Key takeaways:

TOPCon is expected to remain the dominant cell technology for the next decade, supported by high yield, manageable costs, and strong ROI

PECVD continues to be highlighted as an efficient deposition approach due to lower cost, simpler processing, and reduced maintenance needs compared to LPCVD

Future improvements for TOPCon focus on oxidation-layer control, contact resistance, optical losses, and doping optimization

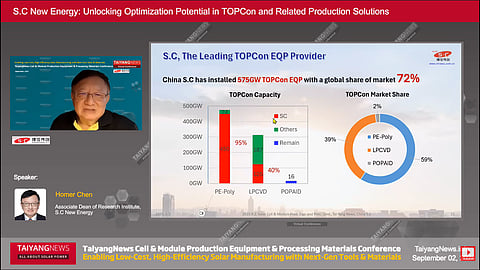

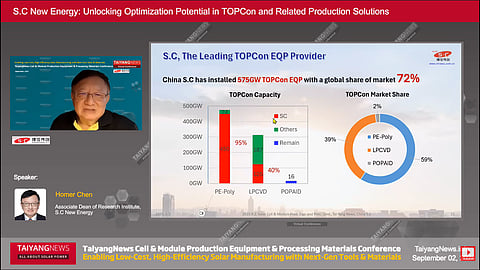

Homer Chen, Associate Dean of the Research Institute at Shenzhen S.C (China S.C), presented optimization opportunities in TOPCon production and the company’s related equipment solutions at the TaiyangNews Cell & Module Production Equipment & Processing Materials virtual conference.

He opened by stating that TOPCon remains mainstream and will dominate for the next 10 years. PERC is projected to phase out soon, whereas perovskite and back-contact (BC) technologies continue to face maturity, cost, and reliability challenges. He emphasized that for investors, the return on investment (ROI) still favors TOPCon due to its stability, manufacturability, and high yield.

Chen presented an important table comparing TOPCon, HJT, and XBC technologies in which HJT cells show a future potential mass-production efficiency of 27%, compared to TOPCon at 26.8%. The real differentiators, however, are the equipment investment ratio, maximum manufacturing-ready production lines, and the overall production cost. With 3 times lower CapEx than HJT, more than 775 GW of global production capacity available, and a production cost of $0.02/W against $0.028/W for HJT, TOPCon technology is promising, with ROI in about 2 to 3 years, compared to about 5 years for HJT.

A major part of the presentation focused on PECVD as a deposition route for TOPCon. Chen emphasized that Shenzhen S.C has supplied significant volumes of PECVD and LPCVD equipment globally, claiming a leading share in TOPCon equipment deliveries. He argued that PECVD offers advantages such as lower CapEx, lower consumable costs, faster doping rates, and simpler processing compared with LPCVD. By contrast, LPCVD suffers from longer quartz tube replacement cycles, higher logistics burden, and downtime associated with refurbishing high-temperature components.

According to Shenzhen S.C, the future optimization directions for TOPCon include oxidation-layer thickness control, contact-resistance reduction, minimizing optical losses, and improving carrier lifetime with optimized doping concentration.

Chen stated that the company provides LECO and edge-passivation (EPD) tools as standard, and offers polyfinger structuring as an optional enhancement to improve efficiency. He also highlighted the company’s experience helping customers address intellectual property concerns by providing Freedom-to-Operate (FTO) support through US law firms.