- Enphase has announced plans to start domestic microinverter manufacturing in the US in Q4/2023 with the IRA incentives

- It aims to install 6 lines of 750,000 million each, targeting 4.5 million units a quarter

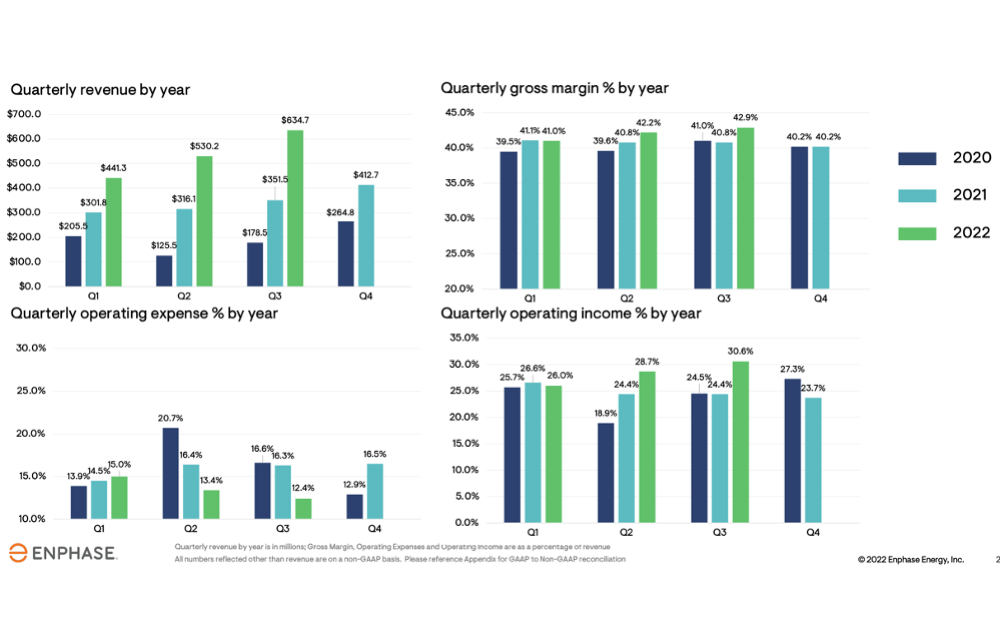

- Revenues improved 20% annually to $634.7 million in Q3/2022 while net income went up to $114.8 million

- North America and Europe were strong markets with the US alone accounting for 71% of the revenue mix

- In Q4/2022, it has guided for $680 million to $720 million revenues with gross margin of 39% to 42%

Solar microinverter manufacturer Enphase Energy has announced plans to start manufacturing in the US with 4 to 6 lines, starting from Q4/2023, buoyed by the $0.11 per W production-based tax credit on microinverters manufactured in the US under the Inflation Reduction Act (IRA).

In the last quarter of 2023, it aims to bring online 4 lines in the US, each with a capacity to roll out 750,000 units or a total of 3 million units a quarter. Once all 6 proposed lines are online it would be manufacturing 4.5 million units a quarter. For these, it has signed letters of intent (LOI) with 3 contract manufacturers out of which 2 are existing partners of the company. Roth Capital Partners counts all of these 6 lines to represent between 4.8 GW AC to 7.8 GW AC capacity.

“Our thought process is that we will need the additional capacity anyway considering our fast-paced growth globally,” said Enphase President and CEO Badri Kothandaraman who added that the company awaits finer details of the implementation plan to firm up the plans.

“The company indicated that there will likely be some sharing of the credit to ensure the process is economic for the contract manufacturer as well, but expects to receive the majority of the benefit,” commented Jeffrey Osborne of Cowen. “That said, assuming a 384W inverter is manufactured in the US, the full credit would be ~$42. Based on industry checks, we believe an IQ8 sells through distribution for ~ $150. Assuming a ~15% margin for the distributor (~$25) would yield a cost ex-credit of ~ $125, implying the credit would eliminate ~34% of the cost to manufacture the inverter.”

Currently, the company has an annual global manufacturing capacity of around 5 million microinverters per quarter. It should increase to 6 million from Q1/2023 as it starts manufacturing at Flex Romania fab. The management will evaluate the need for another line to be installed immediately in Europe once the Romanian fab is online (see North America PV News Snippets).

In terms of IQ batteries, Enphase is adding an additional cell pack supplier from China early next year for a 3rd generation battery.

Q3/2022

Enphase reported a strong quarter in Q3/2022 with ‘record’ quarterly revenues growing 20% annually to $634.7 million and 42.2% GAAP gross margin. Operating income grew to $135.4 million compared to $37.3 million a year back, while net income went up to $114.8 million from $21.8 million in Q3/2021 (see $351 Million Q3/2021 Revenues For Enphase).

The US contributed 71% of its revenue mix in the reporting quarter with 29% coming from international markets. In the US, revenue increased 7% sequentially and 69% YoY. In Europe, Enphase revenues improved 70% QoQ and 136% YoY led by strong demand for microinverters in the Netherlands, France, Germany, Belgium, Spain and Portugal, stated the management while adding that microinverter supply continues to be tight and channel inventory below normal.

The Latin America markets, the revenues went up 100% QoQ and 129% YoY. Demand for solar and storage has improved in Puerto Rico due to the hurricane.

It shipped 4342,805 microinverters or 1,709 MW DC in Q3/2022 along with 133.6 MWh of IQ batteries.

Enphase is laser focused on reducing installation time for its systems that also helps bring down costs. In North America, from a median commissioning time of 118 minutes in Q3/2022 it now aims to bring it down to 80 minutes exiting Q4/2022 thanks to improvements in its software.

With its 3rd generation IQ battery due to be launched in North America and Australia in H1/2023, it is targeting commissioning times to be sub 30 minutes. The 4th generation IQ battery will be introduced in 2024.

Guidance

Enphase management forecasts $680 million to $720 million revenues for Q4/2022 for shipments of 120 MWh to 135 MWh of IQ batteries. GAAP gross margin will be lower sequentially, in the range of 39% to 42%, and operating expenses between $152 million to $156 million.

Philip Shen of Roth cautions that the US residential solar market may be slowing down in H1/2023, and pick up pace in H2/2023. This may impact Enphase business here. Nonetheless, the company’s EU business will ‘offset the potential slowdown in the US with aplomb’.