- Low accepted level of RCZ, which is about 3% compared to 5 to 6% with p-type is making the n-type wafer expensive

- High spec for polysilicon quality—a cause for concern with Chinese suppliers—, not to mention supply constraints of late, are also pushing manufacturing costs up for n-type wafers

- Non-acceptance of low-grade wafers such as “A-” or “B” grade is also a cause of concern that ultimately increasing the costs for n-type wafers

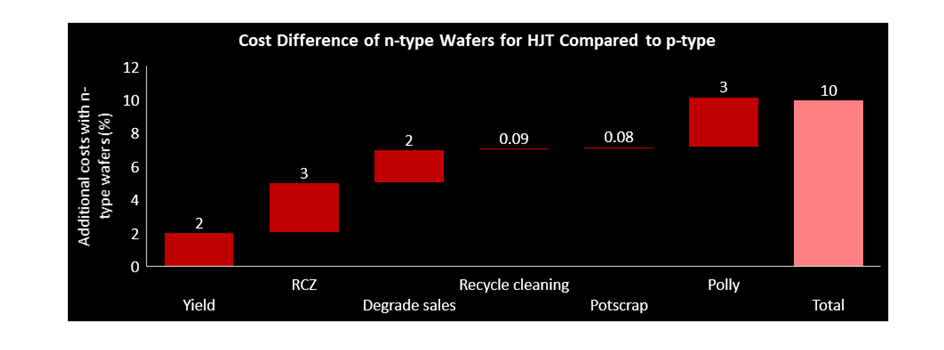

- Recycle-cleaning and pot scrap are yet two additional steps in n-type wafers compared to p-type with less than 0.1% cost impact.

The differentiation of HJT compared to main stream technologies such as PERC starts with the wafer base – the technology in today’s context employs n-type wafers. It is public knowledge that n-type wafers are more expensive, which roots back to the fact that n-type wafer production involves higher manufacturing costs. One of the major cost drivers for HJT is that the accepted level of RCZ for n-type wafers, especially for HJT to attain high lifetime and resistivity ratio, is 3 to 4% against 5 to 6% for p-type. This difference translates to an approximately 3% rise in costs at the brick level.

What also contributes to the high costs is polysilicon. n-type wafers demand high-quality polysilicon—a cause for concern with Chinese suppliers—, not to mention supply constraints of late, and these two factors combined are a big contributor to costs, according to YC Wang, Director of Application Engineering and Key Customer Service of LONGi Silicon, the world’s largest wafer maker, who said at a HJT conference of Research Center Juelich that high-quality polysilicon for n-type increases the brick cost by 3 to 8% compared to that of p-type. Losses incurred due to the non-acceptance of low-grade wafers such as “A-” or “B” grade wafer account for about 2%. Other additional costs associated with n-type wafers are recycle-cleaning and pot scrap, each of which contributes slightly less than 0.1%. All these factors put together increase the cost of n-type wafers for HJT by about 10% at the brick level, according to Wang. This gap may also widen, especially when an even higher lifetime is required, which requires limiting the RCZ content further. Polysilicon may also turn out to be a major influence, as the above estimate factors in the lowest impact (3%) of special polysilicon, while it can go up to 8%. This also implies that accepting higher RCZ content and absorbing low-grade wafers offers the potential to reduce costs.

For more information on cost comparisons and HJT processing please check out our TaiyangNews Heterojunction Solar Technology 2020 report, which can be downloaded for free here.