Singapore headquartered solar module maker Maxeon Solar Technologies improved both its annual revenues and shipments for Q2/2022, however its GAAP net loss widened to $87.92 million, up from $77.0 million last year while gross loss expanded to $39.3 million having shot up from -$2.8 million during the same period.

In comparison, in Q1/2022 its net loss added up to -$59 million (see Maxeon Solar Declares Q1/2022 Financial Results).

"Our gross margins continue to be affected by elevated supply chain cost, which we estimate to have had an adverse impact of $40 million year-over-year," explained Maxeon's CFO Kai Strohbecke. "Note these annual supply chain cost increases were partially offset by $30 million of price increases compared to the year ago quarter."

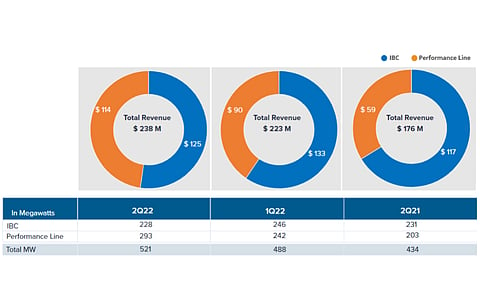

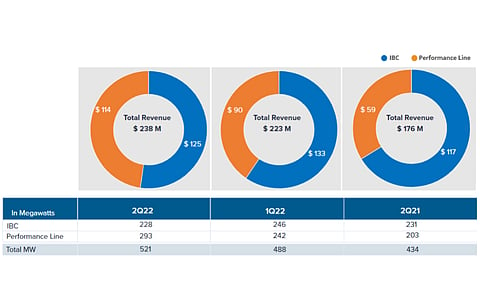

Maximum shipments were for performance line modules with 293 MW, followed by its high-efficiency IBC line with 228 MW. But as the sales prices for the IBC modules are higher their share in the revenues was also higher despite lower shipments: $114 million for the performance module versus $125 million for the IBC modules. Geographically, Europe Middle East and Africa (EMEA) region drove revenues, followed by the US and Canada.

In terms of segments, it was the distributed generation (DG) segment that contributed most to revenues with $212 million, followed by the large scale segment adding $26 million. In Europe, DG revenue went up 60% YoY on 'record volume, price increase and AC panel mix'.

During the reporting quarter, Maxeon started volume shipments of bifacial performance line modules assembled at its 1.8 GW Mexicali site for US projects. It now claims to have more than 3 GW of contracted backlog with deliveries extended till 2024, stating it is 'solidly booked out' for US utility scale business and is now looking to secure longer term supply contracts for 2025 and beyond.

With the Inflation Reduction Act (IRA) clearing way for solar manufacturers to secure state funding Maxeon said it is accelerating plans to add an incremental 3 GW in the US. Full ramp up of the 1.8 GW Mexicali module fab is on track for 2023 (see Maxeon Solar's Q2/2021 Revenues Grew Over 6% YoY).

Philip Shen of Roth Capital Partners believes Maxeon will 'likely need the support of a DOE loan guarantee and additional arrangements with customers interested in US capacity'.

"We've produced our last ever Maxeon 5 module and are on track to have a fully utilized half gigawatt of Maxeon 6 capacity later this year. The Maxeon 7 pilot line achieved its performance targets and, with funding recently secured, we now plan to scale the technology," shared CEO Jeff Waters.

The Maxeon 6 module is the uncontested efficiency leader in the monthly TaiyangNews Top Solar Modules Ranking for commercial panels (see Top Solar Module Listing – July 2022).

Maxeon recently raised $207 million by issuing a private convertible bond to its shareholder TCL Zhonghuan Renewable Energy Technology (TZE) to fund its Maxeon 7 conversion project in the Philippines and Mexico (see China PV News Snippets). "This transaction also highlights TZE's continued commitment to, and confidence in, Maxeon's success," emphasized Waters. TZE, formerly known as Tianjin Zhonghuan Semiconductor (TZS), is the world's second largest solar wafer manufacturer and a major shareholder in Maxeon next to Total Energies.

Guidance

The Maxeon management has guided for Q3/2022 shipments in the range of 580 MW to 620 MW, bringing in $270 million to $290 million revenues. Adjusted EBITDA is guided as between -$27 million to -$37 million, while gross loss is estimated as $10 million to $20 million that includes out-of-market polysilicon cost.