- SolarEdge has reported record revenues for Q1/2023 at $944 million, having gone up 6% QoQ and 44% YoY

- Solar segment contributed with $908.5 million, while non-solar added $35.2 million

- It expects to start manufacturing in the US by Q3/2023 though the management has not yet revealed the location

The year has begun with a bang for Israel based global solar PV inverter supplier SolarEdge Technologies, Inc as the company reported $943.9 million revenues for Q1/2023, with CEO Zvi Lando calling it a ‘record revenue quarter from our non-US, non-Europe region’.

It is the rest of the world that defines its quarterly earnings, as revenues grew 30% QoQ and came from 24 countries across the Asia Pacific, Africa and South America, the management shared during a call with analysts.

Additionally, record quarterly solar revenues were reported from Germany, Austria, Switzerland, France, South Africa and Australia while the Netherlands and Italy came in with ‘very strong’ revenues.

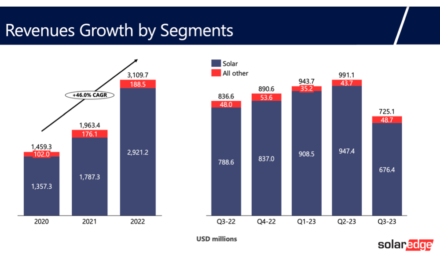

Revenues having grown 6% QoQ and 44% YoY improvement include $908.5 million from the solar segment which itself went up 9% and 49% respectively (see SolarEdge Reports ‘Record’ 2022 Revenues, Up 58% Annually). Non-solar segment brought in $35.2 million.

GAAP gross margin was 31.8% and that from solar segment too was a high of 35%. Operating expenses came down 41% QoQ to $156 million even as these were up 22% compared to Q1/2022 (see SolarEdge’s Q1/2022 Financial Results). It also improved 564% quarterly and 318% annually on GAAP net income with $138.4 million.

SolarEdge shipped 2.1 GW or around 330,000 commercial and industrial (C&I) inverters sold globally. The company also sold 6.4 million power optimizers and 221 MWh of residential batteries during the reporting quarter.

“The general improvement in the market, combined with the actions that we have taken have allowed us to return to a more normal mode of operation. In most product areas, we are at a point where our manufacturing capacity is able to meet demand, and we can use normal shipping routes, build inventory and reduce lead times,” added Lando.

Management plans to add manufacturing sites in the US to further expand capacity and benefit from Inflation Reduction Act (IRA) offered manufacturing credits. It claims to be on track to manufacture in the US in Q3/2023. Yet, it did not reveal the location of the fabs.

SolarEdge plans to start with a contract manufacturer here. It is currently in the process of getting equipment to start manufacturing on site and also working on its own fab to be built and operated by the company.

Nonetheless, it believes to have more than enough capacity produced in the US to cover the US demand.

Guidance

SolarEdge has guided for its Q2/2023 revenues to fall within the range of $970 million to $1,010 million, including $930 million to $980 million contributed by the solar segment. Non-GAAP gross margin is guided within 32% and 35%, that for solar between 34% to 37%.

Jeffrey Osborne, financial analyst at TD Cowen opined, “We note mix (expected increased portion of commercial and battery revenue) limits gross margin upside. Management pointed to the high end of its 20%-30% revenue growth guidance range. Exceeding this range is dependent on component supply and ramping manufacturing.” However, in summary Osborne said about the results, “SolarEdge delivered better than expected Q1/2023 results, provided healthy Q2/2023 guidance, and maintained its 2023 revenue growth guide of 20%-30%. While management continues to see US resi softness near term, the company’s relative strength in European and commercial markets provide the ability to better navigate the expected near-term headwinds. Remains our top pick for 2023.”