China’s solar PV manufacturing growth rate declined in 2025 for the first time in over a decade, reflecting deep structural adjustment, according to CPIA’s Bohua Wang

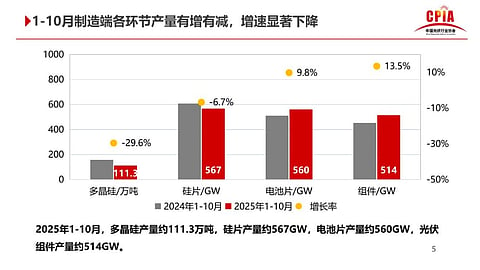

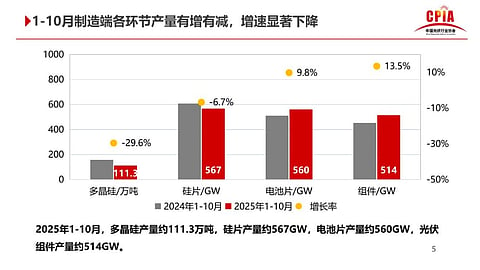

Polysilicon and wafer output fell sharply, while cell and module production still grew, but at a much slower pace

Government-led ‘anti-involution’ measures helped stabilize prices and narrow industry losses, though demand and installations showed strong volatility during the year

For the 1st time in over a decade, the Chinese solar PV manufacturing industry has reported a decline in its annual growth rate in 2025. China Photovoltaic Industry Association (CPIA) Honorary Chairman Bohua Wang says this phenomenon points to the fact that the industry has now entered a period of deep structural adjustment.

Within 10M 2025, China produced around 1.113 million tons of polysilicon – a 29.6% annual decline – and close to 567 GW of silicon wafers, which was a drop of 6.7% over 10M 2024. Solar cell (560 GW) and module production (514 GW) continued to improve, albeit at a slower pace of 9.8% and 13.5%, respectively.

Speaking at the 2025 PV Industry Annual Conference in China recently, Wang said that this is the first year-on-year (YoY) decline for polysilicon production since 2013, and the first decline in 16 years for wafer output since 2009.

Anti-involution, hands-down one of the most prominent terms for the solar PV industry in 2025, which refers to the government’s intervention to curb overcapacity and fierce competition, played a significant role. The government’s involvement in the PV sector has been instrumental in changing the course of ‘quantity-driven competition’ to ‘value-driven development’.

“The key shift in manufacturing is the transition from disorderly competition toward regulated development. Central policy guidance on countering irrational competition continues to evolve, growing more assertive and structured. The language has advanced from “preventing” disordered competition, to “comprehensive rectification,” to clear commitment to sector-wide structural governance,” he stated.

Wang emphasized, “Without curbing harmful competition, China cannot build a unified national market or expand domestic demand — both necessary to navigate complex global conditions.”

Pricing improvements

The impacts have been cascading down across the industry. Things are improving in terms of pricing, which hit record lows due to overcapacity and intense competition in the market. 2 major rush-installation cycles, combined with the implementation of the Anti-Unfair Competition Law, exerted a strong influence on pricing, pointed out Wang. As of November 2025, the average prices of polysilicon, silicon wafers, solar cells, and modules increased by 38.9%, 2.2%, 0.4%, and 2.3%, respectively, compared to the beginning of the year. Module prices continued to face demand-side pressure and did not rebound effectively, explained Wang.

Low prices also impacted the balance sheets of PV manufacturers in China. Here, too, Wang sees improvement with losses narrowing by approximately 46.7%. Losses for the industry reached RMB 31.04 billion during 10M 2025. This comprises a loss of RMB 6.42 billion in Q3 2025, a decrease of RMB 5.62 billion from Q2 2025.

Improvement in gross margin shows improvement in order quality and disciplined competition, according to Wang.

Since September 2024, he shared that the CPIA has published regular price indexes based on real order data reported by companies, covering more than 90% of capacity in most segments, under the guidance of the Ministry of Industry and Information Technology (MIIT). Cost benchmark models for mainstream PV products were completed in October 2024, with data from 60 companies covering over 82% of the industry, and up to 95% in some segments.

Installations Rise and Fall

Chinese solar PV installations during the reporting period improved by 39.5% year-on-year (YoY) to 252.87 GW as January to May additions jumped by 150%, thanks to the rush to complete installations before the market-oriented pricing system introduction on June 1, 2025 (see China Solar Installations: From 100 MW In 2009 To 1 TW In 2025).

The period from June to October has been the cooling-off period as installations decreased by 46.1% YoY and over 80% quarter-on-quarter (QoQ). Sharpest declines are seen in the utility scale and commercial and industrial (C&I) segments, while residential demand remains comparatively stable.

Competitive bidding results and progress in major 14th Five-Year Plan base projects are improving market certainty, which reflects in the modest recovery in installations during Q4, he added.

“Distributed development showed another characteristic: clear positive correlation between deployment volume and regional GDP. Among the top five regions for C&I distributed installations, four are also among the top five provincial GDP contributors,” shared Wang.

The CPIA remains positive on solar PV’s growth potential going forward, despite the International Energy Agency (IEA) revising down its forecast (see IEA: Solar PV To Drive 80% Of Renewables Growth By 2030).

Wang believes that even though demand is no longer surging, growth remains steady. “We are far from hitting the ceiling, and even farther from contraction. The industry retains enormous room for expansion,” he summed up.

According to the China Energy Transformation Outlook 2025 (CETO 2025), China is expected to achieve a cumulative installed solar PV capacity of up to 6.5 TW by 2060, with distributed PV supplying about half of total installed PV capacity (see China’s Solar Capacity Forecast To Reach Up To 6.5 TW By 2060).