- Maxeon’s Q2/2021 revenues were mainly led by distributed generation rooftop solar segment

- It experienced higher logistics costs and polysilicon prices during the reporting quarter and sees such challenges continuing in H2/2021

- It is planning to develop 3 GW annual Performance line cell and module capacity in the US for which site selection is going on

- For Q3/2021, it has guided for revenues within the range of $220 million to $240 million

Singapore headquartered solar cell and module manufacturer Maxeon Solar Technologies has unveiled plans to develop a 3 GW solar cell and module fab in the US, after previously sharing the capacity as up to 1.8 GW for this location. It will be over and above the 1.8 GW it announced for Mexicali in Mexico and in Malaysia (see Maxeon Solar Shares Plans To Expand Further Into US Market).

Company’s CEO Jeff Waters said Maxeon has submitted an application with the US Department of Energy’s (DOE) Loan Programs Office to support the deployment of the 3 GW fab. Pending its successful negotiation of a DOE loan guarantee and the passage of enabling legislation including the Solar Energy Manufacturing for America Act and the American Jobs in Energy Manufacturing Act of 2021, Maxeon plans to start solar panel production in the US as early as 2023.

At the US fab, it plans to roll out its Performance line solar cells and modules. It is currently in the process of selecting a suitable site.

Q2/2021

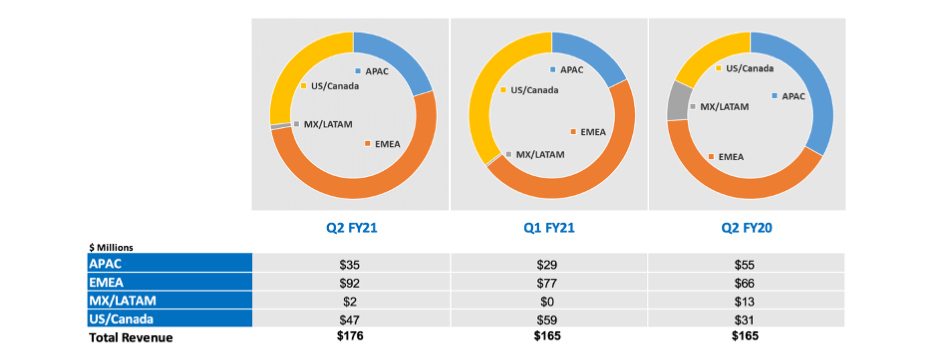

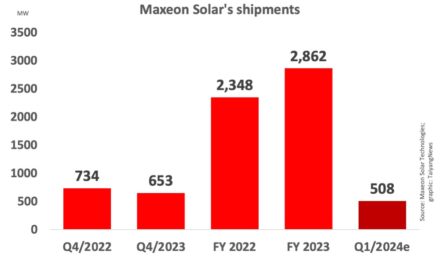

During Q2/2021, Maxeon shipped 434 MW slightly up from 428 MW in Q2/2020, that brought in revenues of $176 million compared to previous year’s $165 million. It did report a net loss which widened to $-77 million, growing from $-46.5 million. Gross loss narrowed from $-8 million in Q2/2020, to $-2.8 million.

It is the distributed generation rooftop business that brought in most revenues of $156 million. IBC cell products led the revenues. Among geographies, the EMEA market contributed $92 million to the total revenues, followed by the US/Canada adding $47 million, APAC bringing in $35 million and Mexico/LATAM another $2 million to the total.

According to Waters, DG business performance in the reporting quarter gives the company confidence for even stronger sequential growth in future quarters.

Management confirmed higher logistics costs and polysilicon prices that it believes have ‘plateaued at levels not experienced for years’ and that it continues to face headwinds from a supply chain cost perspective in H2/2021.

“But we are confident that the current disruptions will taper off and the improvements to our operations and our business, including technology upgrades, manufacturing footprint optimization, and prudent cash management, we positioned the company for profitable growth and be a catalyst for additional business opportunities once the situation has normalized,” stated CFO Kai Strohbecke.

Guidance

In Q3/2021, the company expects to ship between 580 MW to 640 MW capacity bringing in revenues of $220 million to $240 million. It expects a gross loss of $-10 million to $-20 million comprising out-of-market (OOM) polysilicon costs related to polysilicon contracts in the range of $20 million to $23 million.

Strohbecke added that the company plans to take advantage of high prices for polysilicon and ‘opportunistically sell any excess poly that is not consumed’ into its value chain during the quarter, to increase its cash flow.

It is in the process of close the French module fab in Toulouse which will result in restructuring charges of between $3 million to $4 million.