy remains the primary driver of capacity growth in the US power sector through 2035. Solar and wind continue to expand at scale, supported by state policies and private sector demand, while gas and nuclear investments address capacity adequacy and longer-term system needs,” added Zia. “Together, these trends are reshaping the US electricity system into a more diversified and resilient market over the long term.”

Earlier, Wood Mackenzie predicted the US market to grow to 739 GW DC in the next 10 years, adding 502 GW DC between 2025 and 2035 (see US To Install 502 GW DC New Solar Capacity By 2035).