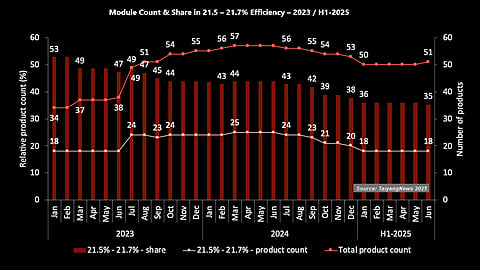

The 21.5% to 21.7% band had the highest product representation but fell from 24 modules in July 2023 to 18 in June 2025, with its share dropping from 44% to 35%

In H1 2025, product count declined from 20 to 18 due to Risen and Akcome PERC modules being delisted

Delisted products in 2024 included PERC modules from Tongwei, Astronergy, Talesun, and JinkoSolar

For easier analysis of the TaiyangNews TOP SOLAR MODULES report, we have divided module efficiency developments into 4 bands: >22.5%, >22% to 22.5%, >21.7% to 22%, and 21.5% to 21.7%. Having already discussed the first 3 bands in earlier articles, this article focuses on the 21.5% to 21.7% range.

The lowest efficiency band in our rankings continues to have the highest product representation and remains dominated by PERC technology. However, over the last 2.5 years, its share has been steadily declining, falling from 44% to 35%. The product count dropped from a peak of 24 in July 2023 to 18 in June 2025. Interestingly, the number of products remained exactly at 18 during the first halves of both 2023 and 2025.

In H1 2025, the number of products declined from 20 to 18 in January and remained unchanged through June. Correspondingly, the share dropped from 38% to 36%, and further to 35% by the end of the first half. These reductions were primarily due to the delisting of PERC modules as companies phased out legacy products from their portfolios. To be specific, in January, both Risen Energy’s PERC module with 21.7% efficiency and Akcome’s PERC module rated at 21.68% were removed from the listing. The dip in the last month of this period is due to the addition of a product in another band (see Highest Solar Module Efficiency Band).

In 2024, the product count started at 24 and increased to 25 in March, maintaining this number through June. The only product addition during the year was Kalyon PV’s PERC module, rated at 21.61% efficiency, in March. This module was later delisted in July. The second half of the year marked a clear decline. Other deletions included Tongwei Solar in September, Astronergy and Talesun in October, and JinkoSolar in December. This brought down the module count to 20 and their share to 38%. All exits were due to the discontinuation of their PERC product lines (see 22%-22.5% Efficiency Band: No More A Gateway).

In 2023, the product count remained flat at 18 during the first half, then saw a sharp increase to 24 in July, which continued through December. The share, however, dropped from 53% in January to 44% by year-end, due to a larger increase in total product listings that do not fall into this band. Top-tier products during the year included those from LONGi, Risen, and Canadian Solar at 21.7%, along with stable offerings from JinkoSolar and Akcome at 21.68%, and Trinasolar, JA Solar, and Talesun at 21.6%. In March, Tongwei Solar’s module efficiency rose from 21.5% to 21.7%, as did Astronergy’s – from 21.5% to 21.6%, which it maintained until reverting in September. DAS Solar reached the 21.7% level in April. In July, 6 companies recorded new efficiency levels: Qn-SOLAR, SolarSpace, and URECO reached 21.57%, while CECEP, GCL SI, and Runergy debuted at 21.5%. GCL SI later improved its module to 21.6% in August, while Jinergy’s 21.6% HJT module moved out of the band. In October, ZNSHINE entered with a 21.5% module. All these efficiency levels remained unchanged through the end of the year (see Module Efficiencies Between 21.7% And 22%).

This text is an edited excerpt from the TaiyangNews TOP SOLAR MODULES H1-2025 report, which can be downloaded for free here.