- Hanwha Qcells will shut down its Chinese solar module production subsidiary by June 30, 2024

- The company intends to focus its resources on the US market as it targets improving operational efficiency

- By the end of 2024, Hanwha aims to increase its total installed solar cell and module capacity to 12.2 GW and 11.2 GW, respectively

Hanwha Solutions, the parent company of solar cell and module producer Hanwha Qcells, has revealed plans to stop its Chinese solar module production and sales to focus on the US market instead.

In a stock exchange filing, the group stated that shutting the Chinese subsidiary Hanwha Q CELLS (Qdong) Co. Ltd. is aimed at improving the company’s module production and operational efficiency.

Later, speaking with analysts to share its Q1/2024 financial results, the management reportedly said that the Chinese factory has around 2 GW annual module production capacity. It will stop the production here by June 30, 2024.

However, a Reuters report claims the Chinese factory had an annual production capacity of 2.1 GW of solar cells and 2.3 GW of modules at the end of 2023. It supplied the same to South Korea, Japan and Europe among other regions.

Instead, the company plans to produce most of its modules in the US where the group expanded its annual module production capacity to exceed 5.1 GW in October 2023. It aims to build a vertically-integrated production capacity of 8.4 GW by 2024 (see South Korean Company Expands Module Plant In US).

Hanwha’s decision to shut down its Chinese fab for the US market follows the announcement of it discontinuing the group’s South Korean factory (see Hanwha Solutions Suspends Production At South Korean Fab).

In the US, it has joined the American Alliance for Solar Manufacturing Trade Committee to demand the imposition of antidumping and countervailing duty (AD/CVD) on solar products coming into the US market from Cambodia, Malaysia, Vietnam, and Thailand. According to the petitioners, China-headquartered companies use their government-subsidized solar products to be assembled in these Southeast Asian nations to ship to the US in order to avoid paying import tariffs (see US Solar PV Manufacturers Launch AD/CVD Petitions).

Meanwhile, Hanwha has been accused by Maxeon Solar Technologies of TOPCon solar patent infringement and the latter has also filed a lawsuit in Texas (see Maxeon Solar Technologies Launches Another Patent Lawsuit).

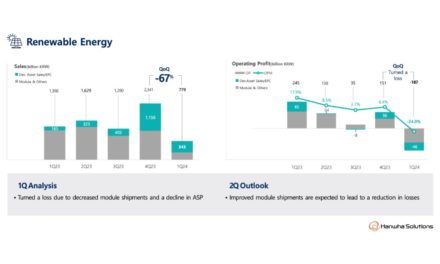

During Q1/2024, Hanwha Solutions recorded a 22.8% drop in annual sales with KRW 2.39 trillion. It suffered an operating loss of KRW 216.6 billion. The management blames a decline in solar module sales and lower selling prices due to oversupply in major markets as the reason for its new and renewable energy segment recording a 76% sequential decline in sales with KRW 778.5 billion and an operating loss of KRW 187.1 billion.

It forecasts improved module shipments in Q2/2024 to help reduce losses.

At the end of 2023, the group operated 10.8 GW solar cell and 10 GW solar module production capacity, which it targets to increase to 12.2 GW and 11.2 GW, respectively, by the end of 2024.