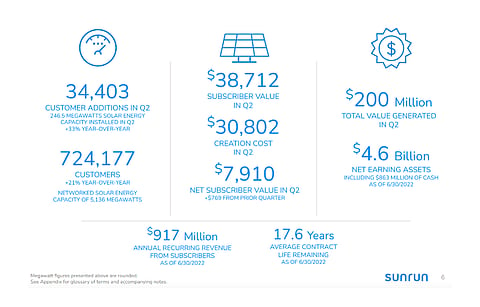

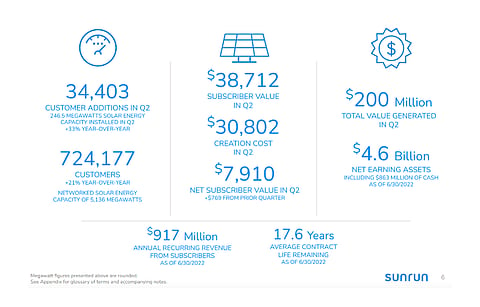

US residential solar financier and installer Sunrun posted a strong Q2/2022 with annual installations growing 33% to 246.5 MW exceeding expectations, 21% improvement in customer additions, and revenues rising 46% to $584.6 million. Gross margin of 15.3% in Q2 was significantly higher than in the previous quarter, reaching 8.9% in Q1.

Management said the company's customer agreements and incentives revenues made up $259.9 million out of total revenues with an improvement of 18% from last year, while solar energy systems and product sales revenues contributed $324.7 million reflecting an annual improvement of 79%.

"The confluence of a growing understanding about the virtues of powering your home with solar energy and storage, compounded by rapid utility rate inflation across the country, is driving record levels of demand, following on the price actions we took in late March and early April. Rapidly escalating utility rates sustained a very strong customer value proposition," said CEO Mary Powell.

Sunrun installed a cumulative of 42,000 residential batteries and expects to grow further during H2/2022.

In Q3/2022, it targets to install between 250 MW and 260 MW capacity. Sunrun is confident of achieving its previously announced target for solar energy capacity installed growth of 25% annual growth in 2022 (see Sunrun Announces Q1/2022 Financial Results).

Management also expects its total value generated for 2022 to be substantially greater than $900 million, and continues to expect net subscriber value above $10,000 in Q3 and Q4. It said the guidance does not assume any increase to the federal Investment Tax Credit (ITC) with the passing of Inflation Reduction Act of 2022.

However, Sunrun did point at the Withhold Release Order (WRO) of US Customs and Border Patrol (CBP) causing delays to the timely release of 'football-fields worth of modules currently sitting at the ports' for the company and others in the industry. "This results in unnecessary friction costs, such as customer system redesigns," complained Powell. "We have called upon the CBP to follow guidelines, respond to consumer demand, and quickly release solar modules that are demonstrated to be in compliance with the latest requirements, and we have seen some recent progress."

Philip Shen's Roth Capital Partners observed, "We would expect RUN to be able to secure all the modules it needs given its scale. We also call out that management 'has seen some recent progress', which suggests detained modules under UFLPA may have been released. Ultimately, what we need to hear is that module vendors have secured an 'advanced ruling' so not only can they clear CBP, but then future shipments can be imported with much more ease."