A new SBICAPS report looks into India’s solar PV market, expecting it to add around 90 GW capacity by FY2027

This growth, including an anticipated 30 GW in FY2025, will mainly be led by the residential rooftop solar segment

While the nameplate solar module production capacity will expand significantly, cell expansion will not be as strong

Over the next 2 financial years, FY2026 and FY2027, India is likely to install between 85 GW and 90 GW of new solar PV capacity with the once laggard residential rooftop solar segment as its driving force, says a new report by SBICAPS.

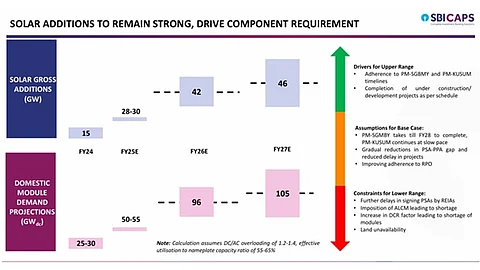

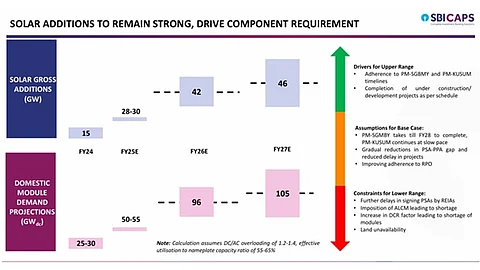

For FY2025, new PV deployments could reach 30 GW, doubling from 15 GW in FY2024. It will further grow to 42 GW by FY2026 and onwards to 46 GW in FY2027, according to the SBICAPS report. India has installed 24.5 GW of new solar during calendar year 2024, including 4.59 GW of rooftop solar (see Utility Scale Solar Powers India’s Record 24.5 GW PV Installations In 2024).

This forecast, cautions SBICAPS, hinges on several factors though. The report writers list these as completion of the PM Surya Ghar: Muft Bijli Yojana (PMSGMBY) by the target year FY2028, moderate reduction in the gap between power purchase agreements (PPA) and power sales agreements (PSA), along with compliance with enhanced renewable purchase obligations (RPO).

Timely execution of the Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) could further augment demand, according to the report.

Additionally, they state land constraints, implementation of Approved List of Cell Manufacturers (ALCM), and restrictive state net metering policies as presenting the downside risks.

Nevertheless, the growth in solar installations will push up demand for solar modules. The report expects the annual solar module demand to increase from 50 GW to 55 GW in FY2025 to 105 GW in FY2027.

Around 90 GW of domestic demand for ALMM modules will be met by existing nameplate capacity that ranges within 90 GW to 100 GW. It will increase to 150 GW to 160 GW by FY2027, reaching an effective capacity of 90 GW to 100 GW.

Solar cell capacity, on the other hand, continues to lag as it is expected to reach 50 GW by FY2027. “Despite integration factor (cell/module capacity ratio) likely improving from 32% to 65%, more than half of India’s cell requirements will continue to be imported in FY27, even if all capacities promised come on board,” reads the report.

This is similar to CRISIL’s recent forecast about India’s total solar cell production capacity expanding from 10 GW at the end of FY2024 to between 50 GW and 55 GW by FY2027 (see Indian Solar Cell Manufacturing Capacity To Exceed 50 GW By FY2027).

On April 10 and 11, 2025, TaiyangNews will hold the TaiyangNews Solar Technology Conference India 2025, an in-person event in New Delhi. It will bring together technologists and scientists working on creating a resilient solar manufacturing industry in India. Registrations are open here.