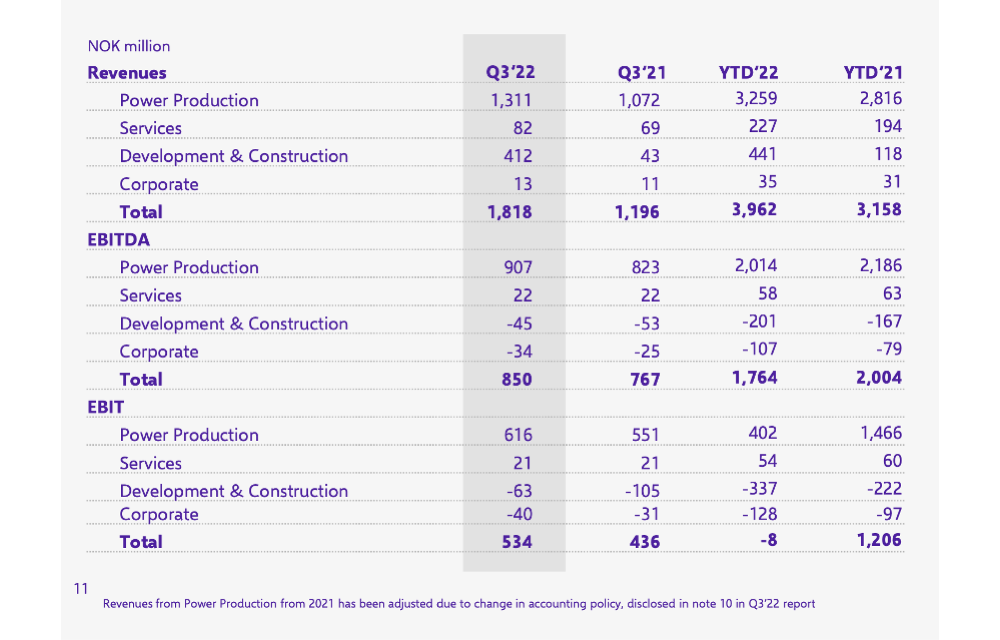

- Higher power prices and higher power sales in the Philippines helped Scatec report its all-time high proportionate EBITDA of NOK 850 million in Q3/2022

- Power production was 7% higher on annual basis with 1,135 GWh with 542 GWh contribution from solar and wind

- For solar PV, the company has found positive outcome of initial traceability studies for its suppliers conducted by a 3rd party

- It has increased proportionate power production EBITDA guidance for 2022 to NOK 2.75 billion to NOK 2.85 billion

Norwegian renewable energy developer Scatec has revised its proportionate power production EBITDA guidance for 2022 to a range of NOK 2.75 billion to NOK 2.85 billion after having increased the same to NOK 907 billion in Q3/2022, attributing the improvement to significantly higher power sales at higher power prices in the Philippines and foreign currency effects.

It is the 2nd time the company has altered its proportionate power production EBITDA guidance. Initially it guided for NOK 2.3 billion to NOK 2.6 billion, but increased range to NOK 2.5 billion to NOK 2.7 billion in Q2/2022 (see Scatec Reports NOK 68 Million Loss For Q2/2022).

Philippines, where it operates hydropower plants, contributed NOK 375 million with an increase of 64% over the previous year to all-time high proportionate EBITDA of NOK 850 million.

Power production during the reporting quarter went up 7% higher YoY to 1,135 GWh, comprising 542 GWh of solar and wind, followed by 339 GWh hydropower in the Philippines and 254 GWh hydropower in Laos and Uganda. All three segments contributed NOK 530 million, NOK 615 million and NOK 166 million, respectively to make up Scatec’s proportionate revenues of NOK 1.31 billion.

On a consolidated basis, its 3rd quarter revenues were NOK 1,163 million with an EBITDA of NOK 886 million thanks to higher net income from joint ventures and associated companies driven by the Philippines.

Proportionate revenue increase in Q3 was partly offset by Ukraine and slightly lower production in South Africa, it added.

“We had an all-time high EBITDA during the third quarter and our construction activities in South Africa, Brazil, and Pakistan are progressing well. We continue to focus on delivering on our strategy and see stable performance of our operating asset portfolio,” says Scatec CEO Terje Pilskog.

Backlog

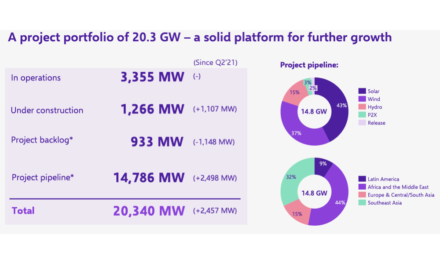

At the end of September 2022, Scatec’s operational capacity was 3.37 GW. Its cumulative project backlog and pipeline improved to 16 GW (15.9 GW to be specific), with 15 GW of project pipeline and 900 MW in the backlog. Wind energy projects of 6.22 GW make up the largest chunk of the pipeline followed by 5.5 GW of solar PV, among others.

At the end of September 2022, Scatec’s total project pipeline and backlog added up to around 16 GW of which solar’s share is 5.5 GW. (Source: Scatec)

For solar PV, Scatec said it hired a 3rd party to conduct a full traceability mapping of its key module suppliers for the upcoming projects. “We have concluded the initial traceability studies with our key suppliers to determine their capacity to provide transparent and traceable supply chains. The outcomes of these initial studies have been positive, and the findings have been included in our supplier selection process and incorporated into the supplier contracts for our projects currently under construction,” added the management.”

The company said it will continue to monitor and follow up on a project specific level even after deliveries have concluded.

Guidance

Going forward, for Q4/2022 Scatec guides for its power production to range between 1,030 GWh to 1,310 GWh on proportionate basis. On consolidated basis, it guides for 2,450 GWh to 2,650 GWh.

For both these parameters, the full year guidance is for 3,950 GWh to 4,050 GWh and 9,600 GWh to 9,800 GWh, respectively.