The US added 11.7 GW of solar PV in Q3 2025, up 49% QoQ, with solar making up 58% of all new generation capacity in the first 9 months of the year

Utility-scale installations totaled 9.7 GW, while the residential segment fell 4% YoY due to tight module supply ahead of the Section 25D deadline

US module manufacturing capacity surpassed 60 GW in 2025, but permitting challenges and FEOC guidance remain key variables for the 2025–2030 outlook, according to the SEIA and Wood Mackenzie report

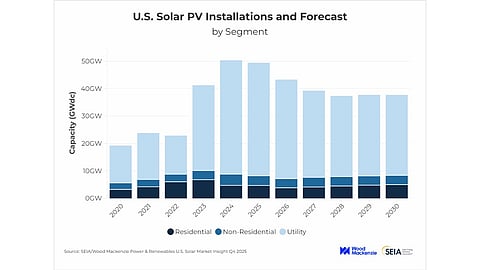

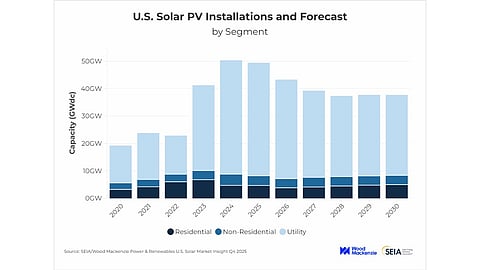

The US added 11.7 GW of solar PV capacity during Q3 2025, making it the 3rd largest quarter on record for the country, representing a 49% sequential increase, according to the Solar Energy Industries Association (SEIA) and Wood Mackenzie. Solar accounted for 58% of all new electricity generation capacity added to the grid during 9M 2025, exceeding a combined 30 GW.

Solar and storage accounted for 85% of all new power added to the grid in the country during 9M 2025, according to the US Solar Market Insight Q4 2025 report.

“This record-setting quarter for solar deployment shows that the market is continuing to turn to solar to meet rising demand,” said SEIA president and CEO Abigail Ross Hopper. “Remarkable growth in Texas, Indiana, Utah, and other states won by President Trump shows just how decisively the market is moving toward solar.”

The residential segment’s additions of 1.08 GW DC declined by 4% year-on-year (YoY) and quarter-on-quarter (QoQ). The report writers claim that despite the expected rush before the December 31, 2025, deadline to claim Section 25D tax credits, ‘tight module availability’ is holding back installations in this segment (see OBBBA Could Cut US Residential Solar Capacity By 46% By 2030).

The commercial segment reported a 9% YoY growth, but a 12% QoQ decline, with 554 MW DC of new capacity, while community solar’s 267 MW DC was a decline of 21% YoY but an increase of 12% QoQ.

Utility-scale solar continued to drive installations with its 9.7 GW DC additions in Q3, increasing by 26% YoY and 68% QoQ. Apart from supply and labor constraints, this segment has been seeing permitting challenges following the July directive from the Department of the Interior (DOI). This has created significant ‘business uncertainty’ in terms of permitting timelines and project approvals, whose impact has been factored into the report’s forecast.

For 2025-2030, its base case outlook projects a combined 246 GW DC of solar deployments, even though Wood Mackenzie’s Head of Solar Research, Michelle Davis, said the US solar industry has more potential. However, things could still change once there is more clarity on federal permitting actions and the Treasury guidance on Foreign Entity of Concern (FEOC).

Recently, 143 solar companies reached out to Congress to seek reversal of the DOI memo that they believe is stalling development in the country (see US Solar Industry Urges Congress To Fast-Track Permitting).

As of December 2025, SEIA estimates that the US solar module manufacturing capacity has exceeded 60 GW, with additional capacity either announced or under construction. With the addition of 2 new factories with 4.7 GW combined capacity in Louisiana and South Carolina coming online, the US added 17.7 GW of new module capacity in 2025.

Cell production capacity currently remains limited to single digits, and so does ingot and wafer capacity. Polysilicon production has also returned to the US with Corning’s fab coming online in Q3 2025 (see Corning Commissioned US Solar Wafer Factory In Q3 2025).

While the executive summary of the report is available for free download, the full report can be purchased from Wood Mackenzie’s website.