- Daqo New Energy’s 2022 annual revenues of $4.61 billion increased by 175% with Q4/2022 contributing $864.3 million

- It sold 133,812 MT polysilicon last year and produced 33,702 MT in the 4th quarter

- Presently, polysilicon prices range between $230.0/kg to $250.0/kg while module prices within RMB 1.7/W to RMB 1.8/W, according to Daqo

- Guides for 31,000 MT to 32,000 MT polysilicon production in Q1/2023 and 190,000 MT to 195,000 MT for full year 2023

One of the world’s leading polysilicon suppliers, Daqo New Energy sailed on the soaring demand for polysilicon whose price shot up by as much as 50% YoY in 2022 helping the Chinese company report 175% annual growth in revenues to $4.61 billion and expects to produce up to 46% more polysilicon in 2023.

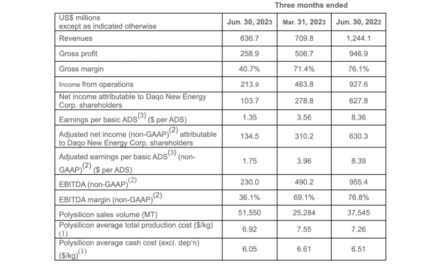

Its net income last year increased by 148.4% to $1.86 billion, compared to $749 million in 2021.

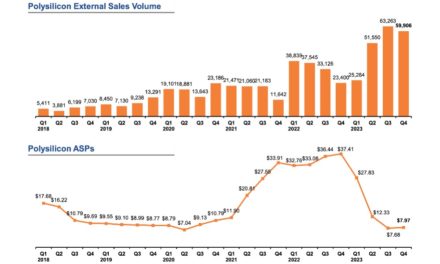

Average polysilicon prices (ASP) in 2022 went up from $21.76/kg to $32.54/kg, according to company CEO Longgen Zhang as it sold 76.4% more last year with sales volume of 132,909 metric ton (MT), exceeding the guidance of 130,000 MT to 132,000 MT (see Daqo New Energy Reports Strong Quarter in Q3/2022).

Close to 99% of its production volume last year was mono-grade polysilicon. Daqo produced 133,812 MT polysilicon last year, including 33,702 MT in Q4/2022 for which the average total production cost rose to $7.69/kg, up from $6.82/kg in Q3. Revenues for Q4/2022 added up to $864.3 million.

During last quarter of 2022, the company sold 23,400 MT down from 33,126 MT in the previous quarter for which Zhang cited temporary seasonal slowdown in the solar PV market ‘temporary seasonal slowdown in solar PV market caused inventory adjustments across the value chain, similar to the year-end of 2021’. ASPs during Q4 rose from $36.44/kg to $37.41/kg.

Daqo’s Q4/2022 polysilicon sales dropped down to 23,400 MT due to temporary seasonal slowdown on sequential basis, however the ASP rose to $37.41/kg. (Source: Daqo New Energy)

Zhang explained, “As a result, the downstream sectors, especially wafer, cell and module manufacturers, reduced inventories and significantly lowered production utilization rates. This led to widespread price declines across the value chain.”

Things have started improving from February 2023 as lower module prices stimulated market demand, and downstream production utilization rates quickly ramped up back to normal levels, reducing channel inventory significantly and leading to a meaningful recovery in polysilicon ASPs, he added.

Current polysilicon prices range between $230.0/kg to $250.0/kg while module prices within RMB 1.7/W to RMB 1.8/W.

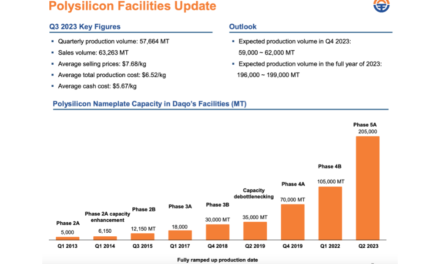

Daqo’s Inner Mongolia located manufacturing expansion phase 5A of 100,000 MT is on track to enter pilot production in April 2023 and ramp up to full capacity by June 2023-end. Phase 5B with another 100,000 MT polysilicon in Inner Mongolia is to enter construction in March 2023 and completed by 2023-end.

For Q1/2023 it guides to produce around 31,000 MT to 32,000 MT polysilicon, and for full year 2023 the forecast is for 190,000 MT to 195,000 MT, inclusive of the company’s annual facility maintenance.

In August 2022, Clean Energy Associates of North America said polysilicon prices will decline throughout 2023 as additional capacity comes online (see Silicon Prices To Ease Beginning 2023).