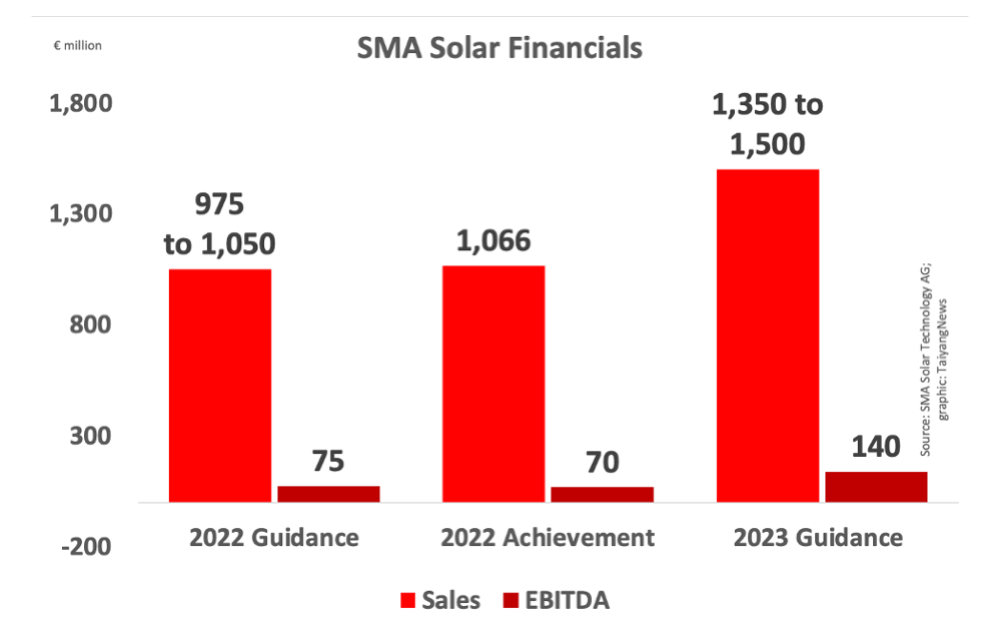

- SMA Solar expects to report €70 million EBITDA for 2022, growing from €8.5 million in the previous year as per its provisional results

- It returned to profitability with a net income of €55.8 million, and achieved positive EBIT of €31.9 million

- Forecasts sales of €1.35 billion to €1.5 billion, and EBITDA to range within €100 million and €140 million

According to German solar PV inverter supplier SMA Solar Technology’s provisional financial results for 2022, the company significantly increased its EBITDA from €8.5 million to €70.0 million and EBITDA margin to 6.6% which the company attributes to persistently high demand and gradual improvements in the supply of electronic components.

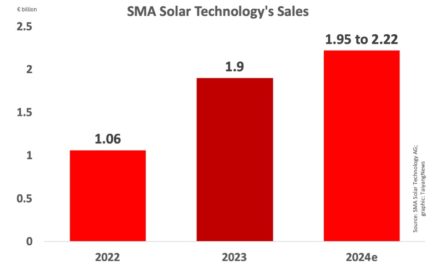

Its sales for the reporting year improved 8.4% YoY to €1.06 billion, which means it exceeds the revised guidance of €975 million to €1.05 billion ‘despite pronounced procurement supply shortages’ (see SMA Solar Revises Annual Earnings Forecast For 2022).

EBIT for the period too turned positive with €31.9 million, rising from -€33.2 million in the previous year. It also turned profitable with a net income of €55.8 million, compared to €net loss of -€23.2 million.

SMA Solar sold a total of 12.2 GW inverter capacity in 2022, compared to 13.6 GW in 2021. Its order backlog till December 31, 2022 rose to a total of €2.07 billion, comprising €1.7 billion in product business. It rose from €886.6 million at the end of 2021.

“The gradually higher availability of electronic components helped us make considerable progress in improving our ability to deliver in the second half of the year,” said SMA CEO Jürgen Reinert, adding, “However, we have not yet fully overcome the challenges on the procurement side caused by ongoing supply problems with individual components.”

Management has guided for its 2023 sales to fall between €1.35 billion to €1.5 billion, and EBITDA to range within €100 million and €140 million.