- Maxeon’s revenues were negatively impacted by SunPower failing its timely payments and high inventory levels in Europe

- GAAP net loss widened to -$108 million, while gross profit went down by 95% QoQ to $2.7 million

- It has signed an amended agreement with SunPower under which it can directly sell products to SunPower installers

- Maxeon will add 500 MW more capacity to the New Mexico fab and bring in Maxeon 7 modules a quarter earlier

Maxeon Solar Technologies, the SunPower Corporation spin–off, has announced reaching a settlement with SunPower after their dispute negatively impacted its Q3/2023 financials. Citing near–term softening of residential demand, the management has now further lowered its annual guidance for 2023.

Q3/2023 financials

As announced previously, Maxeon said that non-payment by SunPower disturbed its distributed generation (DG) business as it stopped shipments to the US residential installer. Additionally, high inventory levels in Europe pulled down its sequential shipments to this region by 37%.

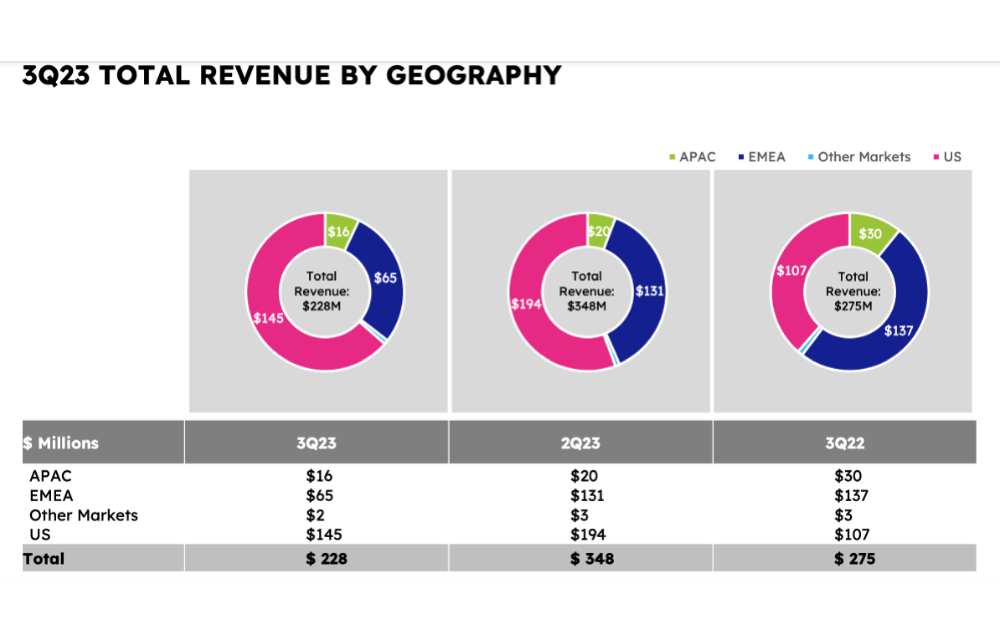

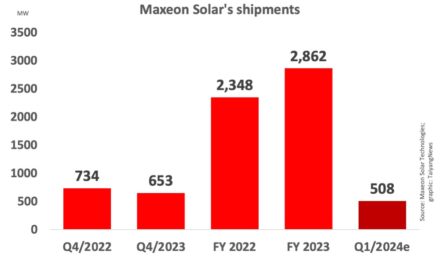

It shipped a total of 628 MW modules during the period, bringing in $227.6 million in revenues, down from $348 million in Q2/2023 and $275.4 million in Q3/2022 (see Maxeon’s Q3/2022 Revenues Went Up 25% Annually).

Gross profit dropped over 95% sequentially down to $2.7 million. However, it was an improvement over a loss of -$15.7 million since last year.

As a result, its GAAP net loss widened to -$108 million, from -$1.51 million in Q2/2023 and -$44.7 million in Q3/2022.

Contracted backlogs of 3.3 GW are booked for delivery through 2025, and an additional 500 MW allocated for 2025, 2026 and 2027 each.

Maxeon says all outstanding disputes regarding the master supply agreement (MSA) with SunPower have been resolved. Both existing supply agreements between the 2 have been terminated and replaced by a revised agreement, according to which:

- Maxeon will supply 85 MW of its IBC solar modules at contracted pricing to SunPower through February 2024. The latter will post a $30 million payment security bond

- SunPower will maintain its exclusive right to distribute M-Series products in the US until March 31, 2024

- Maxeon will be released from non-circumvention obligations with respect to SunPower dealers and will receive warrants to purchase 1.7 million SunPower common stock in a private placement, subject to the provisions of the agreement

Maxeon CEO Bill Mulligan sees the opportunity to sell its products directly to SunPower installers as a positive for the company’s US business as its clears ‘the way for Maxeon to aggressively ramp sales into the US market by leveraging its acquisition of Solaria Corporation and accelerated ramp plans for Maxeon 7 capacity.’

Technology update

The solar manufacturer will expand its New Mexico located solar cell capacity from 3 GW now to 3.5 GW. Recently, the company hired a new GM for this fab (see New General Manager For Maxeon Mexico Facility). It is also building a TOPCon pilot line in the Malaysian Fab 3.

Speaking to analysts post the financial results announcement, Maxeon said it will phase out Maxeon 6 and focus on Maxeon 7 along with future generations. The plan to launch Maxeon 7 into the market has been brought forward by a quarter. It will reserve Fab 5 for future Maxeon 8 capacity, while premanufacturing sufficient volume of Maxeon 6 to ensure a smooth transition to Maxeon 7 in all its key markets, added Mulligan.

Guidance

During Q4/2023, Maxeon forecasts to ship 610 MW to 650 MW modules and report between $220 million and $260 million in revenues. Gross loss is guided as $5 million to $15 million, and adjusted EBITDA of -$27 million to -$37 million. The management says the shipment, revenues, gross loss and adjusted EBITDA include transactions with SunPower based on the contracted volume pursuant to the settlement agreement.

For full year 2023, the company now aims to report revenues between $1.11 billion and $1.15 billion, and adjusted EBITDA of $4 million to $14 million. Capital expenditures are expected within $66 million to $76 million. This is its 2nd downward revision of the annual forecast this year (see Singapore Company’s Q2/2023 Revenues Grew 46% YoY).

Calling 2024 a pivotal year for the company, Mulligan said the management is pinning hopes on the US utility-scale business that’s expected to contribute material margins for the first time since it launched in the country.

According to Philip Shen of ROTH MKM, “While there may not be meaningful IBC volume in H1’24 given the overall module channel inventory, MAXN now has an opportunity to “control its own destiny” with the premium U.S. resi segment.”