Global BESS capacity exceeded 250 GW by the end of 2025, with over 100 GW/280 GWh added in 2025 alone, says Rystad Energy

Falling solar capture prices and curtailment make standalone solar PV less viable in many markets, pushing hybrid solar-plus-BESS projects as a preferred option

The trend is accelerating, especially in several markets in Europe, Australia, and California

Battery generation is increasingly displacing gas-fired power, particularly during peak demand periods

Utility-scale BESS costs continue to decline, led by China’s supply chain, improving project economics, and attracting growing interest in both hybrid and standalone battery projects

Global battery energy storage system (BESS) capacity exceeded 250 GW at the end of 2025, overtaking pumped hydropower energy storage (PHES) as the world’s largest source of energy storage, says Rystad Energy in a whitepaper on energy storage. This comprises over 100 GW/280 GWh installed in 2025.

Driven by the need for fast, flexible capacity to support power systems as the share of renewable energy rises, BESS registered a compound annual growth rate (CAGR) of over 100% between 2020 and 2025.

Standalone solar PV projects are generally not considered financially viable in several markets, especially given curtailment and reduced capture prices for dispatched solar generation, analysts point out. The hybrid solar-plus-storage configuration emerges as a viable solution in such cases. Several countries deem BESS a prerequisite for further solar build-out, including Australia, CAISO in the US, and some European markets.

In Europe, solar power earned much lower capture rates in 2025 than before. In large markets such as Spain, France, and Germany, solar plants received less than 40% of the average market price in Q2 and Q3, down from about 60% in 2024, making new standalone solar projects risky without long-term power contracts. According to the whitepaper, these markets are becoming increasingly difficult to enter with standalone solar PV without clear offtake agreements to secure revenue streams.

Some other European countries – Finland, the UK, and Italy – are doing better, as solar prices there are ‘appearing resilient to cannibalization’ despite more capacity being added. Recently, a SolarPower Europe report found that the European Union (EU) installed 27.1 GWh of battery storage in 2025, representing its 12th straight year of growth. It recommends expanding the cumulative deployment to around 750 GWh by 2030 (see EU Battery Storage Installations Rise 45% In 2025 With 27.1 GWh).

Moreover, BESS is no longer enabling renewables alone; it is also actively replacing gas generation. Analysts cite Victoria, Australia, as an example, where battery generation overtook gas-fired capacity for the first time in 2025. They forecast similar developments in other Australian states, New South Wales (NSW) and Queensland, in 2026.

Elsewhere in the US, California saw battery generation accounting for over 20% of evening generation in April 2025, replacing gas generation.

Falling Costs and Technology Improvements

BESS has caught the fancy of global energy systems primarily because of falling costs. Total turnkey costs for utility-scale BESS continued their downward trajectory last year, driven by incremental technological improvements, higher system energy density, manufacturing scale-up, and intensified competition across the supply chain.

China remains the global cost benchmark with a competitive domestic market and a mature, vertically integrated supply chain. Markets with strong exposure to Chinese suppliers benefit, thereby boosting installations globally both for solar PV and utility-scale BESS. In China, says Rystad Energy, the total turnkey capital cost of a hybrid 4-hour utility-scale BESS fell by around 15% annually to $148/kWh in 2025, setting a global benchmark.

Europe, too, saw its average BESS costs decline 10% YoY to $215/kWh for the same configuration.

The US, on the other hand, is decoupling from Chinese suppliers. Its tariffs and trade policy measures introduced in 2025 raised the cost of imported components and input costs for domestic manufacturing. Here, the average BESS cost rose 6% annually to $263/kWh, ranking among the highest globally (typically exceeding $240/kWh to $260/kWh).

Technological improvements ensure that system lifetimes now exceed 20 years and offer more than 10,000 cycles. “At a capital cost of around $200 per kWh, this translates into a levelized cost of storage of approximately $50 per MWh — or lower in favorable conditions,” reads the white paper. “In regions with stable solar resources, co-located solar-plus-BESS projects are increasingly emerging as the most competitive source of new power generation.”

At the same time, investor interest in standalone BESS projects is increasing, as battery projects can earn good money on their own. In liberalized electricity markets, batteries make money by buying power when it’s cheap and selling it when prices are high, and by providing grid support services.

In emerging markets, however, these grid services remain largely unused and offer untapped potential. In more developed markets like Australia, the UK, and California, batteries are earning more of their income from shifting energy over time rather than from grid services.

The Philippines led the pack of the top 20 most volatile power markets in 2025 on Rystad’s list. By volatile, analysts refer to fluctuation in power prices within the same day, which depends on system flexibility, generation mix, and exposure to supply-side disruptions. It was followed by Australia, among others, on the list. This price volatility is not going to drop anytime soon, which eventually benefits BESS.

Looking Ahead to 2026

“This year is shaping up to be another record year for battery energy storage,” stress Rystad analysts. “As BESS increasingly provides the flexibility and resource adequacy needed to support renewable expansion, and as project pipelines continue to scale globally, battery storage is becoming economically viable across nearly all regions in 2026.”

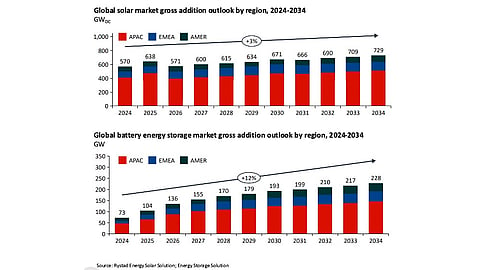

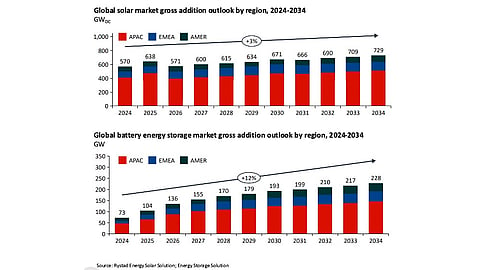

In 2026, solar PV deployments are expected to report the first year-over-year (YoY) decline in annual additions since 2018 – reaching 571 GW in 2026 after exiting 2025 with 638 GW, according to Rystad Energy. As standalone solar PV projects find few takers, 2026 will be a landmark year for BESS as analysts expect deployments to exceed 130 GW/350 GWh, led by China, the US, UK, Australia, and Germany.

Apart from these established markets, emerging markets of Italy, Saudi Arabia and the wider Middle East, Chile, and Eastern Europe are the ones to watch out for as Rystad analysts expect them to align policy frameworks, grid needs, and project pipelines.

Going forward, battery costs may stop falling as fast, analysts point out, mainly due to China’s cuts to export tax rebates. This could raise battery cell and container prices by about 6% in each phase, caution the analysts, while rising lithium prices could add another 2–5% to overall system costs.

Notably, China will cancel value-added tax (VAT) export rebates for solar PV cells and modules from April 1, 2026, while lowering battery export rebates from 9% to 6% before phasing them out completely by January 1, 2027 (see China To Remove Solar Export Tax Rebates From April 1, 2026).

The complete white paper, titled Energy Storage Outlook: The expanding role of BESS in global energy systems, is available for free download on Rystad Energy’s website.

Rystad Energy’s Vice President Renewables & Power Sushma Jagannath will be at the TaiyangNews Solar Technology Conference India 2026 (STC.I 2026) on February 5 and 6 in Aerocity, New Delhi. Jagannath will share insights on supply, demand, and price dynamics. This 2nd edition of the TaiyangNews physical conference is bringing together the Indian solar PV manufacturing industry. It will also have banks, investors, and policymakers in attendance. Register for the event here.