- Maxeon’s Q2/2023 revenues grew 46% YoY but higher interest rates and California policy disruption impacted guidance

- Performance Line modules made up 596 MW of 807 MW total shipments, followed by 211 MW IBC shipments

- Management has lowered FY 2023 revenue and adjusted EBITDA guidance citing challenging market conditions

- With residential demand softening in the near term, it will have an increased focus on the C&I segment

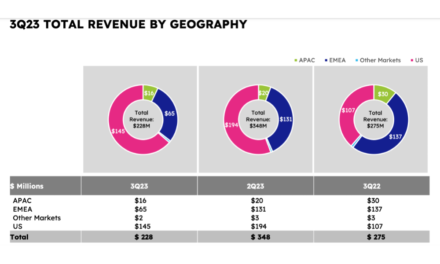

Solar panel manufacturer Maxeon Solar Technologies grew its annual revenues in Q2/2023 by 46%; however, citing softening of residential demand and challenging market conditions that it expects to persist through the end of this year, the management has lowered its 2023 annual guidance. The US and Canada regions contributed the largest chunk of its Q2 revenues of $348 million with a share of $194 million, followed by EMEA with $131 million, $20 million from APAC and $3 million from the LATAM region.

In terms of the product mix, Performance Line continues to lead sales with $204 million from 596 MW shipped. IBC range shipments of 211 MW pulled in $144 million in revenues.

Gross profit for the reporting period improved to $56.2 million from -$39.3 million in Q2/2022; however, the company reported a GAAP net loss of -$1.51 million compared to a net profit of $20.27 million in the previous quarter.

“The demand environment in the global distributed generation (DG) market weakened significantly in late-Q2 due to the combined effect of higher interest rates, the impact of policy disruption in California, and significant channel inventory industry-wide. Our DG sales team was able to deliver on-plan ASP and gross profit but came in short of target on volume and revenue,” explained Maxeon CEO Bill Mulligan.

Going forward, Maxeon will have an increased focus on commercial and industrial (C&I) segment to deal with a slump in the residential segment. “We therefore expect a somewhat higher mix of C&I sales over the next few quarters with some push-out of volume from Q3 to Q4 and into 2024 due to the longer sales cycles associated with C&I projects,” added Mulligan.

Guidance

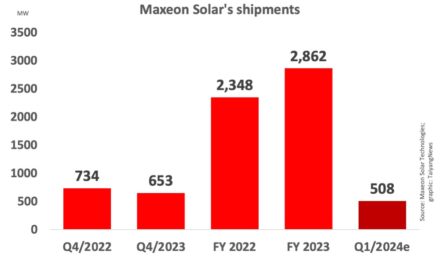

For Q3/2023, Maxeon anticipates between 700 MW and 740 MW shipments and revenues ranging within $280 million and $320 million. Adjusted EBITDA is guided between $2 million and $12 million, and gross profit within $29 million and $39 million.

Maxeon has lowered its annual guidance for 2023 while offering subdued revenue forecast for Q3/2023. (Photo Credit: Maxeon Solar Technologies, Ltd.)

As per the revised guidance for FY 2023, the company now expects to report revenues within $1.25 billion and $1.35 billion and adjusted EBITDA between $80 million and $100 million. The company had previously guided for full year revenues to fall in the range of $1.4 billion and $1.6 billion (see Maxeon Meets Shipment & Revenue Guidance).

Maxeon has also announced Mesa Del Sol in New Mexico’s Albuquerque as the location of its maiden US manufacturing fab with 3 GW annual capacity (see Maxeon Picks New Mexico For New Solar Fab).