US solar additions fell 15% YoY in H1 2025, reflecting policy-driven slowdown and uncertainty

Utility-scale, residential, and community solar installations declined while commercial solar grew in Q2

The country added 4.3 GW of new module manufacturing capacity in Q2, but upstream production saw no growth

Analysts forecast 246 GW DC of installations by 2030, but warn of downside risks due to policy uncertainty

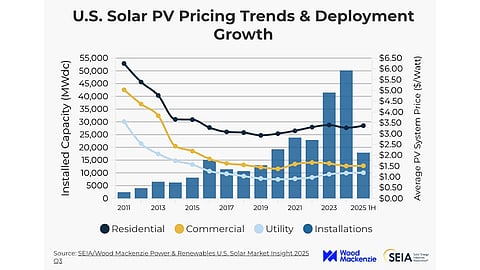

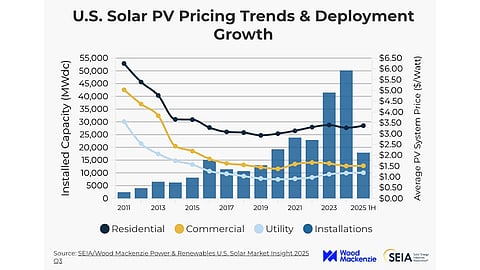

Solar growth in the US slowed down in early 2025, with policy challenges slowing deployment momentum. Industry data shows 17.9 GW of new capacity was added in the first half of the year, down more than 15% from 2024.

The U.S. Solar Market Insight Q3 2025 report from the Solar Energy Industries Association (SEIA) and Wood Mackenzie projects further downside risk if such measures persist. Its low-case forecast indicates potential losses of 44 GW in solar deployment by 2030, equal to an 18% decline. Compared to pre-One Big Beautiful Bill Act (OBBBA) or HR1 estimates, the shortfall could deepen to 55 GW, or 21%, signaling mounting uncertainty for US solar growth.

“Instead of unleashing this American economic engine (solar and storage), the Trump administration is deliberately stifling investment, which is raising energy costs for families and businesses, and jeopardizing the reliability of our electric grid,” said SEIA President and CEO Abigail Ross Hopper. “But no matter what policies this administration releases, the solar and storage industry will continue to grow, because the market is demanding what we’re delivering: reliable, affordable, American-made energy.”

Interestingly, 77% of all solar capacity installed during H1 2025 was in the Republican-ruled states. Solar and storage accounted for 82% of all new power added to the national grid; solar alone accounted for 56% of all new electricity-generation capacity.

Installations

Nevertheless, solar installations of 7.5 GW DC in Q2 2025 represented a drop of 24% from Q2 2024 and 28% since Q1 2025. This came mainly from the utility-scale segment that expanded by 5.7 GW DC, which represented a YoY decline of 28% and 22% quarter-on-quarter (QoQ). Texas, one of the strongest solar states, led the decline in this segment.

The residential segment also registered an annual drop of 9% and a sequential decline of 3% with 1.05 GW DC additions, challenged by high interest rates as well as economic and policy uncertainty.

Another segment where installations declined (52% YoY and 34% QoQ) was community solar, with only 174 MW DC reported. Analysts explain that programs in major state markets are at or near capacity, and that no new notable markets are ready to replace them as yet.

The only segment that reported a YoY increase in Q2 2025 was commercial solar, as it grew 27% with 585 MW DC of new capacity, led by California’s NEM 2.0. This was its 2nd highest quarterly addition to date, stressed the report writers, while reflecting on the uncertainty around meeting construction-start deadlines for projects that enter construction after 2025.

Manufacturing

During Q2 2025, the US brought online 4.3 GW of new solar module manufacturing capacity, expanding the country’s total to 55.4 GW. However, there were no new additions in the upstream manufacturing of polysilicon, wafer, or cell that are more resource-intensive.

Looking ahead, analysts expect fewer new manufacturing facilities to come online in the near term. While Section 45X tax credits remain in place, new Foreign Entity of Concern (FEOC) requirements could jeopardize eligibility for roughly half of operational solar manufacturing capacity across solar cells and modules, according to Wood Mackenzie. Rising tariffs, labor, and utility costs further underscore the importance of these credits for manufacturers’ profitability.

“Many manufacturers will have to consider selling factories, restructuring ownership, or exiting the market if they no longer qualify for the tax credits,” caution the report writers.

Despite these challenges, SEIA and Wood Mackenzie forecast 246 GW DC of solar installations over the next 5 years, though a low-case scenario carries an 18% downside risk (44 GW DC). Developers are accelerating projects in response to policy changes and expiring tax incentives, with roughly 50 GW of utility-scale projects poised to start construction in 2025 and another 40 GW in H1 2026.

Residential solar is also expected to see a surge in installations before the 25D tax credits expire. Overall, near-term demand remains strong due to constrained power supply and rising gas costs, partially offsetting potential setbacks from the OBBBA, the writers stress. The report’s base case scenario projects a 5% average annual contraction in installations through 2030, compared with 2% in the previous forecast.

“The market reality for the solar industry will be shaped by federal policy actions and their outcomes in the coming months,” stress the analysts.

The complete report can be purchased for $5,990 from Wood Mackenzie’s website.

Stacy J. Ettinger, SEIA’s SVP Supply Chain & Trade, will discuss the solar PV manufacturing scene in the US in the wake of shifting federal priorities at the TaiyangNews 2025 Solar — Made in the USA summit at Las Vegas on September 8, 2025, at RE+. Co-organized with RE+ and EUPD Research, the summit will feature leading names from the world of solar to discuss the future of US solar and storage manufacturing and future strategies for the players in light of the regulatory hurdles created by the OBBBA. Registrations are open and can be done here.