- Maxeon has released its preliminary financial results for Q4/2023, reporting -$32 million gross loss

- Annual GAAP net loss widened to -$274 million while revenues improved by 22%

- As DG market slowdown continues, management plans to accelerate Maxeon 6 phase-out

Maxeon Solar Technologies has offered a very conservative shipment and revenue guidance for Q1/2024 after reporting a gross loss of -$32 million and a GAAP net loss of -$184 million in Q4/2023 while sharing its preliminary unaudited results for last year.

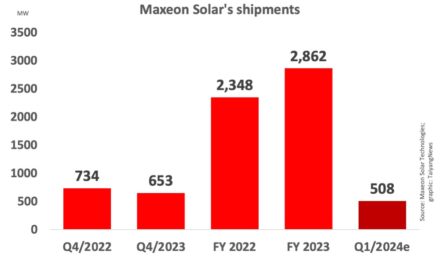

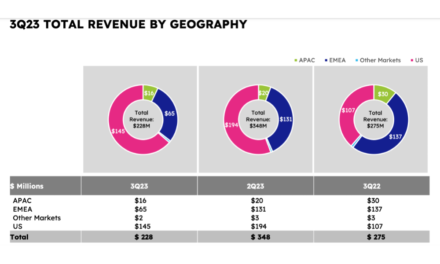

The solar module manufacturer shipped 653 MW during the reporting quarter, reflecting almost a 4% sequential increase and an 11% annual decline. Its revenues of $229 million during the reporting quarter were at par with Q3/2023, but dropped by over 29% on an annual basis.

The management says Q4 revenues were driven by the US utility-scale business, with stable ASPs.

On an annual basis, its total shipments during FY 2023 improved by approximately 22% to 2.86 GW while revenues went up 6% to $1.12 billion. Nonetheless, its GAAP net loss widened from -$267 million in 2022 to -$274 million in 2023 (see Maxeon Reports $20 Million Gross Profit For Q4/2022).

The company said it plans to file its annual 20-F report by April 30, 2024. Commenting on the manufacturer delaying its Q4/2023 financials, Roth MKM’s Philip Shen said the company may have preannounced Q4 to frame the quarter and Q1.

Maxeon CEO Bill Mulligan shared, “As disclosed in our last earnings call, Maxeon has been executing a transformation of our IBC capacity timed to coincide with the current DG market slowdown. As part of this initiative, we made the decision to ramp down all of our Maxeon 6 capacity faster than we had originally expected, resulting in higher than initially planned restructuring costs in the fourth quarter.”

For its Maxeon 7 panels, the company recently announced 24.9% aperture efficiency. It plans to make these available commercially in Q3/2024 (see Maxeon Solar Announces 24.9 Percent Solar Module Efficiency).

The manufacturer added that going forward, its focus will be to return to profitability by reducing manufacturing costs, OpEx rationalization and liquidity management. It has guided for close to 508 MW in shipments and $186 million in revenues.

Maxeon is currently in a patent lawsuit against Canadian Solar for TOPCon technology. Roth MKM believes given the ‘strength’ of the company’s TOPCon IP portfolio that predate any other TOPCon technology, it can lead to a disruption in the industry (see Maxeon Alleges Patent Infringement By Canadian Solar).