- Daqo New Energy’s Q3/2023 revenues dropped significantly due to polysilicon ASPs going down

- It produced 57,664 MT during the period, but shipped 62,967 MT, significantly bringing down its inventory

- The manufacturer has raised its 2023 annual guidance for polysilicon production to between 196,000 MT and 199,000 MT

- The 100,000 MT phase II of the Baotou polysilicon project has been delayed by 2 quarters

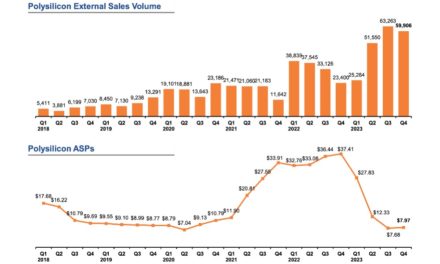

Chinese polysilicon manufacturer Daqo New Energy saw its revenues decline by 24% sequentially and by 60% YoY in Q3/2023 for which the management attributes the decrease in polysilicon ASPs. From $12.33/kg in Q2/2023, Daqo said the ASP declined to $7.68/kg in the reporting period.

The drop in ASP also pulled down the company’s gross margin to 14%, compared to 40.7% in Q2/2023 and 80.2% in Q3/2023. However, the manufacturer said the decrease in revenues was mitigated by an increase in sales volume, while the gross margin decline was mitigated by lower production cost. It sold 63,263 MT externally.

“At the end of the second quarter, after polysilicon prices reached bottom, customers began reordering and taking delivery of products, significantly reducing industry inventory levels,” said Daqo’s Chairman and CEO Xiang Xu. “In July, as module makers intensified competition, module prices fell from ~RMB 1.5 ($0.20)/W in June to ~RMB 1.3 ($0.18)/W in July. Meanwhile, the high demand in the module sector coupled with lower utilization rate for polysilicon due to power rationing and system maintenance drove a marginal recovery in polysilicon prices.”

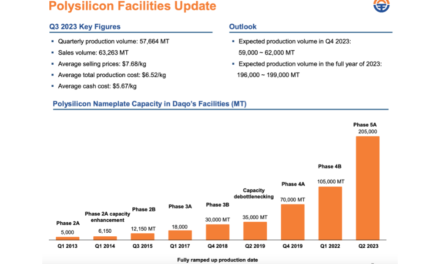

Daqo produced 57,664 MT polysilicon in Q3, 27% more than the previous quarter with its Inner Mongolia 5A fab contributing close to 40% of the total production volume. Its production cost decreased by 5.8% QoQ to $6.52/kg, for which it cites improvements in manufacturing efficiency, reduction in cost of raw materials especially metallurgical-grade silicon as the reasons.

With 62,967 MT capacity shipped during the period, Daqo said its polysilicon product inventory across the 2 facilities decreased significantly ‘now at a level of less than one week of production volume,’ the same as in Q2/2023 (see Low Polysilicon Prices Impact Daqo’s Q2/2023 Results).

The drop in polysilicon prices impacted the company’s revenues but it was mitigated by an increase in sales volume, according to the management. (Photo Credit: Daqo New Energy)

The management believes its n-type polysilicon will differentiate it from its competitors as its customers increasingly transition to the technology. Xu added, “During the third quarter, we saw an acceleration in the transition from P-type to N-type cell technology with strong growth in N-type product demand volume and the N-type products’ ASP premium expanded to RMB 10-12 ($1.37-1.64)/kg in Q3. Going forward, we expect this transition to further accelerate as N-type products expand market share, leading to continued demand growth.”

Xu stressed that the current price range is unlikely to be profitable for new entrants given their cost structure. Philip Shen of Roth MKM said the management on call with the analysts said 20% to 30% of the current overall polysilicon manufacturing could go away because it is not economic.

Guidance

In Q4/2023, Daqo expects to produce between 59,000 MT and 62,000 MT of polysilicon. It has also raised the annual production guidance for 2023 to 196,000 MT and 199,000 MT, up from 193,000 MT to 198,000 MT it forecast 3 months ago.

Delay in project commissioning

In a separate announcement, Daqo said it will delay the commissioning of its 100,000-ton polysilicon project in Inner Mongolia’s Baotou under phase II. Instead of the earlier target commissioning date of 2023-end, it will now aim to bring it online by Q2/2024. The reason it cites is the construction progress of the project along with market environment, and the demand and supply situation.

This is part of the company’s December 2021 announcement to build 200,000 MT solar-grade polysilicon, and 21,000 MT for semiconductor industry. Phase I of the solar-grade polysilicon with 100,000 MT capacity was commissioned in March 2023 (see China PV News Snippets).