- China’s TZE has become the controlling stakeholder in Maxeon Solar Technologies

- Management cites difficult market conditions due to high interest rates and policy changes as having hampered its Q4/2023 and Q1/2024 business

- For the utility-scale market, Maxeon will exclusively focus on the US market starting now

Chinese solar PV company TCL Zhonghuan Renewable Energy Technology (TZE) has acquired a controlling stake in Singapore-headquartered Maxeon Solar Technologies, a company in which it is already the largest shareholder. Maxeon says this $97.5 million debt financing and an additional $100 million equity from TZE supports its immediate liquidity needs.

The past few months have been tough on the Singapore-based interdigitated back contact (IBC) solar module manufacturer. Citing a ‘very difficult market environment’ since Q3/2024, Maxeon blames challenging industry pricing conditions and demand disruptions in the distributed generation (DG) business due to high interest rates and policy changes.

Project pushouts by 2 of its large-scale customers in the US also contributed to the company underutilizing its manufacturing operations, leading to increased costs and lower revenues and profits than planned. It lost compliance with the Nasdaq for not filing its 2023 annual report on time. With the Q4/2023 and Q1/2024 financial results, it has now regained compliance.

Nonetheless, as the company comes under majority control of a Chinese firm, Philip Shen of Roth MKM wonders about the ability of the company to secure a loan from the US Department of Energy (DOE) for its New Mexico facility. Construction on site for the TOPCon factory was to start in Q1/2024, depending on a successful financial close under the DOE’s Title 17 Clean Energy Financing Program (see Maxeon Picks New Mexico For New Solar Fab).

Q4/2023 and Q1/2024

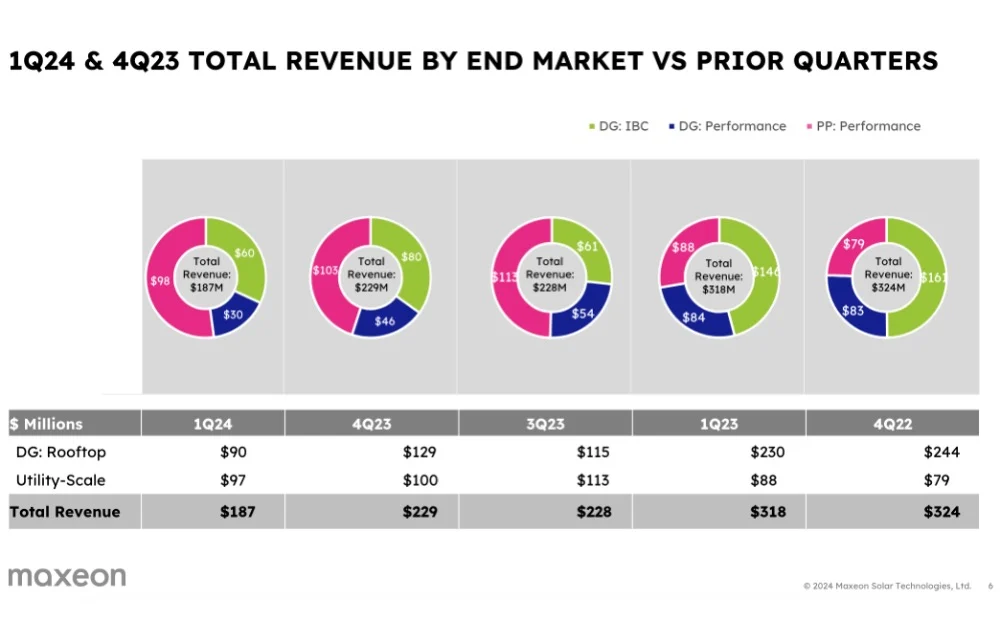

During Q4/2023, Maxeon’s GAAP net loss was -$186.29 million, narrowing down to -$80.2 million in Q1/2024. Revenues in Q1/2024 declined from $228.77 million in Q4/2023 to $187.45 million.

On a non-GAAP basis, Q1/2024 was the 3rd consecutive quarter that the company reported a negative adjusted EBITDA, at -$38.97 million.

Maxeon shipped 488 MW in the 1st quarter this year, down from 774 MW in Q1/2023 and 653 MW in Q4/2023. It comprised 396 MW of Performance Line and 92 MW of IBC panels. Shipments for these panels declined from 527 MW and 126 MW in the previous quarter, respectively.

The US continued to lead the sales with $133 million in Q1/2024, a drop from $142 million in the previous quarter. The remaining revenue destinations were EMEA with $38 million, APAC with $14 million, and other markets pitching in with $2 million.

In terms of end markets, its conventionally strong rooftop solar DG market saw a significant decline in revenues, from $129 million in Q4/2023 to $90 million in Q1/2024. Over the same period, utility-scale declined from $100 million to $97 million.

“Our distributed generation (DG) business faced ongoing price and demand headwinds in both the US and Europe. Against this challenging industry backdrop, we were able to execute on several key strategic initiatives, including completion of all deliveries to SunPower Corporation under the Settlement Agreement,” said Maxeon CEO Bill Mulligan.

Maxeon also added over 100 new partners to its US dealer channel during Q1. In Europe, it launched the 7th generation Performance Series module, the manufacturer’s 1st TOPCon technology product.

Mulligan added, “We recently sold our stake in the Huansheng Photovoltaic (Jiangsu) Co., Ltd (HSPV) joint venture, along with executing an IP-license for shingling technology for their use in utility-scale markets outside of the United States, for $34 million. In addition, we entered into a new supply agreement with HSPV for continued support of our international DG business.”

The management specified that in the future the US will be the exclusive focus for its utility-scale business.

Guidance

Going forward, it targets to ship 520 MW to 600 MW during Q2/2024. The revenue guidance is conservative at $160 million to $200 million. Adjusted EBITDA will continue to be in the negative, between -$51 million and -$31 million.

For FY 2024, the revenue guidance is $640 million to $800 million, and adjusted EBITDA of between -$160 million and -$110 million.

“While current pricing and demand conditions remain challenging, we are seeing some positive trade policy trends and we are cautiously optimistic that these could result in stronger pricing power, improved demand and incremental bookings,” added Mulligan.