- DuPont is focusing on a clear variant of Tedlar, the company’s brand name for its proprietary PVF, to make it more cost-effective and durable

- PET, in addition to being the unanimous choice for the core layer, the chemistry of the polyester film is also optimized with UV protection attributes to be used as the outer layer

- PET films supporting the building of transparent backsheet is the key topics of focus at DTF, a key supplier of PET

While the previous solar backsheets article Coatings And Non-Fluoro Are Gaining Traction detailed the trends in PVDF, this article summarizes developments associated with other key polymer chemistries used in solar backsheets – Tedlar and polyester.

PVF, or Tedlar, which is exclusively supplied by DuPont, is also a high-priced fluoropolymer component of the backsheet. While it is generally priced higher compared to PVDF, their prices were evenly matched at a point during the high price period. However, this has no effect on the Tedlar market. The price tag of Tedlar also comes with a proven track record. This fluoropolymer was preferred by 2 world-leading module makers; however, rumor has it that one opted out, at least significantly if not completely, in favor of a low cost and green product. As a result, the share of Tedlar has reduced. However, DuPont would not reveal its shipment data as part of its policy.

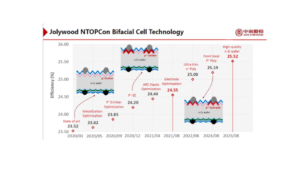

On the other hand, DuPont is focusing more on its clear variant of Tedlar to make it more durable and cost effective, according to Oakland Fu, global marketing manager for PV application at DuPont. Indeed, the transparent backsheet based on the clear variant of Tedlar has proven itself to match the reliability of glass. DuPont has also introduced Tedlar a frontsheet. As to the major trends, Fu anticipates the backsheet segment to change in the future due to the advent of advanced cell architectures such as TOPCon, HJT and IBC, which might put new requisites on backsheets on top of the encapsulation films. “High water vapor barrier,” he quoted as an example of such requisites.

PET is yet another important backsheet component. In addition to being the unanimous choice for the core layer, the chemistry of the polyester film is also optimized with UV protection attributes to be used as the outer layer. DTF has been an important supplier of such high-performance PET films. However, Celanese recently acquired the majority of the former DuPont Mobility & Materials business which included DuPont’s former 50% share in DuPont Teijin Films. DuPont Teijin Films continues to operate as a 50/50 joint venture and continues to trade under the name DuPont Teijin Films.

DTF, in close cooperation with Coveme, played an instrumental role in the development and commercialization of PET-based backsheets. DTF offers its PET solutions to the PV industry under the Mylar brand name. The UVHPET range is specially designed for enhanced UV barrier and hydrolysis resistance properties to serve as the outer layer of the backsheet. The main focus in 2021 and 2022 for the company was to keep up with the orders, according to Steven Davies, EMEA market manager of the company. As to the business in the last 2 years, Davies characterizes 2021 as “a very solid year,” while the year 2022 is a bit challenging due to “energy crisis, raw material supply shortage and volatile demand.” DTF would not reveal shipment data, but Davies says that there are more than 250 million modules operating in the field using a backsheet based on the company’s outer PET film, “without any failure reported so far.” The company also supplies a Mylar core PET film, which according to DTF has been used since the birth of the solar industry and can complement any outer layer. The important product development for the company is focused on the transparent backsheet, which is interestingly excluded from anti-dumping duties in India.

PET is also the preferred backsheet type in India as well, according to the country’s leading backsheet supplier RenewSys. Avinash Hiranandani, GCEO & managing director of the company, explains that the current crop of module products in India can be put under 2 groups – 335 W multicrystalline modules and 540 W monocrystalline products. Most of the 335 W modules have been using PET based backsheets.

“There are about 100 odd such customers who are running 335 W module lines,” says Hiranandani. He attributes a 50-50 share for PVDF and PET even for 540 W module products. While PVDF backsheets are inherently expensive these days, anti-dumping duties on Chinese PVDF backsheets make them cost that much more – and the lines for larger modules are still coming up. Taking all these factors into consideration the share of non-fluoropolymers in India is “about 70%,” said Hiranandani.

Cybrid’s Yang also segregates the Indian market into two segments, but into different categories – overseas and domestics. The larger companies that are exporting their products are mainly employing the KPf structure as they can circumvent the antidumping duties, while the small players are using low cost coating and PET products, according to Yang.

For more details, download the TaiyangNews Market Survey on Backsheets and Encapsulation 2022-23 for free here.