CPIA has raised its 2025 solar forecast for the China market to 270 GW AC to 300 GW AC, as H1 installations exceeded expectations

Provincial targets and green power mandates add momentum to the country’s full-year demand

The association sees growing export challenges as global markets localize manufacturing, leading to China’s first-ever YoY module export drop in H1 2025

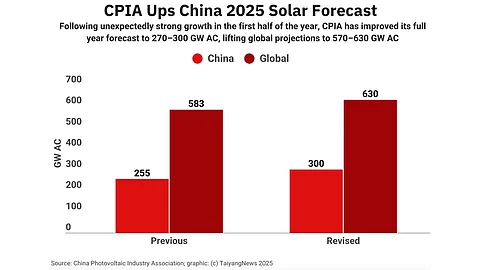

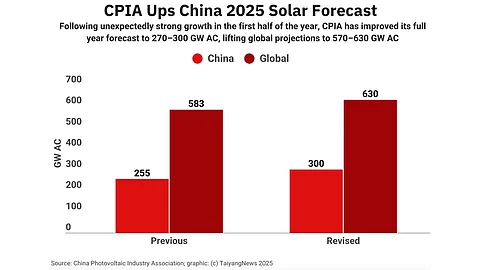

China Photovoltaic Industry Association (CPIA) now expects the country to add 270 GW AC to 300 GW AC of solar installations in 2025, up from its earlier projection. Surging H1 installations in the world’s largest solar market have also prompted it to revise global forecasts to 570 GW AC to 630 GW AC.

The association had earlier forecasted China’s 2025 solar installations to fall by 8% to 22%, down to 215 GW AC to 255 GW AC. This would have been the first annual decline in 6 years for the world’s largest solar market – contributing to global additions of 531 GW AC to 583 GW AC (see China’s Solar PV Market To Slow Down To Around 255 GW In 2025).

CPIA attributed its previous forecast to the country moving towards a market-oriented pricing system that came into force on June 1, 2025. However, this same factor has become the reason for the CPIA to raise its annual forecast to even exceed the 277 GW it installed in 2024, as the rush to cash in on the feed-in-tariff (FIT) regime pushed H1 numbers to around 200 GW (see China Solar Installations: From 100 MW In 2009 To 1 TW In 2025).

Speaking at the association’s H1 2025 conference, CPIA’s Bohua Wang also attributed the increased forecast to strong momentum across the country. Provincial governments steam ahead with installations, since existing projects follow the old policies, and actual targets for most provinces are higher than the 2024 indicative targets. During H1, 17 provinces added at least 1 GW capacity, while large-scale solar-wind hybrid projects progress steadily, and grid connections remain solid.

Additionally, the green power consumption mandate for the 5 key industries of aluminum, steel, cement, petrochemicals, and chemicals will also create demand, not to mention energy-hungry data centers. By 2030, China targets 253 GW of solar capacity for desertification control, which will also boost the market despite the policy changes (see China Solar PV News Snippets: LONGi Commissions 1st Hi ROOF S C&I Project & More).

Nevertheless, CPIA’s upward revision is still conservative when compared to China’s State Grid Energy Research Institute’s 380 GW AC forecast, representing a year-on-year (YoY) increase of 35.5% attributed to growing demand from data centers and for cooling as a key determinant.

Speaking at the recent TaiyangNews Global Solar Market Developments 2025 Webinar, Rystad Energy Vice President Marius Bakke estimated new solar installations this year to total 655 GW DC. At the same event, AECEA Director Frank Haugwitz said he expects China to install up to 350 GW AC capacity (see Expect Record Solar Growth In 2025, But Near-Term Risks Loom).

Haugwitz lowered the projections post the webinar to 300 GW AC, announcing it on his LinkedIn account, while stating that the State Grid has lowered its estimate to 260 GW AC.

Meanwhile, the country’s H1 2025 new solar installations exceeded 212 GW, with the addition of 14.36 GW in the month of June (see China’s June 2025 Solar PV Additions Fall To 14.36 GW).

Prices

China's module prices rebounded briefly in early April amid the 4.30 and 5.31 installation rush this year, but plunged afterward. From April onward, prices dropped across all segments for over 10 straight weeks, notes the association, falling below early-year levels and hitting historic lows by early July. It does say that prices began recovering after July 10, 2025.

Production and exports

The initial 6 months of 2025 were ‘extremely challenging’ for the Chinese solar industry as manufacturers were forced to lower production. The industry reported a growth of 7.7% YoY in solar cell output at 334 GW, while module output grew by 14.4% to 310 GW, showing a relatively higher capacity utilization rate of around 50%.

Polysilicon production of 596,000 metric tons (MT) was 43.8% lower, while 316 GW of wafer production also declined by 21.4%. Their utilization rates were under 50% and 40%, respectively.

The country shipped 35.5 GW, or 7.5% less, wafer capacity, as shipments were impacted by the US imposing antidumping and countervailing duties (AD/CVD) on Southeast Asian imports. Cell shipments of 44.5 GW grew by 74.4%, driven by the rapid increase in module capacity in India and Indonesia.

Module exports of 125.6 GW during the period represented a 2.82% decline, the 1st ever YoY drop for this segment, according to CPIA. It reflects a slowdown or moderation in overseas demand. The top 10 markets accounted for less than 60% of total module export value for the first time, while the share of other regions rose by nearly 10 percentage points YoY to over 40%.

Hence, despite the growth, the association notes that China’s global competitiveness is declining as key markets ramp up local solar manufacturing. The US now produces 6x more modules than before the Inflation Reduction Act (IRA) and is largely self-sufficient. India has more than doubled its capacity to over 100 GW, while Europe, the Middle East, and Africa have advanced enough to support over 20 GW of full supply chains.

Wang pointed out that as these regions reduce reliance on imports, China’s exports face growing pressure – global demand growth no longer guarantees growth in Chinese shipments.