- Manz says it has booked a non-cash impairment of €21.6 million in its solar business for the Chinese CIGSfab order

- It missed the 2021 annual earnings forecast due to this as per its preliminary financials, but says no negative impact on liquidity

- Management said with the impairment booked, it can now move ahead from the uncertainty regarding the order

German production equipment supplier Manz AG has decided to book €21.6 million non-cash impairment for its solar business stating the uncertainty surrounding the completion of an order of its CIGS thin-film manufacturing equipment by China’s Shanghai Electric Group and China Energy Investment Corporation Limited (formerly Shenhua Group).

For the background, back in 2017, Manz had received the order to supply its CIGS production lines worth €263 million with 350 MW capacity to the 2 Chinese companies which back then it termed as the largest CIGS thin-film module production line in China and 2nd largest worldwide. As per the plan, installation was to start in 2017 and finished in 2018. However, there have been delays on the part of the customers due to delay in completion of buildings that will host the lines, Manz had previously reported.

Back to the present, Manz now says it has booked the impairment on ‘goodwill and a brand name’ in the financial statements for 2021. While it has no negative impact on the company’s liquidity, it admitted that it won’t be able to achieve its earnings forecast for 2021 due to this one-time effect.

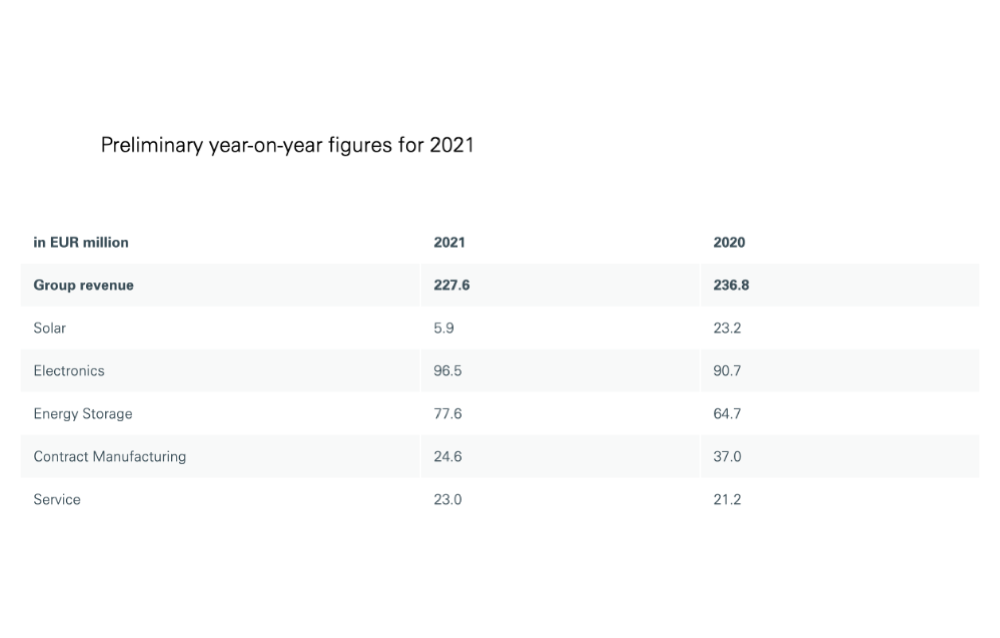

As a result, its preliminary financials for 2021 show it locked in €228 million as revenues, down from €236.8 million in 2020. EBITDA of €18.9 million came in as compared to €19.4 million in the previous year. EBIT of €-15.5 million was impacted by the non-cash impairments of €21.6 million.

Its solar segment contributed €5.9 million to group revenues, having gone down from €23.2 million in 2020, with EBIT of €-30.5 million, widened from €-7.8 million in the previous year.

However, Manz management said with the impairment, it is now ‘leaving uncertainty in this area behind us and can fully focus on implementing our strategy of achieving sustainable profitable growth’.

It reported revenue growth in other business segments, namely electronics, energy storage and contract manufacturing. Citing an overall positive industry outlook in its markets, barring the unknown impact of the Russian invasion on Ukraine, the company expects to become profitable in 2022.

Going forward, the German company forecasts its 2022 revenues to increase in the mid double-digit percentage range on annual basis, with EBITDA margin in mid to upper positive single-digit percentage range and an EBIT margin in the low to mid positive single-digit percentage range. This forecast, it added, does not include the completion of its CIGSfab contract with the Chinese partner.

Manz will release details of 2021 financials in its Annual Report to be released on March 30, 2022.