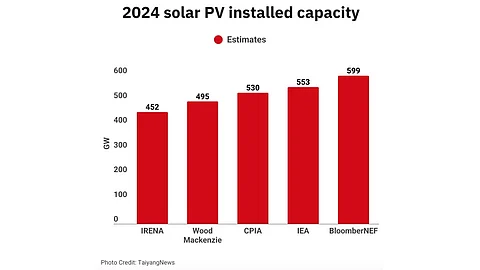

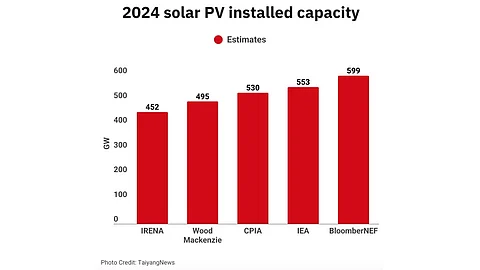

The global solar PV installation estimate for 2024 by various analysts varies widely

For 2025, the forecast remains divergent as China, the world’s largest solar market, adjusts to policy changes

Limitations related to grid capacity and policy uncertainty are among the reasons listed for the subdued forecast for 2025

Global solar PV installation numbers for the year 2024 have been released by various leading analyst firms and none of them come close to each other. In fact, these estimates start from 452 GW reaching up to 599 GW, of course with a variance of DC and AC numbers.

Bloomberg New Energy Finance (BloombergNEF) pegs 2024 solar PV installations at 599 GW DC, of which China contributed 335 GW DC.

According to the International Energy Agency (IEA), last year’s global solar PV installations totaled 553 GW, with a 30% year-on-year (YoY) growth, thanks to the increase in electricity demand (see IEA: Global Solar PV Installations In 2024 Totaled 553 GW).

The International Renewable Energy Agency (IRENA) says global PV additions totaled 451.9 GW in 2024, representing a 32.2% YoY increase (see IRENA: A Record 452 GW Solar Capacity Installed In 2024).

Record decline in solar module prices due to overcapacity was one of the significant factors responsible for clean energy growth in 2024, but the trend may not continue this year.

The world is just out of the first quarter of 2025. The projections for this year by the above-mentioned analysts show they don’t agree with each other for this year as well. Their estimates range from 493 GW to 698 GW.

Earlier this year, in January 2025, Wood Mackenzie pegged 2024 global solar PV installations at 495 GW DC, but forecast a decline of 0.5% in 2025 to 493 GW DC. Growth this year will be driven by power demand due to mushrooming data centers and growing electrification trends.

However, Wood Mackenzie’s Principal Analyst, Utility-scale solar PV, North America, Sylvia Levya Martinez, listed policy uncertainty, protectionist measures and interconnection and transmission bottlenecks for bringing the annual growth trend of solar buildout this year to a ‘halt, even under current module oversupply conditions’.

Speaking at the TaiyangNews Solar Market 2024 Review & 2025 Outlook Webinar in January this year, BloombergNEF Lead Solar Analyst Jenny Chase used the word ‘slump’ in dollar terms for the global PV market in 2025. In Europe, especially, reducing conventional power prices does not create enough incentive to buy solar.

At the event, Chase forecast around 12% annual growth in 2025 installations, with 670 GW DC to 700 GW DC in new additions. Speaking at the China Photovoltaic Industry Association (CPIA) seminar in February 2025, BloombergNEF’s Youru Tan revised the forecast for this year’s installations to reach up to 698 GW DC, basing it mostly on cheaper solar modules for untapped markets (see BloombergNEF Raises 2025 Solar Installation Forecast To Around 700 GW DC).

However, the CPIA provided a more conservative forecast with regard to the new additions this year. In February, it forecast 2025 new additions to range within 531 GW to 583 GW, similar to the 530 GW level it believes the world added in 2024. This will mean that China’s annual solar PV growth will taper off after 6 years of strong increase.

Its subdued projections for this year are based on the market conditions within China, the world’s largest solar market. The CPIA cites insufficient grid capacity for renewable energy and the market-oriented power pricing system as the responsible factors (see China’s Solar PV Market To Slow Down To Around 255 GW In 2025).

Barring an installation rush expected before the market-oriented mechanism comes into force on June 1, 2025, PV additions of around 40 GW during 2M 2025 with a 7.5% year-on-year (YoY) growth probably set the expectations for the rest of the year.

Senior Advisor with Apricum—The Cleantech Advisory, Frank Haugwitz, agrees with the CPIA’s thought as he expects a ‘flattish demand outlook’ for China’s solar market during the country’s 15th Five-Year Plan (2026-2030). There will be a boom period till June 1 this year, followed by a bust in the remaining months till year-end. For 2025, it could even be ‘negative deployment’ YoY, according to Haugwitz.

But then, we are talking about China, which has defied forecasts earlier. The CPIA had earlier forecast up to 220 GW AC of new PV additions in 2024, later raising the forecast to up to 260 GW AC; China ended up exceeding 277 GW AC eventually (see China Exited 2024 With Over 277 GW New Installed Solar PV Capacity).