- Fitch Solutions expects capital costs for solar and wind projects to remain high in 2023 with high material prices

- These will be partially offset by falling operational costs and rising technology efficiency

- Supply chain pressures have started to now ease and new polysilicon capacity coming online in response to increasing demand will also help lower prices

- Countries in the MENA region or elsewhere eying Europe as an offtaker for green hydrogen will need to add storage to support the same, leading to high costs

Fitch Solutions Country Risk & Industry Research sees supply chain bottlenecks for solar starting to loosen in 2023 even as high capital costs for solar and wind energy projects as experienced in 2022 are likely to continue, though the impact will depend on the technology used and materials needed.

Fitch crystal ball sees elevated capital costs for the 2 technologies continuing into 2023 with high material prices leading to ‘altered project economics and higher strike pricing’ for solar and wind projects as some developers feel the pinch more acutely. Analysts, however, add that in many cases these capital costs will be absorbed by the counter balancing efforts of falling operational costs and rising technology efficiency.

With new polysilicon production capacity coming online to meet increasing demand, its price will experience an ‘overall contraction post-2022’.

“Furthermore, we expect that supply chains are already reacting to rising demand for renewable content and at the end of 2022 shipping freight index rates were already seeing declines,” according to the analysts.

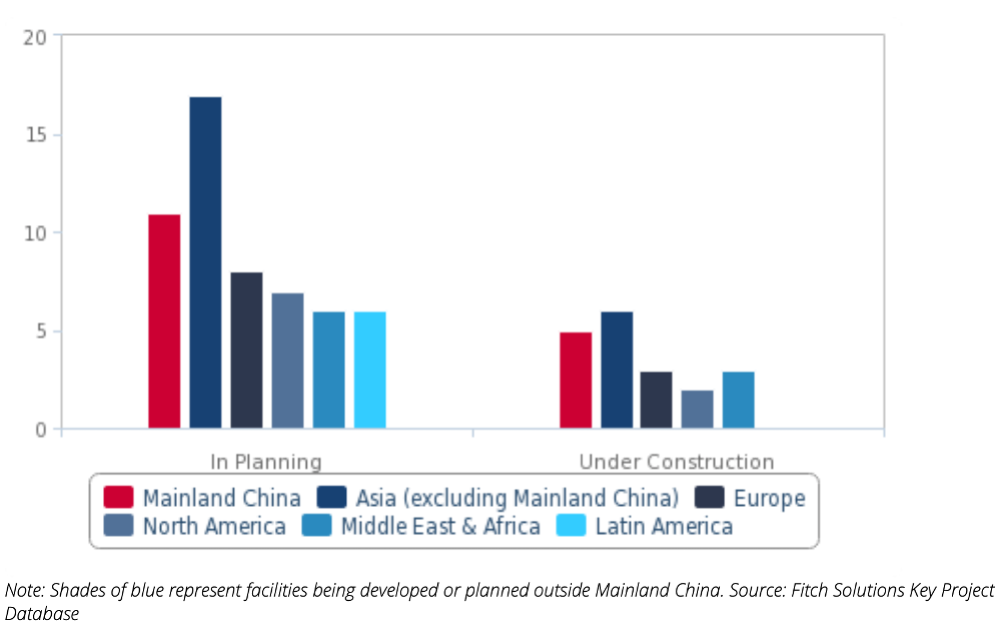

As for PV manufacturing, mainland China remains the world’s largest supplier even as diversification leads to reshoring in North America and Europe as rest of Asia gets ready to host new facilities. This is thanks due to governments restricting imports through taxes and customs duties while incentivizing domestic manufacturing.

Currently, about 80% of renewable equipment manufacturing facilities are planned outside mainland China while the Asian giant manufactures close to 80% of all polysilicon, wafers, cells and modules required for solar power projects.

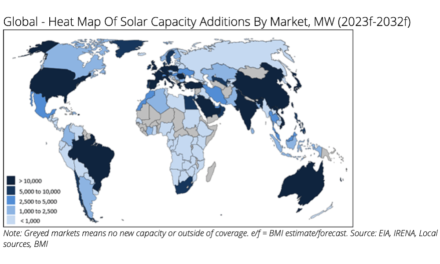

Among other trends expected in 2023, Fitch sees Middle East North Africa (MENA) region developing green hydrogen industries and increasing their renewable energy capacity, especially markets within the GCC region as the UAE, Saudi Arabia and Oman. They will also leverage their gas experience to produce blue hydrogen.

“The EU’s 100% renewable electricity origin rules for green hydrogen will weigh on the attractiveness of green hydrogen investments in MENA and other African markets. Given the intermittent nature of renewable power, green hydrogen production would have to be supported by energy storage solutions which will make green hydrogen developments in MENA and elsewhere costlier if looking to the EU as an off taker,” reads the Fitch analysis. “The new rules might impact green hydrogen projects in MENA’s pipeline as the majority of the projects are in planning stages with only a handful in financial closure.”

The largest green hydrogen projects over the next few months can be expected to come up in Asia-Pacific, Europe and North America.

The continuing energy crisis in Europe and supportive policy framework under REPowerEU will boost renewable installations even though reliance on coal continues in the near term.

For Africa that continues to experience low electrification rates, impeding power sector expansion and renewable power adoption, global lenders, along with European and US donors, are supporting efforts of off-grid solar companies in Sub-Saharan Africa.

“We believe that investment into Africa’s move to grid scale renewables will grow in 2023. As the region’s non-hydropower renewables project pipeline continues to grow, we expect to see more investments that will move a significant portion of projects from planning stages to construction,” state the Fitch analysts.