According to pvXchange, solar module spot market prices in Europe continue to decline, albeit slowly

A possible recovery is likely as manufacturers create an artificial shortage of supply by delaying production

However, the year-end rush to complete projects and the trend of securing supply at low prices may delay the price recovery

The perpetual downward spiral in solar module prices in Europe is likely coming to an end, as all signs point to a price recovery, according to the latest price update from pvXchange.com, a Germany-based online module trading platform for solar modules and inverters.

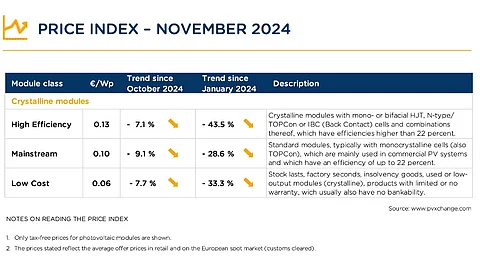

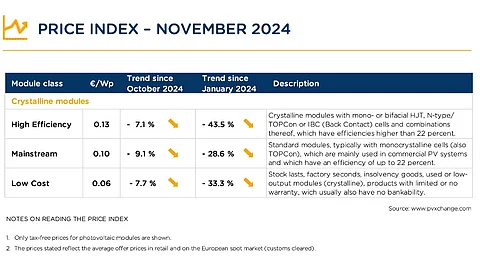

In the November edition of its monthly price overview, the average offer prices for duty-paid goods on the European spot market declined by 8%. This decline was seen across the 3 categories of high efficiency, mainstream and even low-cost modules.

For high-efficiency crystalline modules, the average price of €0.13/W reflected a decline of 7.1% since October 2024 and 43.5% since January 2024.

The prices of mainstream modules in Europe, typically with monocrystalline cells with an efficiency of up to 22%, reflected a decline of 9.1% month-on-month (MoM) and 28.6% since January this year (YtD) to €0.10/W.

Even the low-cost modules were available for an average price of €0.06/W as declines of 7.7% MoM and 33.3% YtD were observed. This module class includes modules in stocks, factory seconds, insolvency goods, and used or low-output modules with limited or no warranty.

In comparison, TaiyangNews’ latest PV Price Index for calendar week 46 (CY 46) shows that the average solar module prices in China declined in the range of 21.8% to 31.4% YTD in 2024. On a week-on-week (WoW) basis, the 2 TOPCon module types lost value with the 182 mm variant down 2.8% and the 210 mm down 2.1% WoW. In CW 47, PERC modules are the only products to see price changes, with the monofacial variant declining 1.5% WoW, while the bifacial 182 mm and 210 mm variants declined 1.5% and 1.4%, respectively (see TaiyangNews PV Price Index – 2024 - CW47).

The Managing Director of pvXchange, Martin Schachinger attributes the price decline in Europe to moderate demand, end-of-year stock clearances, and emergency sales shortly before or during insolvency proceedings by individual suppliers. Notably, companies across the board in Europe’s largest PV market Germany have been declaring insolvency at an alarming rate of late (see Germany’s Wegatech Seeks Insolvency Protection & Restructuring). The German market is expected to stay at the same level as last year or grow only a little (see Germany Installed Over 1.36 GW New Solar PV Capacity In October 2024).

However, Schachinger believes that this ‘perpetual downward spiral’ in prices is likely to be over now as there are several signs that show that prices are ‘stabilizing and even rising again.’ A major enabling factor will be the manufacturers agreeing on an ‘artificial shortage of supply.’

Schachinger said that Chinese producers have slowed down their production owing to a lack of international demand, a trend to be continued over the winter. “If demand can no longer be met, we will quickly find ourselves in a seller's market again in which suppliers can dictate prices. Whether and how quickly this works out depends, of course, on how many modules are still in the warehouses of manufacturers and wholesalers in Europe,” he adds.

In such a scenario, the price of black or transparent high-efficiency bifacial double-glass modules is likely to see a sharper increase. At the same time, lower-cost modules will be available at ‘bargain prices.’

The Chinese government’s decision to lower the export tax rebate from 13% to 9% will not have so much of an impact on the export costs for manufacturers since this would lead to a price increase of €0.03/W to €0.05/W, he believes (see China To Lower Solar Export Tax Rebates From 13% To 9%).

Indeed, China continues to direct its PV manufacturing industry towards efficiency improvement and upgrades rather than adding more production capacity (see China’s January-October 2024 Solar PV Installations Exceed 180 GW).

Even though the tell-tale signs all point towards a recovery in the market, Schachinger says that companies are slowly starting to pull back their cancellation orders and are slowly starting to fill up their coffers with the available supply, especially those with large pipelines.

He states, “An onset of a year-end run can then quickly lead to a new bottleneck and the associated price increase that suppliers are so eagerly awaiting - often just a small impulse, such as a minimal tax increase, is enough ...”.

However, the hope for price increases on the manufacturing side has been unfulfilled for many months. And as most European markets have not been growing this year and the near-term outlook is not bright, it remains to be seen if there’s already a price turnaround on the horizon.