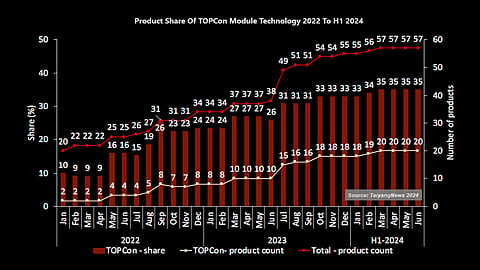

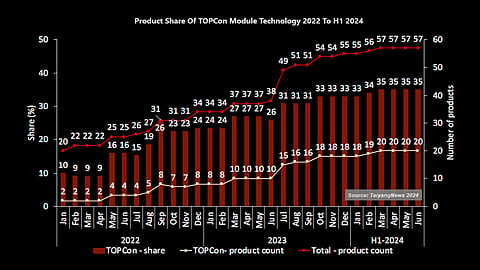

TOPCon started with just 2 products in January 2022, increasing to 18 by the end of 2023, and reaching 20 by March 2024.

The technology's market share rose from 10% in January 2022 to 33% by the end of 2023, and further to 35% by March 2024

Major players such as JinkoSolar, Jolywood, Qcells, Astronergy, and JA Solar contributed to the rapid growth and adoption of TOPCon technology

New entrants like Qn-SOLAR, Suntech, GCL-Si, Runergy, SolarSpace, and URECO expanded the TOPCon product lineup.

The TaiyangNews TOP SOLAR MODULES Analysis focused on the share of different cell technologies over the past 30 months. In our previous articles, we presented the shares of IBC and HJT technology. With this article, we move on to the TOPCon technology. TOPCon—represented by only 2 products in January 2022—quickly entered the commercial space and had 8 products on offer by December of that year. As a result, it increased its share from 10% to 24%. By the end of 2023, TOPCon had 18 products listed, translating into a share of 33%. It’s the only cell technology stream that has increased its product share over the 2.5-year period.

In January 2022, we first listed products from JinkoSolar and Jolywood, which remained the only pair of TOPCon module makers that could offer higher efficiency products. Later, in May 2022, Qcells and Astronergy started selling such products. In August, EGing PV joined the stream, followed by JA Solar, DAS Solar and Trina, as reflected in the September listing. However, in the subsequent 2 months, Qcells' product lost its place in the list as its data was not accessible and only became available again in December 2022 (see Trends In Solar Module Efficiencies).

The next change happened in March 2023 when 2 more companies—Tongwei and Canadian Solar —started offering TOPCon modules commercially. With these additions taking the listed products to 10, the technology’s share increased to 27%. However, in June 2023 Qcells’ product was again removed from the company’s website and, consequently, also from our listing. However, the product count remained at 10 with DMEGC’s product entering our listing for the first time the same month (see Share Of IBC Technology).

In July 2023, 5 modules were included from companies using their own TOPCon cells for their manufacture—Qn-SOLAR, Suntech, GCL-Si, Runergy, and SolarSpace. Then URECO joined the stream in August, followed by Yingli and CECEP in October. The total product count increased to 18 through these additions and remained unchanged till the end of 2023, as did TOPCon’s share of 33%. While there was no change in January 2024, the number of products increased to 19 in February and 20 in March, increasing the share to 34% and 35%, respectively. However, the technology stream has gone through many other changes in the next 3 months (see HJT Module Trends And Developments).

The TaiyangNews TOP SOLAR MODULES H1/2024 Report summarizes the key findings from over 30 editions published during 2022 and H1/2024. Download the free report here.