- Bernreuter Research counts China’s Tongwei and GCL Technology as the world’s top 2 largest polysilicon manufacturers

- Both the companies are likely to expand their production capacity to 370,000 MT each by 2023

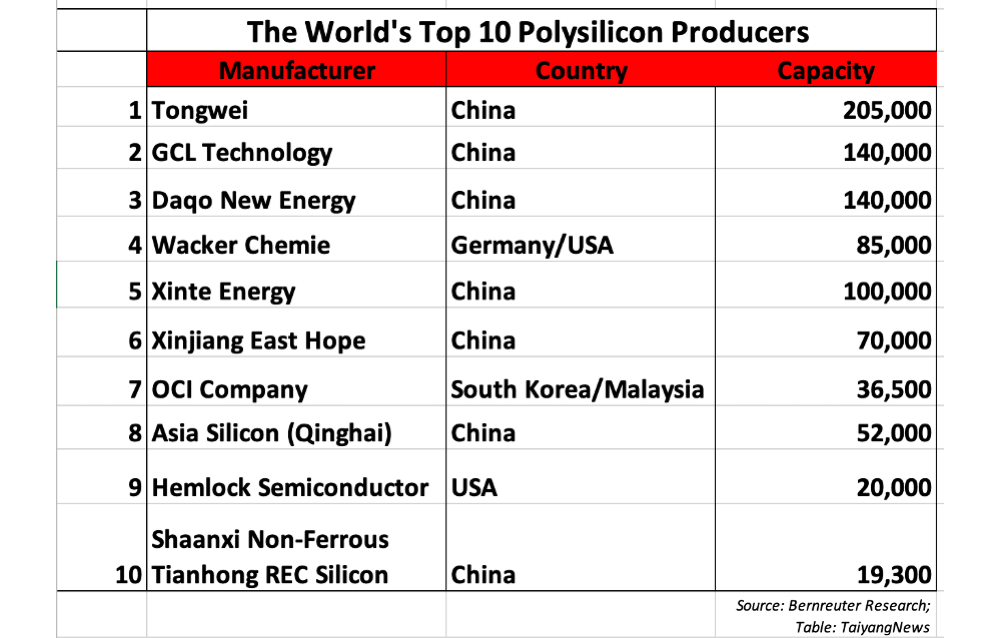

- Wacker Chemie has slipped to the 4th spot as it continues to lower its solar grade polysilicon manufacturing in favor of electronic grade polysilicon

- It says China accounted for over 80% solar-grade polysilicon market share in 2021

- As Chinese producers scale up manufacturing, soon China could account for over 90% of global market share in the domain

The latest ranking of the world’s top 10 producers of polysilicon by Bernreuter Research sees 3 Chinese manufacturers—Tongwei, GCL Technology and Daqo New Energy—hogging the top spot while the sole European producer on the list, Wacker Chemie dropped down to the 4th spot.

Bernrueter Research’s top 10 ranking assesses the manufacturers basis their actual output in a given year, this time it is 2021.

Tongwei and GCL, the top 2 producers exceeded annual output of 100,000 metric tons (MT) each in 2021 and are expected to reach a production capacity of 370,000 MT by 2023, each. While Tongwei’s production capacity stood at 205,000 MT at the end of 2021, GCL’s capacity was 140,000 MT.

Other companies on the list from 5th to 10th positions are Xinte Energy, Xinjiang East Hope New Energy, OCI Company, Asia Silicon (Qinghai), Hemlock Semiconductor, and Shaanxi Non-Ferrous Tianhong REC Silicon.

Wacker slipping down the rankings is due to its business model, explained Head of Benreuter Research, Johannes Bernreuter as it focuses more on electronic-grade polysilicon while ‘abandoning more and more market share in the rapidly growing solar-grade sector’.

Hence in the future, Bernreuter believes Wacker will further slide down to 6th spot by 2023 with its share overtaken by Xinte Energy and East Hope, both from China.

Wacker, in fact, is likely to go the US polysilicon producer Hemlock Semiconductor way that lost its top position in 2012. Sharing the case study, Bernreuter says back then, the Chinese accounted for only 30% of the global market share that increased to more than 80% in the solar-grade sector in 2021. Expect it to further swell to over 90% as Chinese companies continue to press ahead with their expansion plans.

“Russia’s invasion of Ukraine has opened the eyes for what it means to be economically dependent on a dictatorial regime. Western governments should not make the same mistake with China,” cautions Bernreuter. “It is high time to establish non-Chinese solar supply chains. China has demonstrated what the ingredients of success are: low electricity rates for power-hungry polysilicon and ingot production, loan guarantees for private investment, cost-efficient equipment manufacturing and strategic foresight.”