Xinyi Solar’s H1 2025 financial results show the impact of solar glass ASP decline due to oversupply, intense competition, and weak demand

Its EBITDA for the period fell 32.2% YoY, while the net profit dropped nearly 59% over the same period

Overseas sales rose as North American orders increased amid US tariff uncertainties

Xinyi says it did not expand capacity, but used inventory to meet 17.5% higher sales volumes

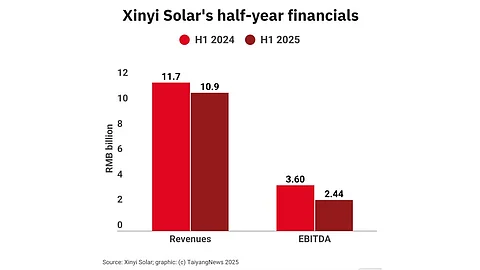

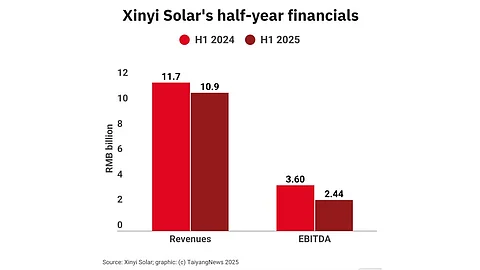

Chinese solar glass manufacturer Xinyi Solar reported a 6.5% year-on-year (YoY) revenue decline in H1 2025, mainly due to falling average selling prices (ASPs) in the solar glass segment. While sales volume rose, pricing pressures offset gains even as solar farm revenue increased.

Out of the total revenues of RMB 10.9 billion ($1.52 billion) for the period, Xinyi said solar glass sales added RMB 9.47 billion ($1.32 billion) or 7.3% less on an annual basis. Its solar farm business contributed 0.7% more with RMB 1.44 billion ($0.20 billion).

In the first half of 2025, solar glass prices fell mainly due to oversupply, tough competition, and weak demand, explains Xinyi. Prices dropped each month despite a short rebound in March–April. A steeper price decline was seen for the thinner 2.0 mm glass that has now surpassed 3.2 mm glass, hurting revenue more.

According to TaiyangNews PV Price Index for the China market, there were double-digit jumps in solar glass prices between week 10 and 13, but they more or less returned to their past levels by the end of H1. Here’s the latest price index (see TaiyangNews PV Price Index—2025—CW31).

Xinyi Solar’s EBITDA during the initial 6 months of this year declined by 32.2% to RMB 2.44 billion ($337 million), while net profit dropped by 58.8% YoY to RMB 745.8 million ($104 million) within the range it forecast recently (see China Solar PV News Snippets).

During the reporting period, Xinyi had more orders coming in from North America, as its module customers placed advance orders in view of the changes in US tariff policies and associated uncertainties. As a result, its sales to the domestic market of China declined to 68.4% of sales compared to 76.1% in H1 2024, while the share of overseas sales increased to 31.6% vis-à-vis 23.9%.

China’s renewable energy reforms boosted PV installations in H1 2025, according to Xinyi, driving solar glass demand. Despite this, the group says it stayed cautious, avoiding production expansion and using inventory to support a 17.5% YoY sales volume growth.

It maintained a daily melting capacity of 23,200 tons/day as of June 30, 2025, at the same level as on December 31, 2024 (see Low Solar Glass Prices Pull Down Xinyi Solar’s FY2024 Net Profit).

However, in July this year, it suspended 2 production lines with a combined daily melting capacity of 1,800 tons/day. Xinyi maintains that it has certain idle production capacities that can be reactivated in response to market conditions. The Chinese manufacturer is also adding 2 new solar glass production lines in Indonesia, which are scheduled to enter commercial operations in Q1 2026.