- According to PV InfoLink, LONGi was the top solar module supplier in H1/2021

- Top 3 module suppliers during the period accounted for more than 80% annual increase in their shipments

- Large format modules are gaining traction as their total contribution to shipments expands

- There was no change in the top 5 solar cell companies during H1/2021 with Tongwei holding the top spot

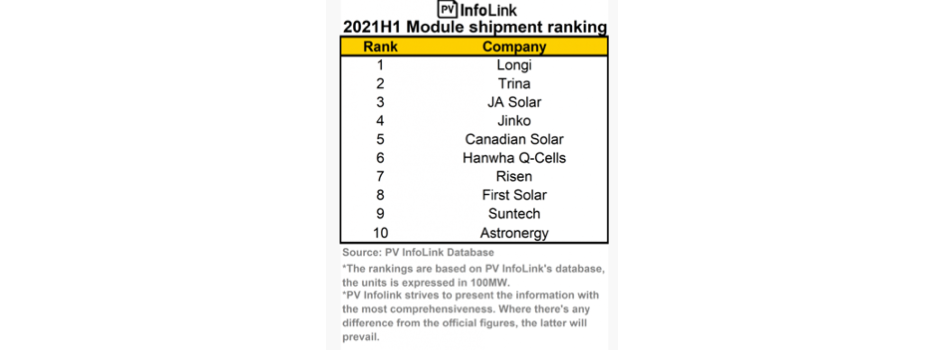

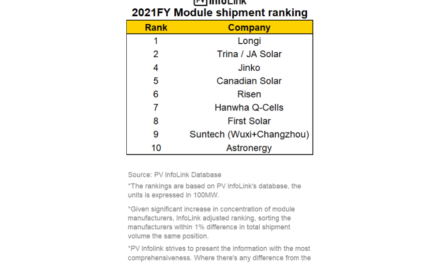

Chinese solar market intelligence firm PV InfoLink has released its shipment rankings for the period between January 2021 and June 2021 and there aren’t many surprises in there since most of the companies have held to their positions since the end of 2020.

The solar module shipment ranking for H1/2021 is led by LONGi Solar, replacing previous year’s top performer JinkoSolar (see JinkoSolar Top Module Supplier During H1/2020). For H1/2021, LONGi Solar is followed by Trina Solar that has been actively shipping to overseas markets. JA Solar stands on the 3rd spot, ahead of JinkoSolar on 4th position.

The top 3 module suppliers, according to PV InfoLink analysts, registered more than 80% of annual increase in shipments.

The following positions on the list are taken up by Canadian Solar, Hanwha Q-Cells, Risen Energy, First Solar, Suntech, and Astronergy, in that order.

Altogether, the top 10 manufacturers shipped 70.5 GW aggregate capacity, ‘accounting for far more than 70% to 80% as in previous years, as calculated with module demand in the first half’. Barring America’s First Solar, the rest of the companies together shipped more than 16 GW of large format modules, accounting for 24% of their total module shipment volumes. First Solar, on the other hand, had shipments within the US increasing due to the US-China trade conflict, as per the analysts.

The continued dominance of big players on this list, as PV InfoLink pointed out, shows market dominance of players with vertically integrated chains and ‘advantages in controlling production costs’ overtaking tier-2 manufacturers.

The H1/2021 solar cell shipment ranking of PV InfoLink remains steadfast since H1/2020 with the same players Tongwei, Aiko, Runergy, ShanXi Lu’An and Solar Space holding on to the top 5 spots in that order (see Tongwei Secures Top Spot in Solar Cell Shipment Ranking).

While there was annual growth in their shipments, the cell sector was impacted by high prices of wafers and modules, along with lower capacity utilization. There was also ‘severe overcapacity of mono-Si PERC cells’ to add to the troubles, bringing down their shipment volumes marginally down on annual basis.

Large wafer sized cells with 182mm and 210mm are gaining ground as the top 3 cell makers had 38% of their total shipment during the reporting period from these cell sizes, even as smaller formats are being phased out. Production lines with 158mm sizes will be eliminated in H1/2022 and demand for 166mm will quickly switch to larger formats.

Another trend spotted is that of vertically integrated companies strengthening their own cell production lines, spelling trouble for professional cell manufacturers that see their cell purchase volumes coming down.

“This year, cell oversupply can hardly be solved, as book sales are still conservatively estimated to see 150 GW of production capacity additions,” according to PV InfoLink.