- Enphase Energy has reported a significant decline in its Q4/2023 revenues of $302.6 million

- The US and Europe markets contributed 35% and 70% less to the quarterly revenues on a sequential basis

- The management has offered a subdued guidance as it continues to execute on plans to undership

Enphase Energy says its Q4/2023 revenues declined significantly as the company continued to undership its products to manage high inventory levels at its distribution partners, while also attributing it to further softening in demand.

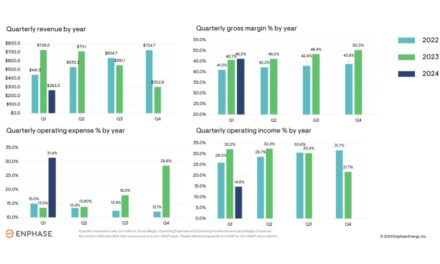

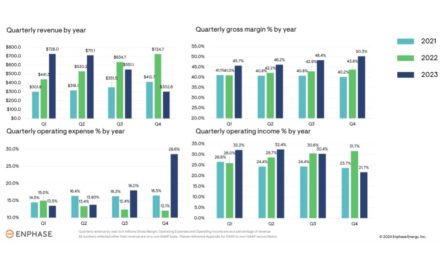

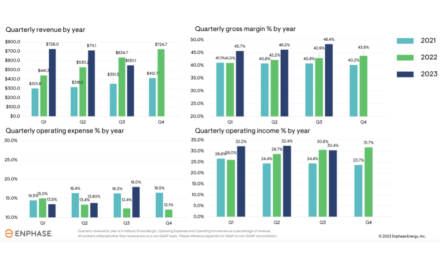

Of the total $302.6 million revenues, the US contributed 35% less sequentially while the share of Europe declined by about 70%. In the previous quarter, the microinverter manufacturer reported $551.1 million in revenues which was a decline of over 22% annually (see Enphase Energy’s Q3/2023 Revenues Impacted).

The US market accounted for 75% of its total revenues mix, followed by 25% from international markets.

GAAP gross margin improved though to 48.5%, but the manufacturer suffered an operating income loss of -$10.23 million. Net income was reported as $20.9 million, down from $113.9 million in the previous quarter and $153.7 million in Q4/2022 (see Enphase Exited 2022 With Over 68% Jump In Annual Revenues).

It shipped 1,595,677 microinverters representing close to 660.1 MW DC capacity and 80.7 MWh of IQ batteries during the reporting quarter. Its microinverter shipments comprised 913,000 units manufactured in the US.

As announced previously, the management is ceasing operations at its contract manufacturing locations in Romania and Wisconsin, but will continue to focus on manufacturing microinverters in the US with its existing contract manufacturing partners in South Carolina and Texas (see Troubled Times For US Solar PV Industry?).

On an annual basis, Enphase exited 2023 with revenues of $2.29 billion, down from $2.33 billion in 2022. Operating income of $445.7 million was almost at the same level as last year’s $448.26 million.

Guidance

On the call with analysts to discuss the financials, Enphase President and CEO Badri Kothandaraman shared that he expects to clear the factory inventory and clear the channel in H1/2024. This would mean lower shipments during the period. For destocking of its products, he anticipates the situation to normalize in Q2/2024, both in the US as well as Europe.

Nonetheless, Philip Shen of ROTH MKM points out that several solar installers in the US are announcing bankruptcies and shutdowns, including ADT Solar and Suntuity, among others. This, he said, could pose a risk to Enphase’s destocking plans in the US.

For Q1/2024, the management has guided for revenues within the range of $260 million to $300 million, comprising shipments of 70 MWh to 90 MWh of IQ batteries.

According to Jeffrey Osborne of TD Cowen Enphase appears to have made progress taking inventory out of the channel as reflected by lower QoQ undershipment expected in 1Q24.

GAAP gross margin is expected to fall within 42% to 45% with net IRA benefit that’s anticipated within a range of $12 million to $14 million, based on estimated shipments of 500,000 units of US-manufactured microinverters.

For 2024, it expects GAAP and non-GAAP annualized effective tax rate with IRA benefit, excluding discrete items, to be within a range of 19% to 21%.