Mercom counts India to have installed 14.9 GW solar capacity in H1 2024, comprising 5 GW in Q2

Solar installations of 9.9 GW in Q1 contributed to this surge as developers rushed to make use of ALMM exemption before April 1, 2024

India’s large-scale projects pipeline stood at 146 GW at the end of June 2024, with an additional 104 GW tendered and awaiting auction

Mercom cautions that transmission infrastructure constraints pose challenges going ahead, especially in Rajasthan

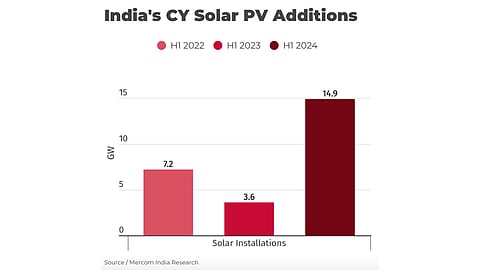

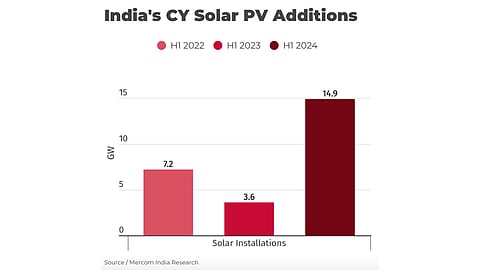

Indian solar PV installations between January and June 2024 increased by 282% annually to 14.9 GW, topping all previous half-yearly and annual installations, according to Mercom India Research’s new report Q2 2024 India Solar Market Update.

These figures are different from JMK Research’s 12.15 GW for the same period (see India’s CY H1 2024 New Solar Capacity Additions Exceeded 12 GW).

Mercom analysts attribute the annual growth in H1 additions this year to several delayed projects being commissioned. Previously, Mercom had announced 3.6 GW of solar PV capacity additions for calendar year (CY) H1 2023 (see India Added 3.6 GW New Solar In H1/2023).

The new additions of 14.9 GW comprise 9.9 GW the country installed in Q1 2024, and 5 GW in Q2 2024. The latter comprised 4.3 GW of large-scale projects including almost 1.8 GW of open access facilities.

In Q2, installations dropped over 49% Quarter-over-Quarter (QoQ) and increased 170% Year-over-Year (YoY).

Mercom points out that this surge in installations during Q1 was not a trend, but a response to the Approved List of Models and Manufacturers (ALMM) coming back into force from April 1, 2024. The quarterly decline, however, was due to the ALMM reimposition that impacted several open access projects, and also owing to grid connectivity and transmission infrastructure delays for large-scale projects.

The states with the largest quarterly installations were Rajasthan, Gujarat and Karnataka, contributing 30%, 22%, and 21% respectively.

Solar PV also accounted for 71% out of the 81% of renewable capacity additions, including large hydro, out of the 20.8 GW new power capacity in India.

At the end of June 2024, India’s cumulative installed solar PV capacity reached 87.2 GW with utility-scale projects making up 87% and rooftop solar 13%, as per the report. The top 10 states together contributed 94% of the cumulative large-scale solar installations.

The report writers registered a decline of 22% YoY and 65% QoQ in tender activity during Q2 as 10.7 GW was tendered, compared to 13.6 GW in Q2 2023, and 30.7 GW in Q1 2024. Only 6.7 GW was auctioned, down 73% from 25.1 GW in the 1st quarter this year. Overall, during H1 2024, 41.4 GW tenders were announced, up 51% from 27.5 GW in the previous year.

Even though the country’s large-scale project pipeline as of June 2024 was 146 GW, with another 104 GW tendered and awaiting auction, Mercom India’s Managing Director Priyadarshini Sanjay cautions that there are challenges in realizing this capacity. These exist particularly in Rajasthan with its transmission infrastructure constraints, which can be alleviated by the use of hybrid and energy storage projects using the same transmission lines.

She also pointed out the limited capacity of domestically produced modules that may struggle to meet demand. These are also expensive; hence, Sanjay expects the average cost of large-scale solar projects to go up after having declined by 2% QoQ and 26% YoY.

The complete report can be purchased on Mercom’s website.