Solar PV will drive global renewable growth, accounting for 80% of new capacity additions

US and China slowdowns reduce projected capacity, but India, Europe, and emerging markets accelerate

Rapid renewable growth pressures grids, requiring urgent investment in storage, flexible generation, and integration

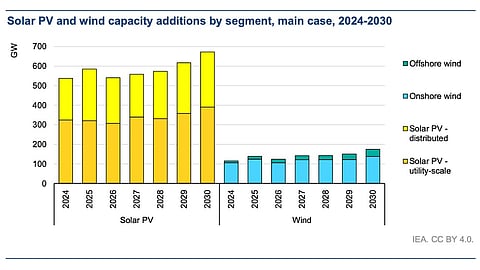

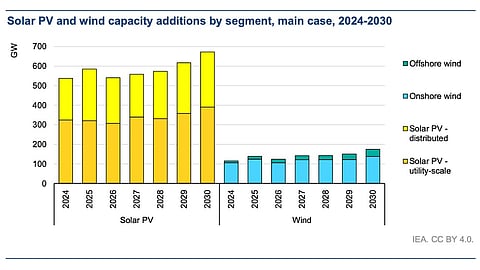

Solar PV is set to dominate the next wave of renewable energy expansion – estimated at 4.6 TW by 2030 – accounting for around 80% of new capacity additions globally, according to a new International Energy Agency (IEA) report. This dominance will be driven by low module costs, relatively efficient permitting processes, and broad social acceptance for this technology.

Yet, in its Renewables 2025 report, the IEA has lowered the renewable energy growth forecast for 2025-2030 by 5% compared to the previous year, translating into 248 GW less capacity to be commissioned over this period. This drop in projections compared to 5.5 TW presented last year for 2024-2030 reflects policy, regulatory, and market changes since 2024, it explains (see World To Add 5.5 TW+ New Renewable Energy Capacity By 2030).

Solar PV alone accounts for over 70% of the absolute reduction in the latest IEA report, mainly from utility-scale projects.

While the IEA says that the world will likely fall short of the COP28 tripling renewables pledge for 2030 at this rate, analysts believe the target can still be brought within reach if countries minimize policy uncertainties, reduce permitting timelines, increase investment in grid infrastructure, expand flexibility, and de-risk financing (see Over 120 Nations For 11 TW Global RE Target By 2030).

For the US market, the IEA has lowered its forecast by almost 50% across all technologies except geothermal, owing to an earlier-than-expected phase-out of investment and production tax credits (PTC), and foreign entities of concern (FEOC). Solar PV is expected to have almost 140 GW less capacity by the end of this decade. Distributed solar, especially residential PV, accounts for the largest drop, as the US residential tax credits are set to expire at the end of 2025 (see OBBBA Could Cut US Residential Solar Capacity By 46% By 2030).

China’s shift from fixed feed-in tariffs (FIT) to market-oriented pricing is also in the picture for this downgrade. For China alone, its forecast is a drop of 129 GW in absolute renewables capacity. Solar and wind growth in the country is expected to pick up quickly from 2027, boosting global capacity through 2030.

Despite some policy-driven slowdowns in the United States and China, the overall renewable power outlook remains strong, according to the IEA, thanks to growth beyond the traditional markets. India, Europe, and emerging economies are picking up momentum through supportive policies, faster permitting, and rising rooftop solar adoption.

India, it notes, is on course to become the 2nd largest renewables growth market globally, after China. It will ‘comfortably’ reach its ambitious 2030 target.

Robust Near-Term Projections

The IEA noted a 22% annual increase in global renewable energy capacity in 2024, with nearly 685 GW installed. This year is expected to be another record year with over 750 GW additions in the main case scenario, which could even hit 840 GW in the accelerated case.

Solar PV will lead this expected growth with annual additions projected at almost 600 GW for 2025 – representing close to 80% of the total – as distributed solar expands while utility-scale solar remains stable. Deployments for solar PV will likely drop to over 500 GW in 2026, before picking up 2027 onward, reaching annual additions of close to 700 GW in 2030.

“In addition to growth in established markets, solar is set to surge in economies such as Saudi Arabia, Pakistan and several Southeast Asian countries. As renewables’ role in electricity systems rises in many countries, policy makers need to play close attention to supply chain security and grid integration challenges,” adds IEA Executive Director Fatih Birol.

Another lever of growth is demand from corporations and utilities as their contracts are increasingly fueling global growth. Most major developers have either maintained or increased their 2030 deployment targets compared to last year, point out the analysts. Corporate power purchase agreements (PPA), utility contracts, and merchant plants together account for 30% of the global renewable capacity expansion to 2030. This is double their share in the IEA’s forecast compared to last year.

No Change in Production Concentration

As for the solar PV supply chain, China remains the world’s largest supplier across key production segments now, and in the near future as well, even as countries undertake diversification efforts.

In 2024, global solar module manufacturing capacity reached about 1,100 GW to 1,350 GW—more than twice the amount of solar installed that year. This oversupply has kept panel prices low and is expected to slow new factory growth between 2025 and 2030, especially in China. During this period, new capacity additions will be smaller—230 GW for modules, 190 GW for cells, and 80 GW for wafers—while polysilicon capacity will drop by 60 GW.

About 35% of new factories will be built outside China, up from less than 10% over the last 6 years, but China will still dominate 75–95% of the global solar supply chain by 2030, according to the report.

Faster Storage, Grids Needed for Renewables

Nevertheless, the IEA says that the rapid growth of solar and wind power is placing greater strain on electricity systems as power curtailments and negative prices are becoming more common. This requires urgent investment in grids, energy storage, and flexible generation. Some countries are starting new capacity and storage auctions, but more needs to be done for reliable and cost-effective integration of renewables.

The share of renewables in transport and heating will rise slightly by 2030. Their share in transport energy use is expected to grow from 4% to 6%, led by renewable electricity for electric vehicles in China and Europe, and biofuels in countries like Brazil, Indonesia, and India. In heating, renewables’ share is projected to increase from 14% to 18%.

The complete IEA report is available for free download on its website.

According to a recent Ember report, solar-led renewables overtook coal as the largest source of electricity generation for the 1st time, in H1 2025 (see Ember: Global Renewables Overtook Coal In H1 2025).