- AGEL’s Q2/2021 power supply revenues grew 15% on annual basis and EBITDA by 19% from last year

- CEEW-CEF and IEA report lists the concern areas Indian government needs to address for utility scale solar and onshore wind to continue to attract investor interest

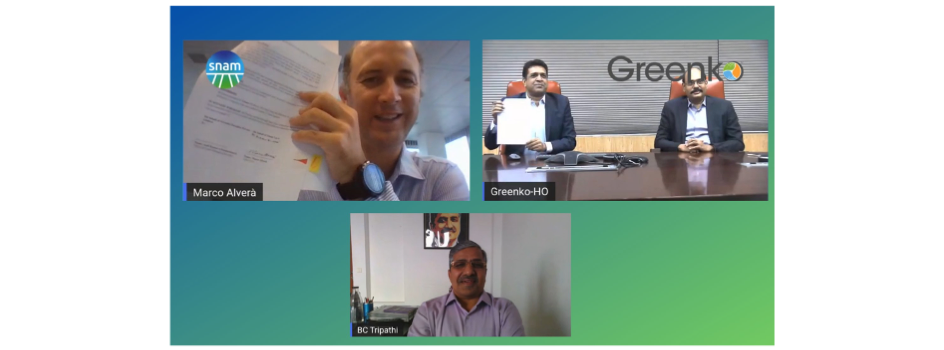

- Snam has executed agreements with Greenko and Adani to develop hydrogen value chain in India and explore green hydrogen

- ITI Limited seeking bidders for 1.5 MW solar PV capacity in the form of rooftop or ground mounted installation in Raebareli

AGEL revenues grow by 15% YoY In Q2/2021: In the 2nd quarter of FY 2021, Adani Green Energy Limited (AGEL) grew its revenues by 15% on annual basis from power supply with EBITDA going up by 19% compared to the same period the year before. Its sale of energy was 1,187 million units reflecting an increase of 22% from last year. AGEL reported its cumulative operational capacity went up to 2.8 GW at a CAGR of 46% over the last 3.5 years. The company said it continues to operate its solar portfolio at 100% plant availability. In October 2020, it completed acquisition of 205 MW solar assets from Essen Group to expand the operational PV capacity of their joint venture to 2.35 GW (see Total & Adani JV Expands India PV Portfolio).

AGEL management said it is setting up a revolving construction facility to help meet the necessary funding required at construction stage for the upcoming projects. “The projects will be refinanced with international bond issuances once the COD is achieved and the construction facility will be rolled over and be available for financing of the next phase of construction,” said the management.

Indian RE sector continues to draw investor interest: A joint report by the International Energy Agency (IEA) and CEEW Centre for Energy Finance (CEEW-CEF) sees investor interest intact for India’s renewable energy sector, read utility scale solar PV and onshore wind. However, analysts caution that evolving risks in terms of discoms’ financial weakness, problems of land availability (especially for solar projects) and evacuation infrastructure along with ‘heightened concerns’ over sanctity of contracts and uncertainty surrounding impending trade barriers could play spoilsport, dampening investor interest. Addressing these concerns will be key to attain India’s renewable energy targets of 450 GW by 2030. The report titled Clean Energy Investment Trends 2020 can be downloaded for free on the CEEW-CEF website.

Snam to explore green hydrogen with Greenko, Adani: Italian gas infrastructure company Snam wants to explore the green hydrogen market in India. It has executed an agreement with Indian renewable energy company Greenko to develop the hydrogen value chain in the country. In a press release, Greenko reportedly said the 2 companies will collaborate to study hydrogen production through renewables and its potential application for both industry and transport.

Separately, Adani Group also announced a collaboration with Snam to explore the hydrogen value chain in India as well as development of biogas, biomethane and low-carbon mobility. “At the same time, the ability to leverage scale and technology to produce 100% green hydrogen using renewable energy is the most economical and cleanest way to serve a concentrated set of end users and industrial clusters,” said Adani group Chairman Gautam Adani. “In this context, the combination of Adani’s ability to provide the largest national energy platform and Snam’s broad technology expertise can be pivotal in helping India accelerate its sustainability journey.”

1.5 MW rooftop solar tender launched: A public sector undertaking under the federal Department of Telecommunication, ITI Limited is soliciting bids for a 1.5 MW grid connected solar PV project in Raebareli, Uttar Pradesh. The project can be ground mounted or set up on the rooftop with net metering and zero export policy. Successful bidder will need to conduct survey, design, fabrication, supply, installation, testing, commissioning of the project and also provide comprehensive operation and maintenance (O&M) for 5 years. Last date to submit bids is November 25, 2020, according to the tender notice.