- Risen replaced its 150 µm wafer with a much thinner and flexible 100 µm wafer for its Hyper-ion HJT cell

- By October 2023, its busbarless 100 µm Hyper-ion HJT Cell realized a 25.8% average production efficiency

- Adoption of 50% low silver content metallization paste reduces metallization cost to 1.02 c/W

Cost is a keyword associated with HJT. Emphasizing its importance, Jiajun Ye, senior product manager at Risen Energy, a pioneer of HJT technology, shared the Chinese solar PV manufacturer’s experience with scaling up cost-optimized GW-scale HJT production at the TaiyangNews High Efficiency Conference (see Risen’s presentation here).

Regarding its motivation to venture into HJT, the 2 key factors for Risen to invest in HJT are low LCOE and low carbon footprint. Risen Energy has faced several difficulties in terms of cost optimization and efficiency gain while commercializing its HJT production from pilot lines.

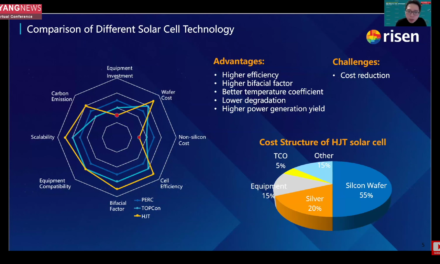

Risen benchmarked HJT with 2 other technologies – TOPCon and PERC – for 8 key indicators: cell efficiency, bifaciality, equipment compatibility, scalability, carbon footprint, equipment CapEx, wafer cost, and non-silicon cost. The technology scores higher in every aspect except for 2 areas – equipment costs and non-silicon costs. Since HJT equipment is not as mainstream as those for PERC or TOPCon, equipment costs can be addressed with economies of scale. The processing costs for HJT are a real concern as the technology requires a higher amount of silver paste, while TCO is a completely new material compared to PERC and TOPCon. However, looking into the cost structure of HJT, the lion’s share, or 75%, of the cost is contributed by silicon wafers and silver. And, naturally, these are the prime focus areas for Risen to reduce the costs and industrialize the technology.

Slimming the wafer

Since the share of wafer costs is the highest at 55%, the first step of optimization was naturally to thin down the wafer. Risen replaced its 150 µm wafer with a much thinner 100 µm wafer. Quoting an internal study report, Ye claimed that after reducing wafer thickness from 150 µm to 100 µm, the same optical absorbance level was observed up to 700 nm light wavelength. The absorbance level only starts to vary towards the infrared band. The reduction of wafer thickness marginally lowers optical absorbance.

The internal study also found that with the slimmer wafer, with a slight decrease in cell short-circuit current (Isc), there is a slight increase in open-circuit voltage (Voc). When evaluating the effect of wafer thinning on the cell’s fill factor (FF) and efficiency, Risen found that these 2 parameters increase a little bit first and decrease slightly when reaching 100 µm. Overall, the company found that the negative impact of wafer thinning to 100 µm or even slightly lower is negligible.

Double benefit: In an attempt to slash silicon costs, Risen slimmed its Hyper-ion HJT cell thickness from 150 µm to 100 µm, maintaining efficiency while boosting flexibility for enhanced reliability. (Photo Credit: TaiyangNews)

The next question that pops up when thinking of thinner wafers is mechanical stability, in the sense that wafers might become more fragile. Counterintuitively, the wafer is more flexible at 90 µm. Risen validated the 90 µm HJT cell’s flexibility compared to much thicker TOPCon and PERC cells by load testing. Ye explained that during the test, the 150 µm PERC cell started to crack when deformation reached 46.74 mm, followed by the 130 µm TOPCon cell at 53.68 mm deformation. On the other hand, the HJT cell with 90 µm thickness did not crack at the maximum point of load test at 98.56 mm deformation, ensuring mechanical stability.

Ye also showed production data showing the yield with ultra-thin wafers reached 99.2% and the breakage rate reduced to 0.2%—yet another testimony to the flexibility and mechanical robustness of thin wafers.

Optimizing non-silicon costs

On non-silicon cost optimization, the company adopted a silver-coated copper paste with 50% silver content to reduce silver consumption in HJT cell production. Subsequently, by Q3 2023, the company had reduced metallization costs to 1.02 c/W, the same as TOPCon, claimed Ye. With further optimization, Risen is expecting to reach 0.64 c/W this year, again at par with TOPCon, which is also under aggressive optimization to reduce silver usage.

While silver-coated copper reduces costs, it brings the reliability topic to the forefront due to the copper content. Risen has also addressed this concern with reliability tests. The first was the XPS spectrum test of lateral diffusion of low-cost metal in low silver content paste over the cell surface area. The test result showed only the presence of indium, oxygen, carbon, tin, silicon, and chlorine, but no copper over the surface area. This result concludes that no horizontal diffusion of the paste’s copper was observed between the finger area. In addition, the company also checked for the vertical diffusion of copper into the cell with microscopic tests in 4 different locations under the cell’s finger area and found no presence of copper.

Further, to simulate the vertical diffusion during prolonged field operation, especially when there is a breakage of silver lines, Risen conducted a more stringent test with 10 nm ITO layers as the barrier between the bottom silicon wafer and the top copper plating. This closely resembles the HJT structure that has silver contacts on top of ITO. The use of copper plating instead of low silver content paste simulates a more aggressive case of direct copper exposure compared to copper encapsulated in a silver shell.

It is observed that the sheet resistance started to increase only after 650°C, indicating copper diffusion through ITO. However, HJT, known for its low-temperature processing not exceeding 200°C, will not have any exposure due to any breakage of silver paste structure after prolonged field performance, underscored Ye. On top, Risen uses an 80 µm thick ITO layer, 10 times thicker than the film used in the above test, alleviating any diffusion or penetration of copper into the silicon layers. The company also compared the power generation of the modules based on low-silver content pastes and the standard and found them to be similar.

All these evaluations indicate that employing silver-coated copper pastes is the right way to reduce the silver costs of HJT. Thus, Risen plans to cut the silver content further to close to 40% this year to reduce the usage of silver from 10 mg/W to 7 mg/W, corresponding to 50% and 40% silver content, respectively.

In parallel, Risen is also working on another shortcoming of the low-temperature cured silver pastes – the low printing speed. The company plans to increase the printing speed from 300 mm/s to 425 mm/s this year. It has also checked the reliability of the final modules featuring these technological advancements through a long list of standard testing protocols and found them compliant. In addition to these, Risen is also adopting other technologies like the zero busbar (0BB) pattern and light conversion film to increase the performance as well as to reduce the production cost of HJT.

Consume wisely: By Q3 2023, with the usage of low silver content pastes, Risen has cut the metallization cost to 1.02 c/W and expects to bring it down further to 0.64 c/W this year. (Photo Credit: TaiyangNews)

Production landscape

Starting in April 2023, the company realized 25.3% average efficiency for its busbarless 100 µm Hyper-ion cell. By October 2023, it improved to 25.8% average batch efficiency. The company’s Hyper-ion module, based on its 210R size HJT cell, resulted in a power range of 690 W to 720 W and an efficiency range of 22.2% to 23.2%. The stringing process of the busbarless cell was done by its patented Hyper-link stress-free interconnection technology. With a total capacity of 15 GW, the company has established 2 new HJT production fabs in Nanbin and Jintan, China. It plans to add 6 GW more in 2024 to reach 21 GW cumulative capacity.