- Daqo New Energy’s Q2/2021 revenues grew more than 230% on annual basis to $441.4 million, thanks to high ASP for polysilicon

- Having sold polysilicon for an average selling price of $20.81 per kg, the company’s net income went up to $232.1 million

- Management has revised its annual production guidance for 2021 to between 83,000 ton to 85,000 ton

- Daqo New Energy is now targeting to grow its annual production capacity by 2024 to 270,000 ton

Current global solar PV supply chain constraints for polysilicon is of course turning out to be a boon for its makers like Daqo New Energy from China that has reported an annual increase of more than 230% in its revenues for Q2/2021 with $441.4 million.

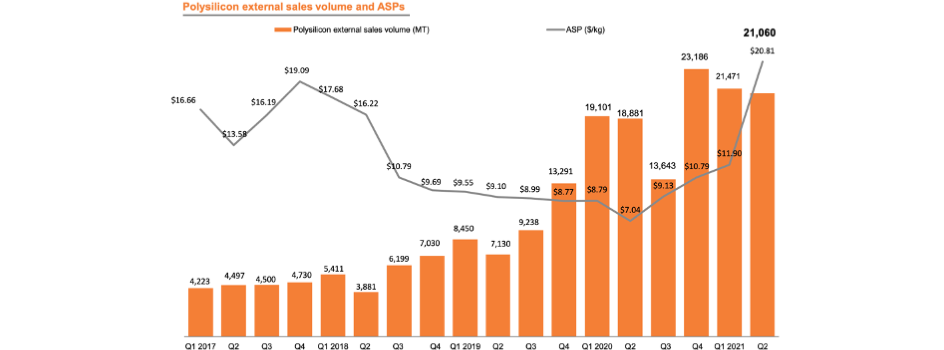

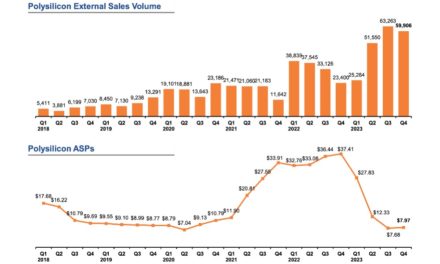

Its gross profit for the reporting quarter went up to $303.2 million, compared to $22.7 million in the previous quarter, and gross margin to 68.7%, up from 17% a year back. The net income of its shareholders grew to a total of $232.1 million, up from $2.4 million in Q2/2020, all thanks to polysilicon ASP of $20.81 per kg, having gone up from $11.90 per kg in Q1/2021.

“In July and August, the market price for mono-grade polysilicon has remained at approximately $26.00 per kg to $28.00 per kg and we expect the strong price momentum to continue into the second half of this year,” shared Daqo CEO Longgen Zhang. Yet, he believes high module prices won’t bring down the demand for solar ‘even at the new market prices’.

“Based on our research, we expect to see approximately 180~220 thousand MT of additional polysilicon supply in 2022 considering a potential six months’ ramp-up period for other polysilicon producers,” added Zhang, “This total global polysilicon supply can be used to produce approximately 240~250 GW of solar modules which can support approximately 200~210 GW of solar installations in 2022. So, the polysilicon sector will still be the one with most constrained supply across the main solar PV manufacturing value chain in 2022.”

Production

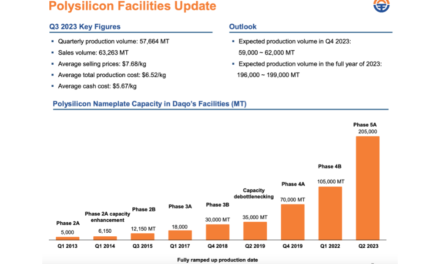

During H1/2021, Daqo New Energy produced 41,287 ton of polysilicon and sold 42,531 tons, comprising 21,102 tons in Q2/2021 out of which 21,060 ton was sold. Its average total production cost increased to $6.31 per kg in Q2/2021, compared to $6.29 per kg in the previous quarter.

Guidance

During H2/2021, the management expects to fully utilize its production facilities. It has raised the annual production guidance for 2021 to around 83,000 to 85,000 tons, up from 81,000 to 83,000 tons (see Daqo New Energy Pockets $256 Million Revenues In Q1/2021).

Following the Chinese initial public offering (IPO) of its principal operating subsidiary, Daqo New Energy when it raised RMB 6.54 billion, the company now aims to increase its total production capacity to 270,000 tons by the end of 2024, representing close to 50% annual growth rate of its capacity over the next 3 years.