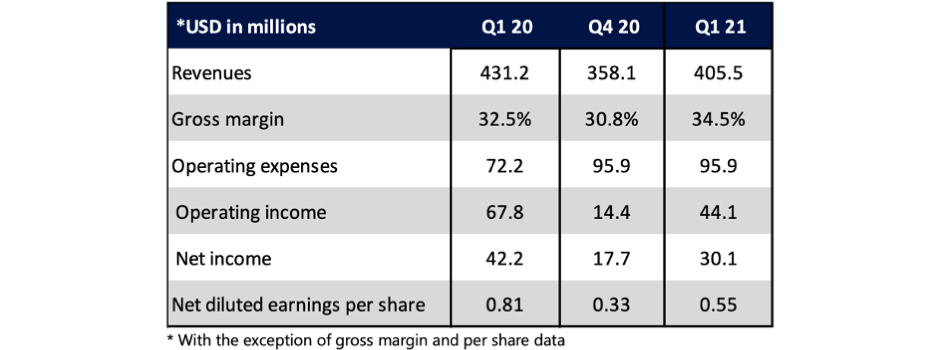

- SolarEdge’s GAAP revenues in Q1/2021 dropped 6% annually to $405.5 million

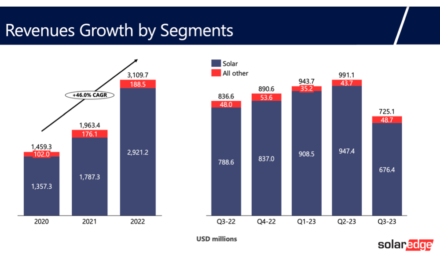

- Its solar products business contributed $376.4 million to the total revenues

- Of the 1.69 GW AC products shipped during the quarter, 45% were commercial and 55% residential products

- The US market with its residential solar demand contributed 43.2% of all solar revenues for the company

- Management has guided for Q2/2021 revenues to fall within $445 million and $465 million range

SolarEdge Technologies, Inc., the Israel based solar inverter supplier, has reported $405.5 million GAAP revenues in Q1/2021 as a 6% decline when compared with Q1/2020, but a 13% increase on sequential basis.

Its solar products business continued to lead sales with the contribution of $376.4 million to the group revenues, yet it was a decline of 8% YoY and a 15% sequential increase.

For its solar products, the US was a big market representing 43.2% of all solar revenues (mainly residential), followed by Europe accounting for 42.1%, and rest of the world (ROW) contributing 14.7%, mostly driven by the Australian market, the management shared on a call.

Of the total shipments of 1.69 GW AC during the reporting quarter, it shipped 721 MW to Europe, 573 MW to the US, and 397 MW to ROW. Overall, 45% of total product shipment comprised commercial products, the remaining 55% were destined for the residential market.

Like its US competitor Enphase Energy, SolarEdge also experienced a substantial increase in ocean freight prices during Q1/2021, for which the management attributed a COVID-19 related impact on trade and supply chains. It claimed ocean freight prices have increased by over 100% over the last month and that its pre-negotiated prices have gradually expired, exposing it to higher freight costs globally.

Philip Shen of Roth Capital Partners commended the company is ‘navigating the chip shortage well’ with its investments in component inventory, dual sourcing, etc., and believes its ROW core inverter business could be the source of ‘upside surprise ahead’. However, Shen argued that the company may not have ‘meaningful’ residential storage revenues until Q3, as its storage product is still not available, according to Roth’s checks. “In other news, we’re starting to refocus our attention on the IP lawsuits between the company and Huawei. The one we’re most interested in is the one in China where Huawei has sued SEDG. SEDG lost one chapter of the case last year and subsequently appealed. These cases are marathons and as management indicated on the call, rarely end in a ‘dramatic fashion.’ Despite this, it merits watching.”

Guidance

Enphase’s management guided for its Q2/2021 revenues to be within the range of $445 million and $465 million, with solar products bringing in revenues of $405 million to $420 million. Non-GAAP gross margin for total revenue guidance is expected between 32% to 34%, and for solar products it is forecast as 36% to 38%.

According to Cowen’s Jeffrey Osborne, “We like the SolarEdge story in the mid-term, but see the company stuck in a transitory period where lower margin international sales are strong, the storage product is likely ~3+ months away from meaningful revenue and the utility scale inverter is also in the wings. We believe SolarEdge is well-positioned beyond FY21.”