- Enphase Energy says its US revenues declined 34% sequentially in Q1/2024 as demand softened

- Deliberate under-shipment in order to manage channel inventory also contributed to the revenue decline

- The European market performed well with revenue improving 70% sequentially

- It forecasts revenue to be in the range of $290 million to $330 million for Q2/2024

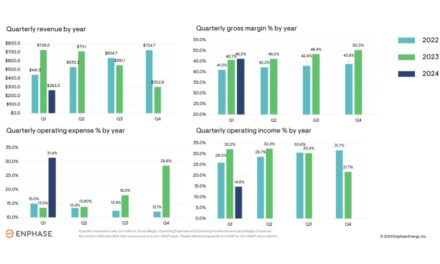

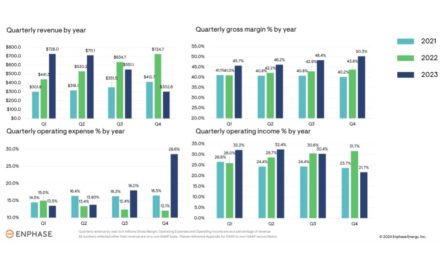

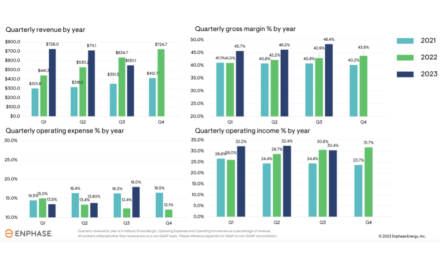

US-based microinverter and storage company Enphase Energy saw its Q1/2024 revenues slipping by almost 13% sequentially and over 63% annually, blaming the decline on seasonality and further softening in US demand.

The company says it also under-shipped during the quarter to manage channel inventory. It managed to lower channel inventory by approximately $113 million during the quarter, which was also ‘less than anticipated because of softer demand.’

Divided between the US as its largest single market and international business, its total Q1 revenues totaled $263.3 million. The US revenues declined by close to 34% compared to the previous quarter for which the management cited under-shipment. Here, its sell-through was down for both microinverters and batteries.

On the other hand, Enphase’s revenues improved 70% sequentially, thanks to an improvement in channel inventory and the introduction of new products.

During the reporting quarter, it earned a GAAP gross margin of 43.9%, down from 48.5% quarter-on-quarter (QoQ) and 45% year-on-year (YoY).

Its GAAP operating loss was -$29.1 million, having expanded from the previous quarter and narrowed from the previous year. It also reported a net loss of -$16.1 million, compared to the net income of $20.9 million in Q4/2023 and $146.8 million in Q1/2023.

Enphase shipped 1,382,195 microinverters in Q1 this year, representing a combined 603.6 MW DC capacity, and 75.5 MWh of IQ batteries. It shipped around 506,000 microinverters from the company’s contract manufacturing facilities that Enphase President and CEO Badri Kothandaraman says qualify for 45X production tax credits.

It is also now shipping IQ8P microinverters with a peak output AC power of 480 W, targeting small-commercial market of North America. This is being shipped to 24 countries globally, including for grid-tied residential applications in South Africa, Mexico, Brazil, India, Thailand, the Philippines, France and Spain.

Guidance

Enphase has provided a revenue forecast of $290 million to $330 million for Q2/2024, including shipments of 100 MWh to 120 MWh of IQ batteries. It expects GAAP gross margin within a range of 42% to 45% with net Inflation Reduction Act (IRA) benefit.

The net IRA benefit is anticipated within a range of $14 million to $17 million. This, it says, is based on estimated shipments of 500,000 units of US-manufactured microinverters.

For the next quarter, Enphase pegs its GAAP operating expenses between $134 million and $138 million.

During this quarter, it expects to ship approximately 0.5 million microinverters within the US from its US facilities. Upon full ramp-up, Enphase expects to achieve a global manufacturing capacity of around 7.25 million microinverter units/quarter, out of which 5 million units will be in the US.