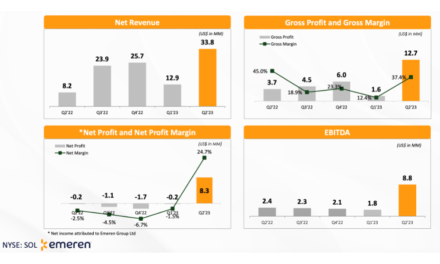

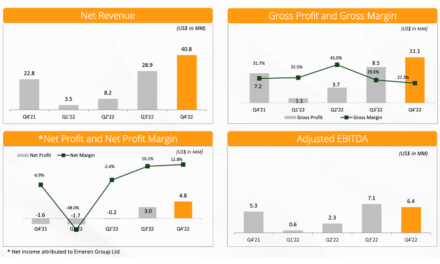

- Emeren’s $33.8 million revenues in Q2/2023 improved significantly on a YoY and QoQ basis

- Attributing tailwind of higher energy prices in Europe, the management said it was able to report a net income of $8.3 million

- Advanced-stage solar development and energy storage pipeline is forecast to grow to 3 GW and 6 GWh by 2023-end

Solar power project developer and operator Emeren Group exited Q2/2023 with $33.8 million in revenues reflecting 312% growth YoY and 163% QoQ, thanks to strong project sales in Europe and its IPP assets; however, it was unable to achieve the revenue target of $38 million to $40 million.

Project development business led revenues with a 42% share, followed by IPP and EPC divisions. In terms of markets, Europe was the highest grosser according to the company with $29.5 million accounting for 87% revenue share. China came next with 12% and the US with 1% revenue share.

A tailwind of higher energy prices in Europe helped it lock in its highest net income in the last 5 years with $8.3 million.

Improved mix of higher margin projects, especially in Europe also helped it report gross margin of 37.4%, up from 12.4% in the previous quarter, but down from 45% last year. Adjusted EBITDA turned positive with $9.3 million vis-à-vis $-0.5 million in the previous quarter, and $2.3 million in Q2/2022.

Pipeline

At the end of June 2023, Emeren had a total solar development pipeline of 2.58 GW capacity at an advanced stage which it aims to increase to 3 GW by 2023-end. It aims to monetize nearly 400 MW of these projects before the end of the year. The company’s early-stage solar pipeline totaled 5.25 GW.

Emeren’s storage pipeline also grew to 8,834 MWh, comprising 4,602 MWh at advanced and 4,232 MWh at early stage. By 2023-end, it expects to grow the advanced-stage energy storage project pipeline to 6 GWh.

Roth MKM’s Philip Shen said, “SOL’s strong balance sheet could provide acquisition opportunities in the US as smaller/weaker developers face liquidity constraints due to high interest rates.”

Guidance

The management is now targeting between $27 million and $30 million in revenues for Q3/2023 with a gross margin of 35% to 38%. Annual revenue guidance for 2023 remains the same between $154 million and $174 million; however, now citing project timing, the company expects to report at the lower end of the range. FY 2023 gross margin forecast is retained at around 30%.