- Large Scale & Project Solutions segment sees significant rise in sales at €228.7 million in Q1/2024

- Q1/2024 Home Solutions sales at €62.6 million registers a fall, as compared to €163.3 million in Q1/2023

- Q1/2024 Commercial & Industrial Solutions sales at €70.5 million registers a fall, as compared to €80.2 million in Q1/2023

- EBIT in Q1/2024 was €38.2 million, as against €50.4 million in Q1/2023

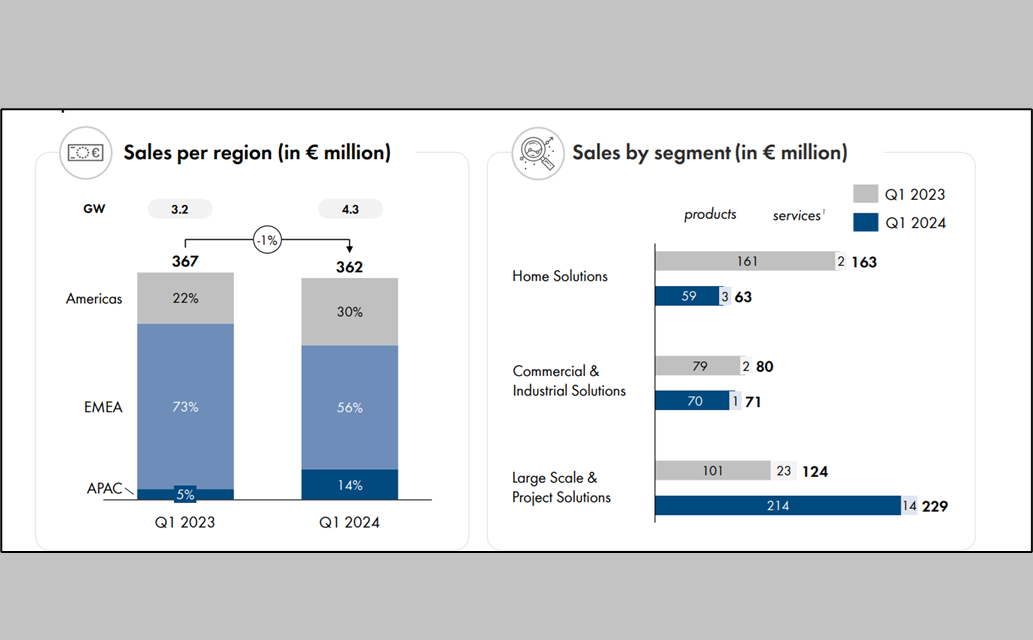

In Q1/2024, SMA Solar Technology AG saw its Home Solutions and Commercial & Industrial Solutions segments being impacted by normalized demands. There were also high inventories lying with distributors and installers. Despite this, the German solar inverter supplier managed to complete Q1 in line with expectations by clocking a total group sales of €361.8 million. This was close to the €367.2 million it had achieved in Q1/2023.

Sales in the Home Solutions segment amounted to €62.6 million, against €163.3 million in Q1/2023. The Commercial & Industrial Solutions segment achieved €70.5 million in sales, against €80.2 million in Q1/2023. The Large Scale & Project Solutions segment saw significant growth in sales at €228.7 million, as compared to €123.7 million in Q1/2023. The company attributes this growth to the high level of sales and the associated increase in productivity, which enabled it to achieve earnings before interest and taxes (EBIT) of €41.3 million, against €2.3 million in Q1/2023.

A decline in sales in the Home Solutions segment led to a fall in EBIT to -€3.6 million, as against a positive €50.3 million in Q1/2023. Similarly, due to low sales and high fixed costs, the EBIT of Commercial & Industrial Solutions segment fell to –€18.2 million, as against –€1.2 million in Q1/2023. Overall EBIT in Q1/2024 was €38.2 million, as against €50.4 million for Q1/2023. This corresponds to an EBIT margin of 10.6%, as against 13.7% for Q1/2023.

Earnings before interest, taxes, depreciation and amortization (EBITDA) were €49.9 million, including €19.1 million in gains from the sale of the shares in elexon GmbH. This means an EBITDA margin of 13.8%, as against the 16.3% in Q1/2023. The company attributes this difference to changes in the product mix and an increase in the Group’s cost base.

Speaking about the quarter results, CEO of SMA Jürgen Reinert said, “We had a good start to the fiscal year in terms of sales, despite the decline in the Home and C&I segments which we believe is only a temporary effect because end customer demand remains fundamentally robust worldwide. We also expect positive stimuli in Germany following the recently agreed Solar Package I. The installation, expansion and modernization of solar and battery systems will become much more attractive, especially for companies and tradespeople. But Solar Package I also creates better conditions for roof-mounted installations, tenant electricity models and solar solutions in the agricultural sector.”

Echoing similar sentiments, CFO of SMA Barbara Gregor said, “As expected, the Large Scale & Project Solutions segments continued its extremely successful sales and earnings performance. In the Home Solutions and C&I segments, operating performance continues to be significantly influenced by the high inventory levels at distributors and installers and the associated shift in incoming orders and sales. We therefore do not expect a significant increase in sales in the two segments and the associated earnings contributions until the second half of the year.“

SMA Solar Technology exited 2023 after a solid run, led by the Large Scale and Project Solutions segment as demand slowed down for the Home and Commercial & Industrial Solutions segments (see SMA Solar Technology Exits 2023 ‘Extremely Successfully).