Italy’s Budget Law 2026 limits solar tax incentives to EU-made modules and cells

Only high-efficiency EU modules – above 21.5% or 23.5% cell efficiency – qualify for incentives

The rules also favor HJT and tandem cells with cell efficiency of more than 24%

Italy will now grant tax incentives for solar PV systems only if their modules and cells are made in the EU. The new rule, introduced under the country’s Budget Law 2026, seeks to promote domestic and regional solar manufacturing.

The new rules introduced under Legge di Bilancio 2026, or the Budget Law 2026, will restrict tax incentives for self-consumption and self-production of solar energy to high-efficiency EU-made modules meeting the minimum module-level efficiency of 21.5%, or to those using modules with EU-made cells with a minimum cell efficiency of at least 23.5%.

Additionally, the incentives will also be available for EU-made modules made up of bifacial silicon heterojunction (HJT) or tandem cells with cell efficiency above 24%.

These details are covered in Volume III, Article 94-154 of Legge di Bilancio 2026 on page 16, as shared by Il Personale.

With these conditions laid down, the government seems to be preferring a specific technology over the others, as pointed out in an article by local media outlet QualEnergia. There are also speculations that with HJT and silicon tandem as the preferred technologies for these tax incentives, this government measure is likely to primarily benefit Enel Group’s solar PV manufacturing arm 3SUN, an HJT solar cell and module producer based out of Italy.

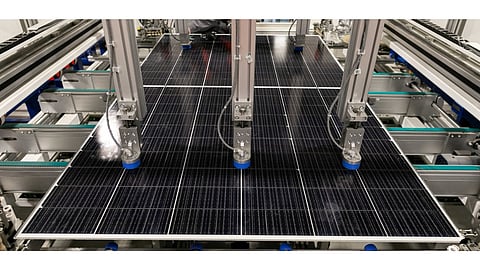

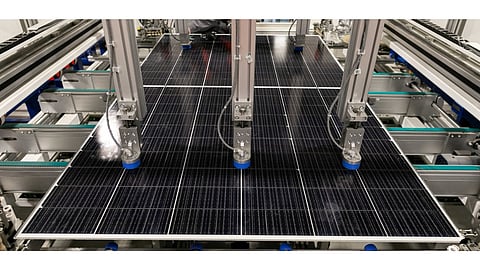

Located in Catania, 3SUN has a 3 GW HJT cell production line. Speaking at the TaiyangNews High Efficiency Solar Technologies 2024 conference in December 2024, 3SUN CTO Cosimo Gerardi shared that the company had 600 MW operational production capacity and will soon ramp up to 3 GW using western equipment. Beyond HJT, it also aims to venture into tandem with HJT and perovskites (see Quality Improvement & Cost Reduction High On 3SUN’s Agenda).

Nevertheless, the Technical and Special Projects Director at another Italian solar PV manufacturer, FuturaSun, Nicola Baggio, criticized Italy’s new solar tax rule while questioning the decision to consider HJT as the only eligible technology. In a LinkedIn post, Baggio opined that this is not a scientific or academic decision. He argued that in China, targets are technology-neutral, and Italy could do the same. Such criteria ‘make the desire to invest in the EU disappear’, he added.