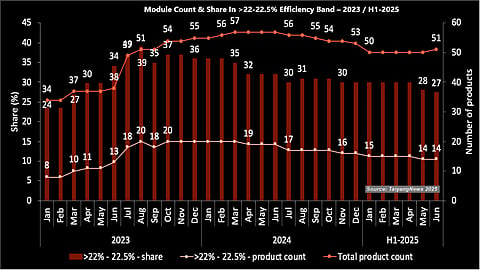

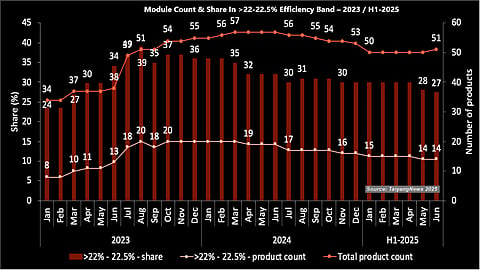

The 22% to 22.5% band grew strongly in 2023, rising from 8 to 20 products and increasing share from 24% to 36%

Starting in 2024, the trend reversed: product count declined from 20 in January to 16 in December, with the share shrinking from 36% to 30%

The downward trajectory continued in H1 2025, with product numbers falling to 14 and share dropping further to 27%, impacted by delistings and upgrades to >22.5%

For easier analysis of the TaiyangNews TOP SOLAR MODULES report, we outlined the development of module efficiencies across 4 bands: >22.5%, >22% to 22.5%, >21.7% to 22%, and 21.5% to 21.7%. The previous article covered the first band, while the second is represented by >22% to 22.5%. One could refer to this as the gateway efficiency band, especially for TOPCon and HJT technologies. It was also the band that saw the highest growth in 2023, when more and more companies began commercial activities with TOPCon. However, as companies quickly gained experience and improved their technologies, they eventually moved up to the higher band. As a result, both the number and share of this band started falling from H2 2024 onwards (see Highest Solar Module Efficiency Band).

This downward trend carried into the first half of 2025. The number of products in this efficiency band slipped from 16 in December 2024 to 15 in January 2025, and dropped further to 14 by June. Correspondingly, the band’s share shrank from 30% to 27% over the 6-month period. The first shift came in January, when Akcome’s HJT module was delisted. The next and the only other change occurred in May, when Trinasolar improved the efficiency of its TOPCon module from 22.5% to 23%, pushing it into the next higher band. These 2 developments were the only updates impacting this category during H1 2025.

Starting with a share of 36% at the beginning of 2024, this efficiency band saw a consistent decrease to 30% by the end of the year. The number of products declined from 20 to 16 – dropping by one in April, 2 in July, and one more in November. In January 2024, DMEGC Solar’s latest TOPCon product reached the top efficiency of this band, improving from 22.45% to 22.5%, before moving into the higher band in April. In February, Tongwei Solar increased the efficiency of its TOPCon module, exiting this band entirely. That same month, Qcells joined our listing with a module rated at 22.3%, which remained unchanged until the end of the year. In March, Türkiye’s Kalyon was listed for the first time with a TOPCon module at 22.38% efficiency. However, this addition was offset by the delisting of Canadian Solar’s HJT module that same month. In April, DMEGC Solar once again improved the efficiency of its TOPCon product beyond 22.5%, leaving this group. In May, EGING PV improved its TOPCon module from 22.45% to 22.5%, where it stayed through the end of the year. In July, JA Solar and REC increased their TOPCon and HJT module efficiencies beyond 22.5%, exiting this band. Another upgrade came in November, when SolarSpace improved its TOPCon module efficiency to 22.65% (see Share Of Different Module Efficiency Bands).

In contrast, the year 2023 saw considerable growth in both product count and the share for this band. The share rose from 24% in January to 36% in December, while the number of products increased from 8 to 20. There were no changes in the first 2 months of 2023, but several followed. In March, Tongwei Solar began offering TOPCon modules commercially at 22.4% efficiency, the same level as JA Solar’s product. Astronergy also increased its efficiency from 22.1% to 22.4% in the same month. Then, in April, both JA Solar and Tongwei Solar reached 22.5%, followed by Astronergy in May. However, Astronergy moved out of this band in September. Canadian Solar, in addition to its already-listed 22.5% HJT module, introduced a TOPCon module with 22.3% efficiency in March. It later improved this to 22.5% in May, matching its HJT offering. Among its peers at the 22.3% level at that time, REC remained unchanged throughout the year, while SPIC exited the band in September with a higher-efficiency product. DAS Solar improved its TOPCon efficiency in March from 22.1% to 22.3%, and later to 22.5%, where it remained for the rest of the year. Trinasolar introduced a 22.3% efficiency TOPCon module in April – its previous 21.9% product was not part of this band. In June, Trinasolar improved the efficiency to 22.5%, which was its final update for the year. Also in June, Risen commercialized an HJT module with 22.5% efficiency, which remained unchanged through the end of the year. In June 2023, DMEGC Solar entered our listing with a 22.4% efficiency module, which was upgraded to 22.45% in July and remained stable thereafter.

A major development in July 2023 was the entry of 6 new companies into the TOP SOLAR MODULES list, 4 of which had products in this band: Qn-SOLAR with a 22.45% module, Runergy and Suntech at 22.4%, and SolarSpace at 22.02%. While Suntech and Qn-SOLAR maintained their initial levels, SolarSpace and Runergy improved their TOPCon efficiencies in December, to 22.45% and 22.5%, respectively. By December, as many as 8 products were listed at the 22.5% efficiency mark. Also in July, EGING PV, which had been at 22.05% since August 2022, commercialized a 22.44% module, improving it to 22.45% in August, and maintaining this level through the end of 2023. In August, 2 more companies – URECO and GCL SI – joined the list, with 2 products from the former and 1 from the latter. URECO’s TOPCon module was rated at 22.45%, and its HJT module at 22.44%; both remained unchanged through the year. GCL SI’s TOPCon module entered with 22.3% efficiency and stayed at that level until December. In October, Yingli and CECEP joined the group with TOPCon modules at 22.36% and 22.1%, respectively; neither saw efficiency changes before the end of the year. In December 2023, Akcome improved the efficiency of its HJT module from 22.22% to 22.37%.

This text is an edited excerpt from the TaiyangNews TOP SOLAR MODULES H1-2025 report, which can be downloaded for free here.