- SECI’s 2 GW ISTS-IX solar auction has created history with INR 2.36 per kWh as the lowest winning tariff, the lowest for solar in the country till date

- Solarpack has emerged as the lowest bidder to win 300 MW in the auction

- Winning bids ranged between INR 2.36 per kWh to INR 2.38 per kWh; the highest bid was quoted by CDC Group’s Ayana Renewable and India’s ReNew Power

- As safeguard duty comes to an end on July 29, 2020 and BCD along with ALMM sometime away, the developer community is making the most of this time

- Foreign companies with deep pockets have access to low financing which inspires these bids, experts believe

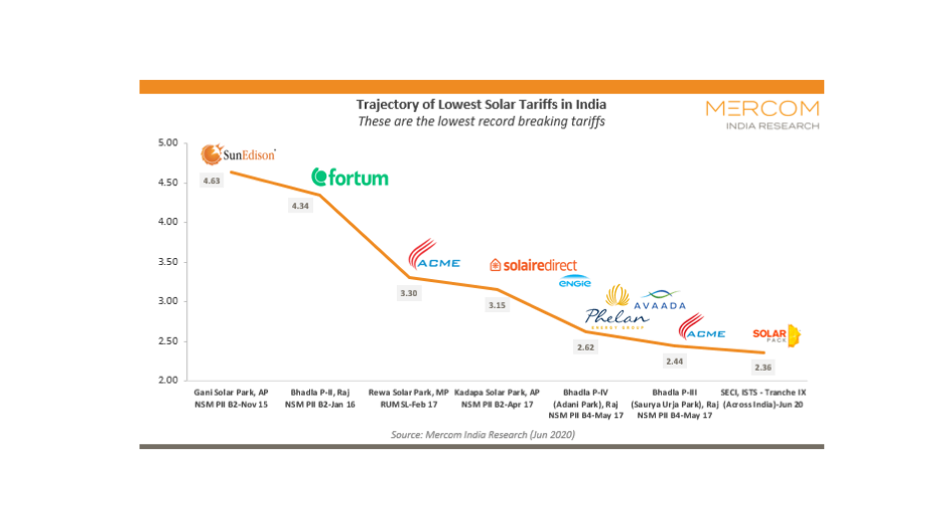

Solar PV tariffs in India have dropped to a new low of INR 2.36 ($0.031) per kWh in a Solar Energy Corporation of India (SECI) auction, breaking the last record of INR 2.44 per kWh by over 3%. This record low tariff of INR 2.36 per kWh was offered by Solarpack Corporacion of Spain to win 300 MW in the 2 GW interstate transmission system (ISTS) tranche-IX auction of SECI that was oversubscribed attracting 5.28 GW capacity. However, Solarpack only won by a hair’s breadth – in fact, all winning tariffs were beat the former record.

Previously, ACME Solar had created history in the Indian solar sector by quoting INR 2.44 per kWh as the lowest winning bid to win 200 MW out of 500 MW auctioned by SECI in May 2017 (see ACME Wins 200 MW At 2.44 INR Record).

Now, Avikiran Surya (300 MW) of Italy’s Enel Green Power, Eden Renewable (300 MW) of the US, ib vogt Singapore (300 MW) of Germany, and Amp Energy Green (100 MW) of Canada won their respective capacities for the same tariff of INR 2.37 ($0.031) per kWh. Ayana Renewable of UK’s CDC Group secured 300 MW in the auction for INR 2.38 ($0.032) per kWh, stated Mercom India Research.

Goldman Sachs, Abu Dhabi Investment Authority, Canada Pension Plan Investment Board and others backed ReNew Power of India bid for 1.2 GW, but won 400 MW for INR 2.38 per kWh.

Solarpack said for INR 2.36 per kWh, it will sell solar power to SECI for a period of 25 years from its 396 MW project located in Rajasthan, due for completion in 2022.

Why such aggressive tariffs?

Analyzing the ‘aggressive’ tariffs quoted in this auction, Mercom Capital Group’s Raj Prabhu believes developers want to take advantage of the safeguard duty coming to an end of July 29, 2020, which may be extended. To replace it, the Ministry of New and Renewable Energy (MNRE) is pushing for the imposition of basic custom duty (BCD) but it can only come into effect from August 1, 2020, if it goes through.

“This low bid is an indication of where the market pricing is for the large-scale solar projects without duties on modules and ALMM. Government agencies cannot expect this level of pricing again once duties and other regulations are imposed,” said Prabhu. “We said in our last webinar that any auctions conducted before July 29th will have an advantage and can attract lower bids.”

Under its Approved Models and Manufacturers of Solar Photovoltaic Modules (ALMM) scheme, the government will only allow Bureau of Indian Standards (BSS) certified solar PV modules (ALMM List-I) and cells (ALMM List-II) to be sourced for all government projects and programs. The effective date for these lists to be implemented is September 30, 2020.

Another market intelligence firm JMK Research and Analytics commented, “The key trigger for this kind of low tariff is zero safeguard duty for developers and pass-through from Basic Custom duty (BCD) under ‘Change In-law’ provision in this specific period. This is likely to significantly reduce project costs.” It points out that Solarpack, Enel and ib vogt have no pipeline of solar projects and might be aggressive to build their portfolio and most of these international developers have access to low-cost financing as well. “And it will be very interesting to see the tender activity for the next 18 GW of RE projects where bid submission Is expected before July 31, 2020.”

Nonetheless, these auction results have brought back attention to the Indian solar market’s potential. “India, though battling through pandemic and lockdown for over 3 months, witnessed 3 historic bids consecutively, all during the lockdown. Starting with the country’s first RTC tender in May, followed by world’s largest solar tender of $6 billion in early June and now historically low tariff of SECI Tranche IX, India has retained its position as the global attraction for solar energy investments,” wrote Subrahmanyam Pulipaka, CEO of the National Solar Energy Federation (NSEF) of India on his LinkedIn account. “This tender (and the 2 consecutive ones before) is a clear manifestation of Indian Solar Sector’s resilience, vibrant ecosystem and not to forget government’s reliable and bankable support system.”

The lowest solar tariff globally till date remains the $0.0135 per kWh for the 2 GW Al Dhafra Solar PV Project, which was announced in early May (see World’s Lowest Solar Tariff For 2 GW Abu Dhabi Tender).