Shoals Technologies Group seems to be well cushioned against impacts of solar supply chain issues that many in the global PV industry are currently facing, as company CFO Phil Garton revealed during the company's recent call with analysts to discuss its Q2/2021 financials.

Citing its business model wherein the balance of system (BOS) solutions provider honors a price quote for 7 days, Garton said, "That means we are not part in a position where we promised a price to a customer but then have the cost of the inputs for that order increase on us and change our margin profile." He added, "And with respect to project delays, we're aware of some in the market, but we're not seeing them materially impact Shoals. And the reason for that is that most of our customers are already in construction or about to start construction when they sign a contract with us."

Since most of its suppliers are based out of North America, the management does not seem to be bothered by the ongoing overseas shipping costs as 'shipping is not a big component of our cost structure'.

As such, the US based company has reiterated its 2021 business outlook for revenues to increase by 31% to 37% YoY within the range of $230 million to $240 million, with adjusted EBITDA as $75 million to $80 million. Adjusted net income is guided to fall within the range of $47 million to $51 million (see Shoals Technologies Grew Annual Revenues In 2020 By 21%).

Q2/2021

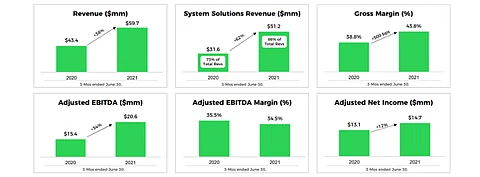

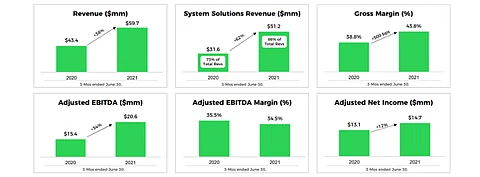

In the reporting quarter of Q2/2021, the company reported 38% annual growth in revenues that added up to $43.4 million, driven by a 62% YoY increase in its System Solutions business, mainly due to strong demand for its combine-as-you-go system. The System Solutions business accounted for 86% of the company's revenues.

Components revenues declined for the quarter 'with the expected change in certain customers' order timing relative to last year', among other factors.

The company increased its gross profit by 56% annually to $26.2 million, and gross profit went up to 43.8% for which the company cited increased revenue and a higher proportion of revenues from combine-as-you-go System Solutions, purchasing efficiencies from increased volumes, improved material planning which reduced logistics costs, enhancements to product design that lowered manufacturing costs, and other manufacturing efficiencies resulting from higher production volume, as the reasons.

Adjusted EBITDA for the quarter was a growth of 34% to $20.6 million compared to last year's $15.4 million.

During H1/2021, its revenues grew 25% to $105.3 million and gross profit to $45 million, an increase of 45% YoY.

With growing demand for its products in the US, Shoals Technologies grew its backlog and awarded orders by 63% on annual basis and 11% on quarterly basis to a total of $200.5 million, as on June 30, 2021.