- Aligned with its forecast, SolarEdge met its Q1/2024 revenue guidance with $204.4 million

- GAAP gross margin for the group was a negative -12.8% while that of the solar segment was -3.5%

- Expecting inventory decline to continue, SolarEdge forecasts its Q2/2024 revenues to fall within $250 million to $280 million

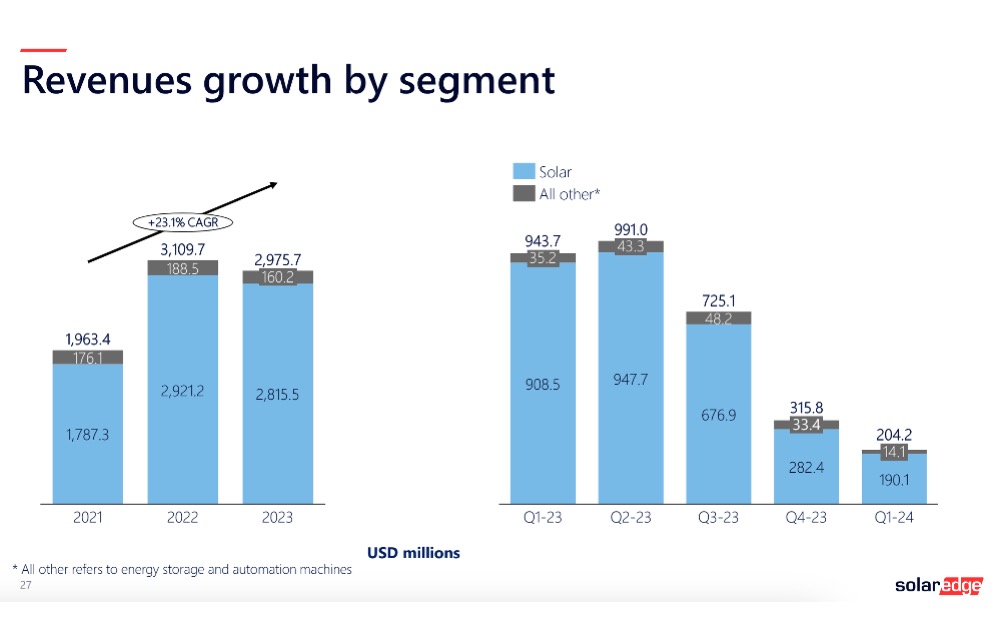

Israel-headquartered solar PV inverter manufacturer SolarEdge Technologies met its Q1/2024 revenue guidance while reporting a sequential drop of 35% and Year-over-Year (YoY) decline of 78%. GAAP net loss was reported as -$157.3 million, which narrowed from a loss of -$162.4 million in the previous quarter.

The forecast for the reporting quarter was restrained due to high interest rates and lower electricity prices.

Solar segment revenues totaled $190.1 million, at the higher end of the guidance range with a negative gross margin of -3.5%. At the group level, GAAP gross margin was a negative -12.8%.

The company shipped 946 MW AC of inverters during the quarter along with 128 MWh of batteries for PV applications. SolarEdge had earlier confirmed that the company will undership in this quarter by close to $250 million to $300 million to get rid of excess inventory. Last quarter, it undershipped by close to $200 million (see SolarEdge Blames Market Dynamics For 2023 Financials).

SolarEdge CEO Zvi Lando explained, “Our first quarter results were aligned with our expectations of inventory clearing and typical seasonality.”

Going forward, it expects channel inventory to continue to decline and revenues to improve. “In parallel, we are focused on a suite of new products that we plan to release in the next several quarters to position ourselves for the next growth cycle in our industry,” added Lando.

SolarEdge forecasts its Q2/2024 revenues to range from $250 million to $280 million. The solar segment will lead with $225 million to $255 million in revenues.

Gross margin from the solar segment is expected within a range of negative -3% to a positive 1%, including close to 420 basis points of net Inflation Reduction Act (IRA) manufacturing tax credit.

Philip Shen of Roth MKM opines the company now sees normalized inventory levels by YE’24, which suggests normalized revenue could be in play thereafter.